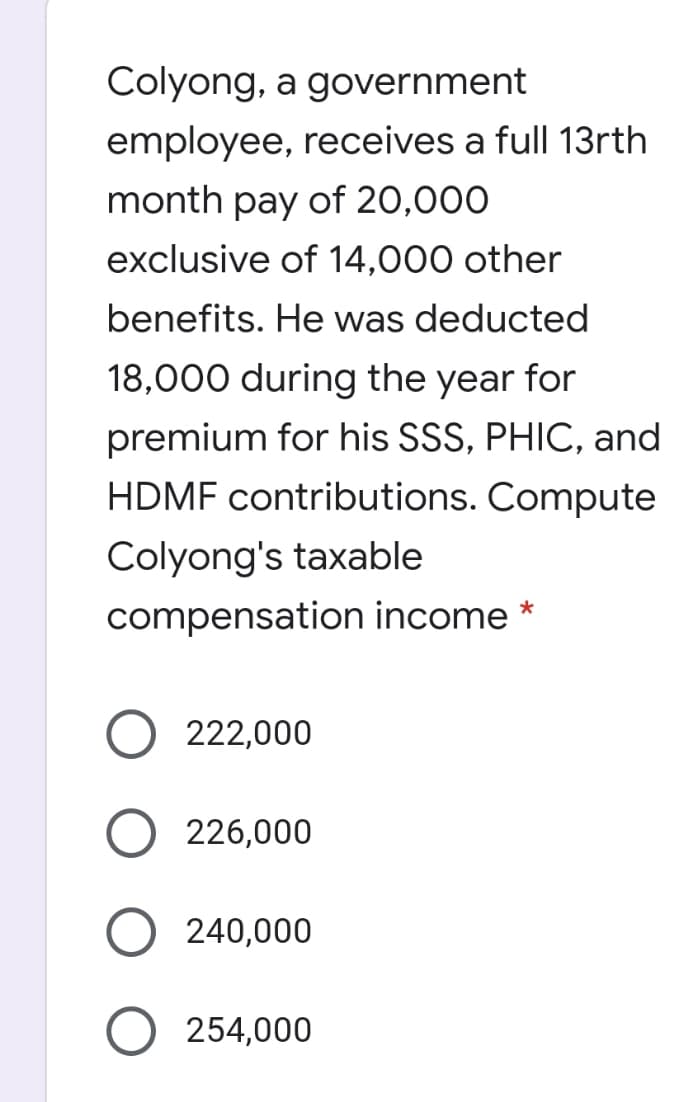

Colyong, a government employee, receives a full 13rth month pay of 20,000 exclusive of 14,000 other benefits. He was deducted 18,000 during the year for premium for his SSS, PHIC, and HDMF contributions. Compute Colyong's taxable compensation income * 222,000 226,000 240,000 254,000

Colyong, a government employee, receives a full 13rth month pay of 20,000 exclusive of 14,000 other benefits. He was deducted 18,000 during the year for premium for his SSS, PHIC, and HDMF contributions. Compute Colyong's taxable compensation income * 222,000 226,000 240,000 254,000

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Transcribed Image Text:Colyong, a government

employee, receives a full 13rth

month pay of 20,000

exclusive of 14,000 other

benefits. He was deducted

18,000 during the year for

premium for his SSS, PHIC, and

HDMF contributions. Compute

Colyong's taxable

compensation income *

222,000

226,000

240,000

254,000

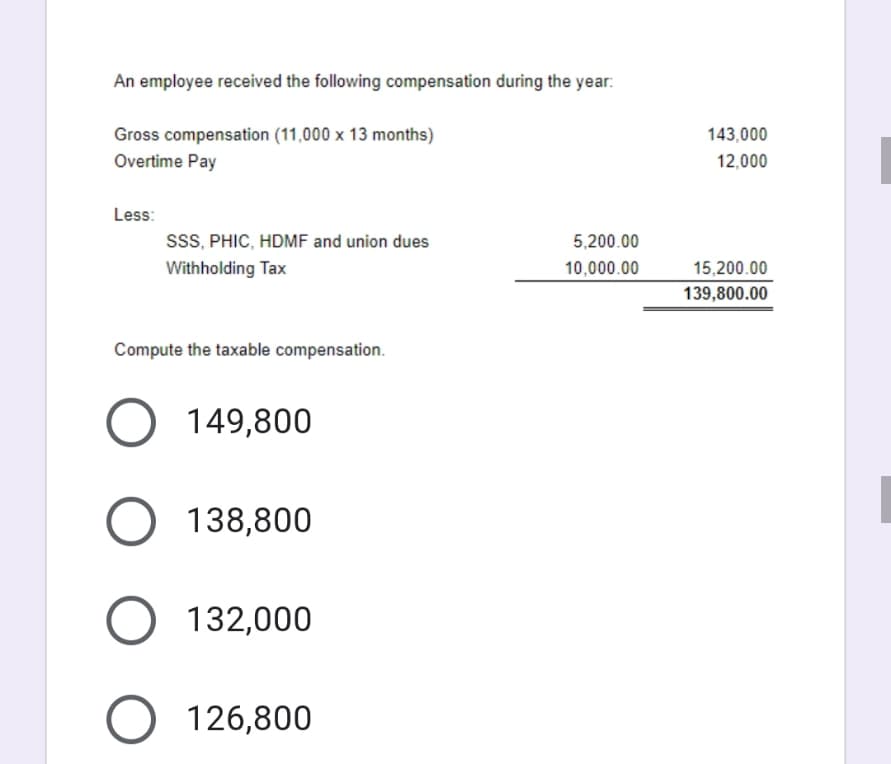

Transcribed Image Text:An employee received the following compensation during the year:

Gross compensation (11,000 x 13 months)

Overtime Pay

143,000

12,000

Less:

ssS, PHIC, HDMF and union dues

5,200.00

Withholding Tax

10,000.00

15,200.00

139,800.00

Compute the taxable compensation.

149,800

138,800

132,000

126,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT