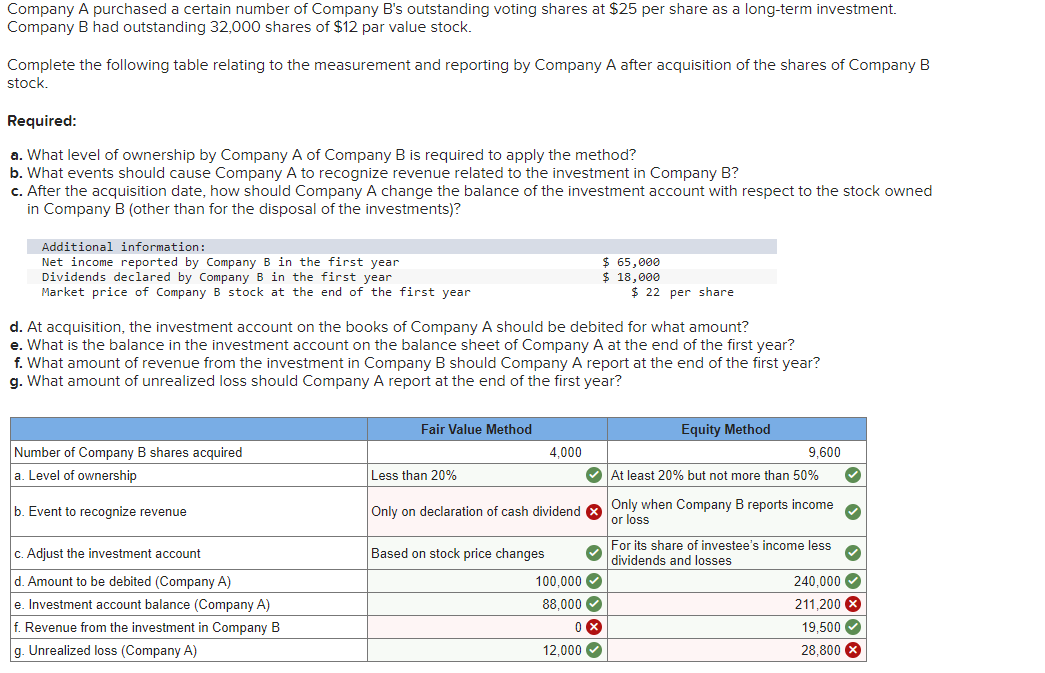

Company A purchased a certain number of Company B's outstanding voting shares at $25 per share as a long-term investment. Company B had outstanding 32,000 shares of $12 par value stock. Complete the following table relating to the measurement and reporting by Company A after acquisition of the shares of Company B stock. Required: a. What level of ownership by Company A of Company B is required to apply the method? b. What events should cause Company A to recognize revenue related to the investment in Company B? c. After the acquisition date, how should Company A change the balance of the investment account with respect to the stock owned in Company B (other than for the disposal of the investments)? Additional information: Net income reported by Company B in the first year Dividends declared by Company B in the first year Market price of Company B stock at the end of the first year Number of Company B shares acquired a. Level of ownership b. Event to recognize revenue d. At acquisition, the investment account on the books of Company A should be debited for what amount? e. What is the balance in the investment account on the balance sheet of Company A at the end of the first year? f. What amount of revenue from the investment in Company B should Company A report at the end of the first year? g. What amount of unrealized loss should Company A report at the end of the first year? c. Adjust the investment account d. Amount to be debited (Company A) e. Investment account balance (Company A) f. Revenue from the investment in Company B g. Unrealized loss (Company A) Fair Value Method 4,000 Based on stock price changes $ 65,000 $ 18,000 $22 per share 100,000 88,000✔ 0x 12,000✔ Equity Method Less than 20% At least 20% but not more than 50% Only on declaration of cash dividend Only when Company B reports income or loss 9,600 For its share of investee's income less dividends and losses ✓ 240,000 211,200 x 19,500✔ 28,800 X

Company A purchased a certain number of Company B's outstanding voting shares at $25 per share as a long-term investment. Company B had outstanding 32,000 shares of $12 par value stock. Complete the following table relating to the measurement and reporting by Company A after acquisition of the shares of Company B stock. Required: a. What level of ownership by Company A of Company B is required to apply the method? b. What events should cause Company A to recognize revenue related to the investment in Company B? c. After the acquisition date, how should Company A change the balance of the investment account with respect to the stock owned in Company B (other than for the disposal of the investments)? Additional information: Net income reported by Company B in the first year Dividends declared by Company B in the first year Market price of Company B stock at the end of the first year Number of Company B shares acquired a. Level of ownership b. Event to recognize revenue d. At acquisition, the investment account on the books of Company A should be debited for what amount? e. What is the balance in the investment account on the balance sheet of Company A at the end of the first year? f. What amount of revenue from the investment in Company B should Company A report at the end of the first year? g. What amount of unrealized loss should Company A report at the end of the first year? c. Adjust the investment account d. Amount to be debited (Company A) e. Investment account balance (Company A) f. Revenue from the investment in Company B g. Unrealized loss (Company A) Fair Value Method 4,000 Based on stock price changes $ 65,000 $ 18,000 $22 per share 100,000 88,000✔ 0x 12,000✔ Equity Method Less than 20% At least 20% but not more than 50% Only on declaration of cash dividend Only when Company B reports income or loss 9,600 For its share of investee's income less dividends and losses ✓ 240,000 211,200 x 19,500✔ 28,800 X

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Transcribed Image Text:Company A purchased a certain number of Company B's outstanding voting shares at $25 per share as a long-term investment.

Company B had outstanding 32,000 shares of $12 par value stock.

Complete the following table relating to the measurement and reporting by Company A after acquisition of the shares of Company B

stock.

Required:

a. What level of ownership by Company A of Company B is required to apply the method?

b. What events should cause Company A to recognize revenue related to the investment in Company B?

c. After the acquisition date, how should Company A change the balance of the investment account with respect to the stock owned

in Company B (other than for the disposal of the investments)?

Additional information:

Net income reported by Company B in the first year

Dividends declared by Company B in the first year

Market price of Company B stock at the end of the first year

d. At acquisition, the investment account on the books of Company A should be debited for what amount?

e. What is the balance in the investment account on the balance sheet of Company A at the end of the first year?

f. What amount of revenue from the investment in Company B should Company A report at the end of the first year?

g. What amount of unrealized loss should Company A report at the end of the first year?

Number of Company B shares acquired

a. Level of ownership

b. Event to recognize revenue

c. Adjust the investment account

d. Amount to be debited (Company A)

e. Investment account balance (Company A)

f. Revenue from the investment in Company B

g. Unrealized loss (Company A)

Fair Value Method

Less than 20%

4,000

9,600

✔ At least 20% but not more than 50%

Only on declaration of cash dividend Only when Company B reports income

or loss

Based on stock price changes

✓

$ 65,000

$ 18,000

$22 per share

100,000✔

88,000✔

0x

12,000 ✓

Equity Method

For its share of investee's income less

dividends and losses

240,000✔

211,200

19,500✔

28,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning