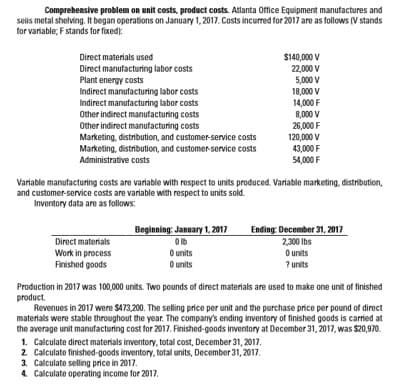

Comprehensive problem on unit costs, product costs. Atlanta 0office Equipment manufactures and selis metal shelving. It began operations on January 1, 2017. Costs incurred for 2017 are as follows (V stands for variable; Fstands for fixed): $140,000 V 22,000 V 5,000 V 18,000 V 14,000 F 8,000 V 26,000 F 120,000 V 43,000 F 54,000F Direct materials used Direct manufacturing labor costs Plant energy costs Indirect manufacturing labor costs Indirect manufacturing labor costs Other indirect manufacturing costs Other indirect manufacturing costs Marketing, distribution, and customer-service costs Marketing, distribution, and customer-service costs Administrative costs Variable manufacturing costs are variable with respect to units produced. Variable marketing, distribution, and customer-service costs are variable with respect to units sold. Inventory data are as follows: Ending: December 31, 2017 2,300 Ibs O units 7 units Beginning: January 1, 2017 Direct materials O units O units Work in process Finished goods Production in 2017 was 100,000 units. Two pounds of direct materials are used to make one unit of finished product. Revenues in 2017 were $473,200. The selling price per unit and the purchase price per pound of direct materials were stable throughout the year. The company's ending inventory of finished goods is carried at the average unit manufacturing cost for 2017. Finished-goods inventory at December 31, 2017, was $20,970. 1. Calculate direct materials inventory, total cost, December 31, 2017. 2 Calculate finished-goods inventory, total units, December 31, 2017. 3. Calculate selling price in 2017. 4. Calculate operating income for 2017.

Comprehensive problem on unit costs, product costs. Atlanta 0office Equipment manufactures and selis metal shelving. It began operations on January 1, 2017. Costs incurred for 2017 are as follows (V stands for variable; Fstands for fixed): $140,000 V 22,000 V 5,000 V 18,000 V 14,000 F 8,000 V 26,000 F 120,000 V 43,000 F 54,000F Direct materials used Direct manufacturing labor costs Plant energy costs Indirect manufacturing labor costs Indirect manufacturing labor costs Other indirect manufacturing costs Other indirect manufacturing costs Marketing, distribution, and customer-service costs Marketing, distribution, and customer-service costs Administrative costs Variable manufacturing costs are variable with respect to units produced. Variable marketing, distribution, and customer-service costs are variable with respect to units sold. Inventory data are as follows: Ending: December 31, 2017 2,300 Ibs O units 7 units Beginning: January 1, 2017 Direct materials O units O units Work in process Finished goods Production in 2017 was 100,000 units. Two pounds of direct materials are used to make one unit of finished product. Revenues in 2017 were $473,200. The selling price per unit and the purchase price per pound of direct materials were stable throughout the year. The company's ending inventory of finished goods is carried at the average unit manufacturing cost for 2017. Finished-goods inventory at December 31, 2017, was $20,970. 1. Calculate direct materials inventory, total cost, December 31, 2017. 2 Calculate finished-goods inventory, total units, December 31, 2017. 3. Calculate selling price in 2017. 4. Calculate operating income for 2017.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 8P: The production of a new product required Zion Manufacturing Co. to lease additional plant...

Related questions

Question

Transcribed Image Text:Comprehensive problem on unit costs, product costs. Atlanta 0office Equipment manufactures and

selis metal shelving. It began operations on January 1, 2017. Costs incurred for 2017 are as follows (V stands

for variable; Fstands for fixed):

$140,000 V

22,000 V

5,000 V

18,000 V

14,000 F

8,000 V

26,000 F

120,000 V

43,000 F

54,000F

Direct materials used

Direct manufacturing labor costs

Plant energy costs

Indirect manufacturing labor costs

Indirect manufacturing labor costs

Other indirect manufacturing costs

Other indirect manufacturing costs

Marketing, distribution, and customer-service costs

Marketing, distribution, and customer-service costs

Administrative costs

Variable manufacturing costs are variable with respect to units produced. Variable marketing, distribution,

and customer-service costs are variable with respect to units sold.

Inventory data are as follows:

Ending: December 31, 2017

2,300 Ibs

O units

7 units

Beginning: January 1, 2017

Direct materials

O units

O units

Work in process

Finished goods

Production in 2017 was 100,000 units. Two pounds of direct materials are used to make one unit of finished

product.

Revenues in 2017 were $473,200. The selling price per unit and the purchase price per pound of direct

materials were stable throughout the year. The company's ending inventory of finished goods is carried at

the average unit manufacturing cost for 2017. Finished-goods inventory at December 31, 2017, was $20,970.

1. Calculate direct materials inventory, total cost, December 31, 2017.

2 Calculate finished-goods inventory, total units, December 31, 2017.

3. Calculate selling price in 2017.

4. Calculate operating income for 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 7 images

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning