Company 1 (P) 720,000 25,000 -591,000 18,000 Company 2 (P) 1,820,000 Sales revenue Interest revenue Expenses Depreciation 31 ,000 -754,000 48,000

Q: > Increase in accounts receivable P 300,000 > Decrease in income tax payable > Depreciation > Net…

A: Introduction: Cash flow statements: All cash in and out flows are shown in cash flows statements. It…

Q: INCOME EXPENSES PROFIT(LOSS) 1. 840,000 2,400,000 1,300,000 360,000 540,000 2. 3. 860,000 2,000,000…

A: Profit and loss in the business can be calculated by deducting or subtracting all expenses from the…

Q: Income Statement UCF Blcycle Vending Machine Company For Period Ending December 31, 20xx 1,000,000…

A: Cash flow from investing activities shows the cash payments and receipts for the investing…

Q: Income statemenja Service revenue 110,500 Salary expense 44,850 Supplies expense 3,225 Insurance…

A: Given that, Insurance expense = 1,800 Supplies expense = 3,225 Utilities expense = 3,300…

Q: 2,000,000 365,000 1,555,000 15,000 120,000 22,000 325,000 18,000 Sales Inventory, January 1…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Income Statement Dec. 31, 2022 Company A Company B Sales P850,000 P1,350,000 Less: Cost of Goods…

A: Efficiency in the management of stock is judged by inventory turnover ratio and days inventory…

Q: Solve for the missing revenues in 20x8 if the company began operations 20x7. 20x7 20x8 Assets $1,000…

A: Retained earnings refer to the amount earned by the organization till the date of preparation of the…

Q: MARIN COMPANY Comparative Balance Sheets December 31 Assets 2010 2009 $ 41,000 $ 57,000 64,000 Cash…

A: Cash flow statement is a statement which is prepared to find out the cash comes in and goes out , by…

Q: Prior Year Current Year Prior Year Current Y $100,000 $120,000 Assets: ods Sold 50,000 60,000 Cash…

A: Current Ratio=current assets/current liability Current Assets=cash+accounts receivable+short term…

Q: $ 120,400 71,400 1,932,000 210,000 28,000 210,000 Interest revenue Cash Sales Accumulated…

A: The income statement explains the financial performance of the company for a particular period of…

Q: 9. TSE company reported a Net income of $150 million for year N. Depreciation expense was $141…

A: Net income = $150 million Depreciation = $141 million Interest expenses = $60 million Tax rate = 30%

Q: Refer to the following financial information of Scholz Company: NOPAT 8,250,000 FBITDA…

A: Formulas: Depreciation and amortization expense = EBITDA - Earnings before tax - Interest expense…

Q: YEAR 1 YEAR2 ASSETS CURRENT ASSETS Cash 210,000 467,550 Accounts Receivable 930,000 883,200…

A: Horizontal analysis - Horizontal Analysis is part of the analysis in which individuals get the idea…

Q: 2022 Sales revenue $500,000 Cost of goods sold Gross profit Operating expenses 400,000 ? Wages…

A: Formula: Gross profit = sales revenue - cost of goods sold

Q: Year 0 Income Statement Sales 320,000 (150,000 170,000 Costs Except Depreciation EBITDA Depreciation…

A: The forecasted sales & variable cost will be increased by 25% but the depreciation expense…

Q: The Walston Company is to be liquidated and has the following liabilities: The company has the…

A: Partnership It is that form of organization which is owned and managed by two or more persons who…

Q: Cash $250,000 Retained Earnings 2,850,000 Accounts Receivable 1,197,000 DIvidends 50,000 Inventory…

A: Formula: Net income = Total Revenues - Total Expenses.

Q: Revlon Company provided the following data for the current year. Segment Revenue Profit (loss)…

A: The information above shows that any operating segment with revenue equal toor greater than P200,000…

Q: Tax rate 25% S 550,424,000 397,185,000 65,778,000 17,963,000 69,498,000 9,900,000 S 59,598,000…

A: EFN stands for external financing needed Change in sales = $550,424,000 - $660,508,800 =…

Q: Ace Business Forms Month Current Assets Fixed Assets Total Assets January P125,000…

A: The financing mix of a corporation is the combination of the debt and equity of the corporation and…

Q: Service revenue 110,500 Salary expense 44,850 Supplies expense 3,225 Insurance expense 1800…

A: Lets understand the basics. Income statement is prepared by management to know income expense and…

Q: Data for item nos. 24 & 25 Di Ka Na Mahal Company reported the following information during the…

A: Pretax financial income P90,00,000 Less: Nontaxable interest received -P10,00,000 Add: Long-term…

Q: 11. ABM company purchased 800,000 in supplies this year. Supplies account increased by ₱200,000…

A: The supplies expense is the amount of supplies used during the period.

Q: XYZ Company Balance Sheet December 31, 20X2 Dec. 31, 20X2 Dec. 31, 20X1 Inc./Dec.…

A: The cash flow statement is an essential part of the financial statements of the organization. It is…

Q: The following are the financial information of Kerung company: NOPAT…

A: Formula: Economic value added (EVA) = Net operating profit after tax - Total invested capital x WACC…

Q: Income Statement Year 0 Sales 320,000 Costs Except Depreciation (150,000) EBITDA 170,000…

A: Forecast net income is dependent on the existing figure of financial statement and growth rate of…

Q: Use the following information for Delta Corporation Year 20X1 20X2 Net sales $1,500,000…

A: External Financing Needed: The Amount of external funds required will be equal to the projected…

Q: Cash $250,000 Retained Earnings 2,850,000 Accounts Receivable 1,197,000 DIvidends 50,000 Inventory…

A: Introduction: Balance sheet: All Assets and liabilities are shown in Balance sheet. It tells the net…

Q: John Lee Company Income Statement For the year ended Dec. 31, 20X2 Amounts in Philippine Peso…

A: Direct Method of Cashflow Statement: One of two accounting procedures for generating a cash flow…

Q: $4 30,000 From the balance sheet: 150,000 Cash ... 200,000 Accounts receivable . 500,000 Inventory…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: 1. Non-current assets (a) Fixed Assets 1,00,00,000 2. Current Assets (a) Inventories ) Raw Material…

A: Formulas: Economic value added = Net operating profit - (Capital employed*Required rate of return)

Q: 9. Sales Purchases P3,348,000 2,150,000 70,000 95,000 185,000 202,000 78,000 56,000 44,000 35,000…

A: Income Statement - This statement shows the income earned and loss incurred by the organization in…

Q: Text World, Inc., reported sales revenue of $450,000, net income of $54,000, andaverage total assets…

A: Return on assets = Net income / Average total assets where, Average total assets = (Beginning total…

Q: Jecember 31, 20Y2 and 20Y1 20Υ2 20Υ1 Sales... $10,000,000 $9,400,000 4,950,000 $4,450,000 $1,880,000…

A: Since we answer only up-to three sub-parts we shall answer first three. Please resubmit a new…

Q: Ace Business Forms Month Current Assets Fixed Assets Total Assets January P125,000…

A: Aggressive startegy is a risky approach in which short term funds are used to finance whole of…

Q: A company had net income of $282,000. Depreciation expense is $26,000. During the year, accounts…

A: Cash flow statement deals with the provision of information about the historical changes in cash and…

Q: What is total operating expenses? Sales Returns and Allowances $40,000 Depreciation Expense $30,000…

A: SOLUTION OPERATING EXPENSE COMPANY INCLUDES RENT , PAYROLL , TRAVEL , UTILITIES , INSURANCE ,…

Q: Selling & administrative expenses 20,200 Loss on sale of plant assets 11,700 Gross profit…

A: Income statement:- Income statement is that statement which focuses on revenue, expense, gains and…

Q: Revenue Expense Net Income 52.500 52,500 29.150 $ (29,150) 612.500 612.500 254,100 S (254,100)…

A: The income statement is prepared to find net income or losses incurred during the period.

Q: Plaza, Inc., acquires 80 percent of the outstanding common stock of Stanford Corporation on January…

A:

Q: Tripeaks Company used the accrual basis of accounting: December 31 January 1 9,000,000 8,000,000…

A: Solution: Expenses are cost of operations to generate revenue for the business. Mainly there are two…

Q: XYZ Company Balance Sheet December 31, 20X2 Dec. 31, 20X2 Dec. 31, 20X1 Inc./Dec.…

A: In financial bookkeeping, a cash flow statement, otherwise called a statement of cash flow, is a…

Q: 1. Sales on account were $548,000. The beginning receivables balance was $128,000 and the ending…

A: The question is based on the concept of Cash flow statement. Cash flow statement is the statement…

Q: MARNI COMPANY Balance Sheet As of December 31 ASSETS Cash 50,000 100,000 200,000 650,000 $1,000,000…

A: = $350,000 = $190,000

Q: XYZ Company Balance Sheet December 31, 20X2 Dec. 31, 20X2 Dec. 31, 20X1 Inc./Dec. Cash 25,000 22,000…

A: The working notes are attached below. You may kindly note that all amounts are in $.

Q: Post Company Sign Company Item Debit Credit Debit Credit Cash 10,000 15,000 Accounts Receivable…

A: Introduction Journal entries are the method of recording of business transactions during an…

Q: Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second…

A: Cash budget refers to an estimation of cash inflows and outflows in a business over a specified…

Q: 600,000 80,000 70,000 120,000 10,000 200,000 30,000 20,000 Inventories Short-term Liabilities…

A: Income statement is one of a financial statement which is used by stakeholders like, investors,…

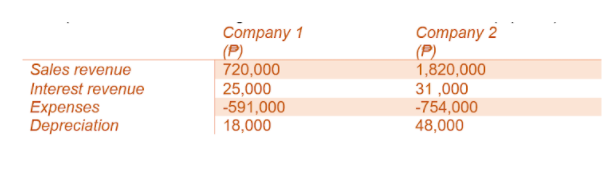

Two companies have the following values on their annual tax returns. Solve for the Taxable Income of the 2 companies.

Step by step

Solved in 2 steps

- 1-1-a Use the following information for Delta Corporation Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Accounts receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will all remain a constant…Question 1 The statement of comprehensive income and the statement of financial position disclosed relates to Jeffrey Ghana Limited. Jeffrey Ghana Limited Statement of Financial Position as at December 31, 2021 2020 2021 GH₵ GH₵ GH₵ GH₵ Non-current assets (cost) 300,000 380,000 Less Accumulated depreciation (60,000) 240,000 (45,000) 335,000 Investment 120,000 70,000 Current assets Inventory 96,000 100,000 Receivables 150,000 127,000 Bank 164,000 146,000 410,000 373,000 Total assets 770,000 778,000 Financed by: Stared capital 300,000 320,000 Income surplus 146,000 166,000 446,000 486,000 Non-current liability 10% Debenture 150,000 100,000 Current liabilities Payables 137,500 152,000 Taxation 36,500 40,000 174,000 192,000 Total…Question C5 Majan Ltd income statement for the year ended 31st Dec 2020 and the balance sheets as at 31st Dec 2009 and 2019 are as follows: Income statement OMR in million Revenue 312 Cost of sales (177) Gross profit 135 Distribution expenses (36) Administrative expenses (15) 84 Rental income 14 Operating profit 98 Interest payable (13) Profit before taxation 85 Taxation (18) Profit for the year 67 Balance sheet as at 31st Dec 2020 and 2019 2020 2019 OMR in million OMR in million Non – current assets Property, plant and equipment Land and buildings 155 155 Plant and machinery 157 163 312 318 Current assets Inventories 18 21 Trade receivables 73 70 Current liabilities…

- QUESTION 1 The following information has been provided for the year ended 31 December 2022 Depreciation for Accounting purposes Machinery R16 000 Equipment R27 500 Wear and Tear Machinery R25 000 Equipment R30 000 Dividends received R35 000 Revenue received in advance R26 000 (2022) Revenue received in advance R18 000 (2021) Profit before tax is R300 000 after taking the above figures into account. Assume a tax rate of 28% Required. CALCULATE the current tax for the year ended 31 December 2022 Show the calculationsThe following items were excerpted from Poeltl, Inc.'s balance sheets: December 31, 2023December 31, 2022Cash$86,300$59,000Accounts receivable65,60070,600Inventory157,000150.300Property and equipment794,500745,400Accumulated depreciation(184,000)(168,200)Accounts payable61,00050,600Wages payable20,40023,000 Poeltl's 2023 income statement showed net income of $463,000, depreciation expense of $57,000, and a gain on disposal of equipment of $16,000. On Poeltl's 2023 statement of cash flows, how much is Net Cash Provided by Operating Activities?A2 aii Use the following information for Delta Corporation: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Account’s receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will all remain a constant…

- E4.17 (LO 2, 3, 5) The following information was taken from the records of Roland Carlson Inc. for the year 2020: Income tax applicable to income from continuing operations $187,000, Income tax applicable to loss on discontinued operations $25,500Gain on sale of equipment $ 95,000 Cash dividends declared $ 150,000Loss on discontinued operations 75,000 Retained earnings January 1, 2020 600,000Administrative expenses 240,000 Cost of goods sold 850,000Rent revenue 40,000 Selling expenses 300,000Loss on write-down of inventory 60,000 Sales revenue 1,900,000 Shares outstanding during 2020 were 100,000. Prepare a multiple step income statement (including earnings per share) and a statement of…Adjustment for depreciation The estimated amount of depredation on equipment for the current year is $133,000. a. How is the adjustment recorded? Indicate each account affected, whether the account is increased or decreased, and the amount of the increase or decrease. b. If the adjustment in (a) was omitted, which items would be erroneously stated on (1) the income statement for the year and (2) the balance sheet as of December 31?A2 1ai Use the following information for Delta Corporation : Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Accounts receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will all remain a…

- 1)The owner’s capital is P200,000. The total liability is P80,000 of which P60,000 is current liability. The non-current asset is P100,000. The working capital, therefore, is: a. P200,000 b. P180,000 c. P120,000 d. P100,000 2) Servicing business using non-conventional reporting of income has P600,000 service revenue. The cost of service is 80% of service revenue and the operating expenses is 25% of gross income. What is the operating income? a. P 90,000 b. P 96,000 c. P100,000 d. P100,800Question 2 The statement of Profit and Loss and other Comprehensive Income and the Statement of Financial Position as at 28 February 2021 for Sefika Ltd is presented below: Sefika Ltd Statement of Profit and Loss and other Comprehensive income for the year ended 28 February 2021 N$ Revenue from Sales 2 081 800 Cost of Sales (1 312 600) Gross Profit 769 200 Operating expenses: (386 400) Loss on disposal of plant and equipment (8 000) Other operating expenses (378 400) Finance cost: Interest expense (75 200) Profit before tax 307 600 Income tax expense (68 400) Profit for the year 239 200 Sefika Ltd Statement of Financial position as at 28 February 2021 N$ 2021 N$ 2020 ASSETS Non-Current Assets: 890 000 824 000 Land and building at cost 725 000 600 000 Plant and equipment at cost 531 000 504 000 Accumulated depreciation- plant and equipment…#18 The beginning balances of an entity amounted to P4,000,000 and P2,200,000 for total assets and total liabilities, respectively. The assets increased to 120% of its beginning balance while the liabilities increased by 75%. The amount of loss was P1,100,000 and no withdrawals were made during the year. Determine the amount of contributions made during the year.