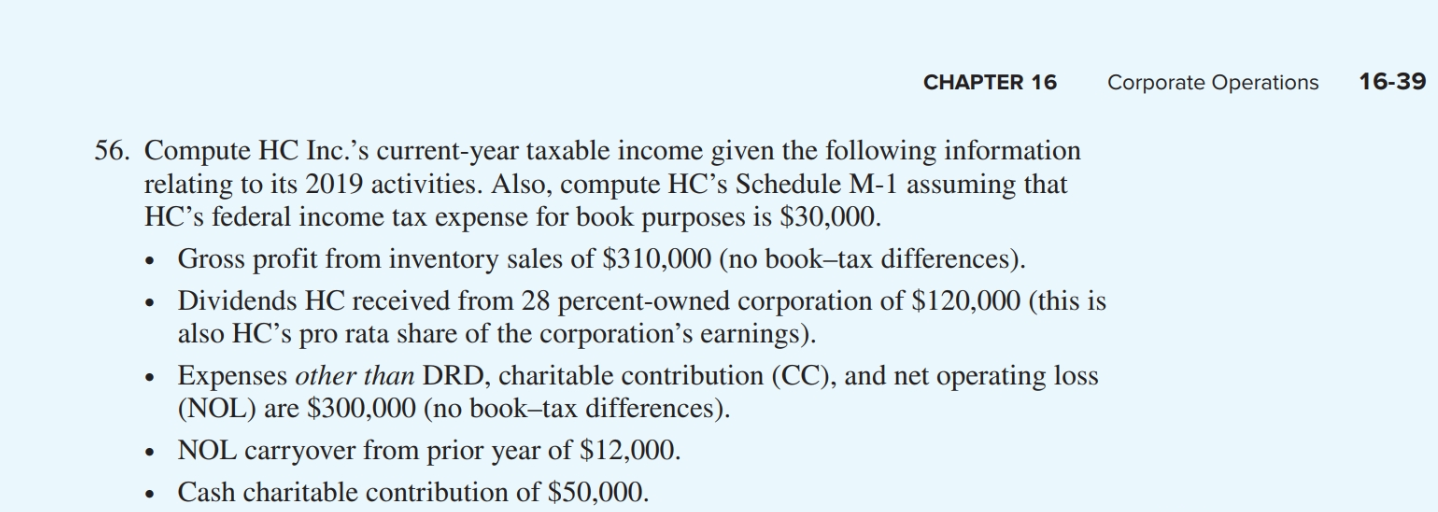

CHAPTER 16 Corporate Operations 16-39 56. Compute HC Inc.'s current-year taxable income given the following information relating to its 2019 activities. Also, compute HC's Schedule M-1 assuming that HC's federal income tax expense for book purposes is $30,000. Gross profit from inventory sales of $310,000 (no book-tax differences). Dividends HC received from 28 percent-owned corporation of $120,000 (this is also HC's pro rata share of the corporation's earnings). Expenses other than DRD, charitable contribution (CC), and net operating loss (NOL) are $300,000 (no book-tax differences). • NOL carryover from prior year of $12,000. Cash charitable contribution of $50,000.

CHAPTER 16 Corporate Operations 16-39 56. Compute HC Inc.'s current-year taxable income given the following information relating to its 2019 activities. Also, compute HC's Schedule M-1 assuming that HC's federal income tax expense for book purposes is $30,000. Gross profit from inventory sales of $310,000 (no book-tax differences). Dividends HC received from 28 percent-owned corporation of $120,000 (this is also HC's pro rata share of the corporation's earnings). Expenses other than DRD, charitable contribution (CC), and net operating loss (NOL) are $300,000 (no book-tax differences). • NOL carryover from prior year of $12,000. Cash charitable contribution of $50,000.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 48P

Related questions

Question

56. Compute HC Inc.’s current-year taxable income given the following information relating to its 2019 activities. Also, compute HC’s Schedule M-1 assuming that HC’s federal income tax expense for book purposes is $30,000.

Transcribed Image Text:CHAPTER 16

Corporate Operations

16-39

56. Compute HC Inc.'s current-year taxable income given the following information

relating to its 2019 activities. Also, compute HC's Schedule M-1 assuming that

HC's federal income tax expense for book purposes is $30,000.

Gross profit from inventory sales of $310,000 (no book-tax differences).

Dividends HC received from 28 percent-owned corporation of $120,000 (this is

also HC's pro rata share of the corporation's earnings).

Expenses other than DRD, charitable contribution (CC), and net operating loss

(NOL) are $300,000 (no book-tax differences).

• NOL carryover from prior year of $12,000.

Cash charitable contribution of $50,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning