Cheryl should build the facility. If demand proves to be low, then to stimulate demand. b) What is the value of this expected payoff? The expected payoff is $ (round your response to the nearest dollar).

Cheryl should build the facility. If demand proves to be low, then to stimulate demand. b) What is the value of this expected payoff? The expected payoff is $ (round your response to the nearest dollar).

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter9: Decision Making Under Uncertainty

Section: Chapter Questions

Problem 46P

Related questions

Question

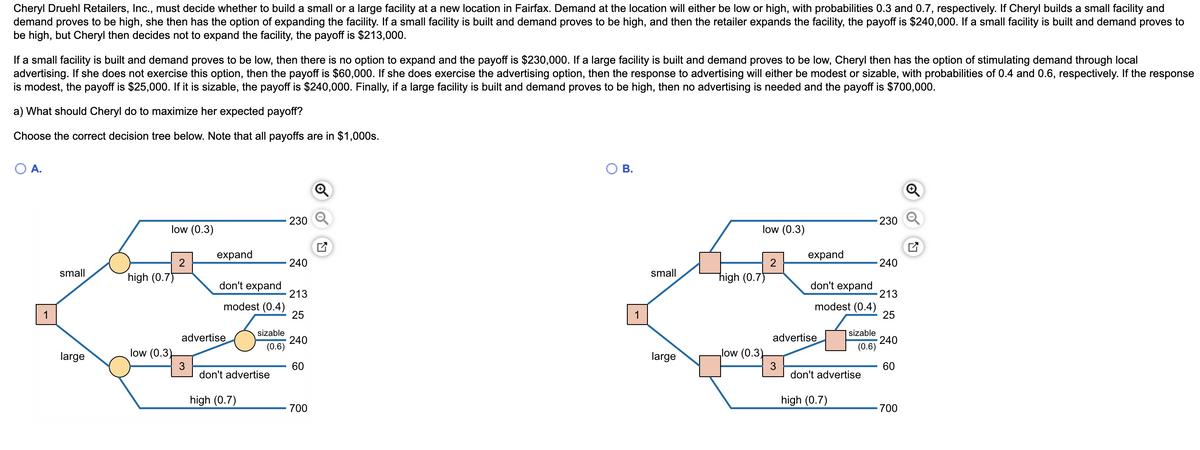

Transcribed Image Text:Ос.

O D.

230

230 Q

low (0.3)

low (0.7)

expand

expand

240

2

240

large

high (0.7)

small

high (0.3)

don't expand

213

don't expand

213

modest (0.4)

25

modest (0.6)

25

1

1

sizable

sizable

advertise

advertise

240

(0.6)

240

(0.4)

small

low (0.3)

large

low (0.3)

3

don't advertise

60

3

don't advertise

60

high (0.7)

high (0.7)

700

700

Cheryl should build the

facility. If demand proves to be low, then

to stimulate demand.

b) What is the value of this expected payoff?

The expected payoff is $

(round your response to the nearest dollar).

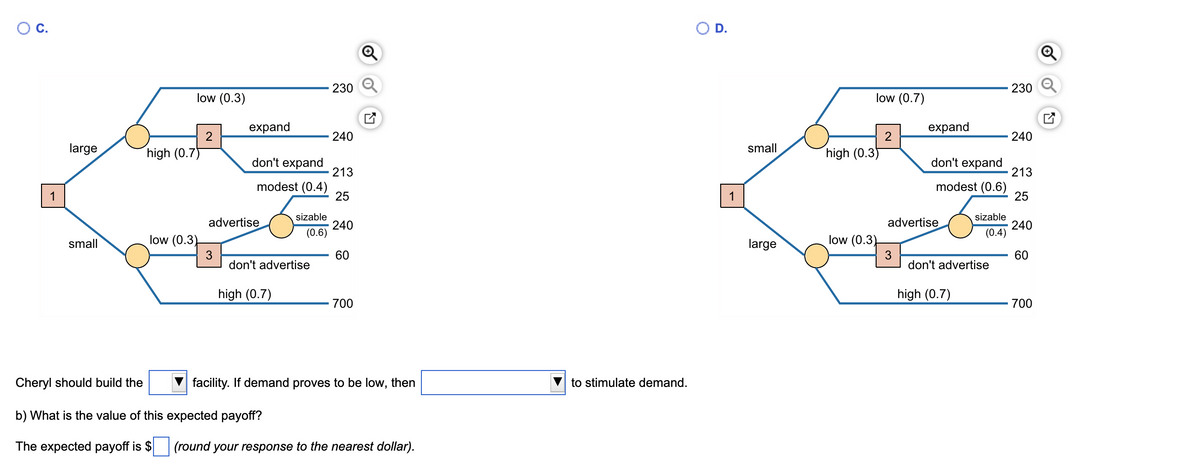

Transcribed Image Text:Cheryl Druehl Retailers, Inc., must decide whether to build a small or a large facility at a new location in Fairfax. Demand at the location will either be low or high, with probabilities 0.3 and 0.7, respectively. If Cheryl builds a small facility and

demand proves to be high, she then has the option of expanding the facility. If a small facility is built and demand proves to be high, and then the retailer expands the facility, the payoff is $240,000. If a small facility is built and demand proves to

be high, but Cheryl then decides not to expand the facility, the payoff is $213,000.

If a small facility is built and demand proves to be low, then there is no option to expand and the payoff is $230,000. If a large facility is built and demand proves to be low, Cheryl then has the option of stimulating demand through local

advertising. If she does not exercise this option, then the payoff is $60,000. If she does exercise the advertising option, then the response to advertising will either be modest or sizable, with probabilities of 0.4 and 0.6, respectively. If the response

is modest, the payoff is $25,000. If it is sizable, the payoff is $240,000. Finally, if a large facility is built and demand proves to be high, then no advertising is needed and the payoff is $700,000.

a) What should Cheryl do to maximize her expected payoff?

Choose the correct decision tree below. Note that all payoffs are in $1,000s.

O A.

В.

230

230 Q

low (0.3)

low (0.3)

expand

expand

2

240

2

240

small

high (0.7)

small

Thigh (0.7)

don't expand

213

modest (0.4)

25

don't expand

213

modest (0.4)

25

1

1

sizable

sizable

240

(0.6)

advertise

advertise

240

(0.6)

large

low (0.3)

large

low (0.3)

3

don't advertise

60

3

don't advertise

60

high (0.7)

high (0.7)

700

700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning