Compute the NPV (at 10 percent cost of capital) and IRR to determine the financial feasibility of this project if this were a tax-paying entity with a tax rate of 30 percent. Use the following tables.

Compute the NPV (at 10 percent cost of capital) and IRR to determine the financial feasibility of this project if this were a tax-paying entity with a tax rate of 30 percent. Use the following tables.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 22P: The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500,...

Related questions

Question

Finance question

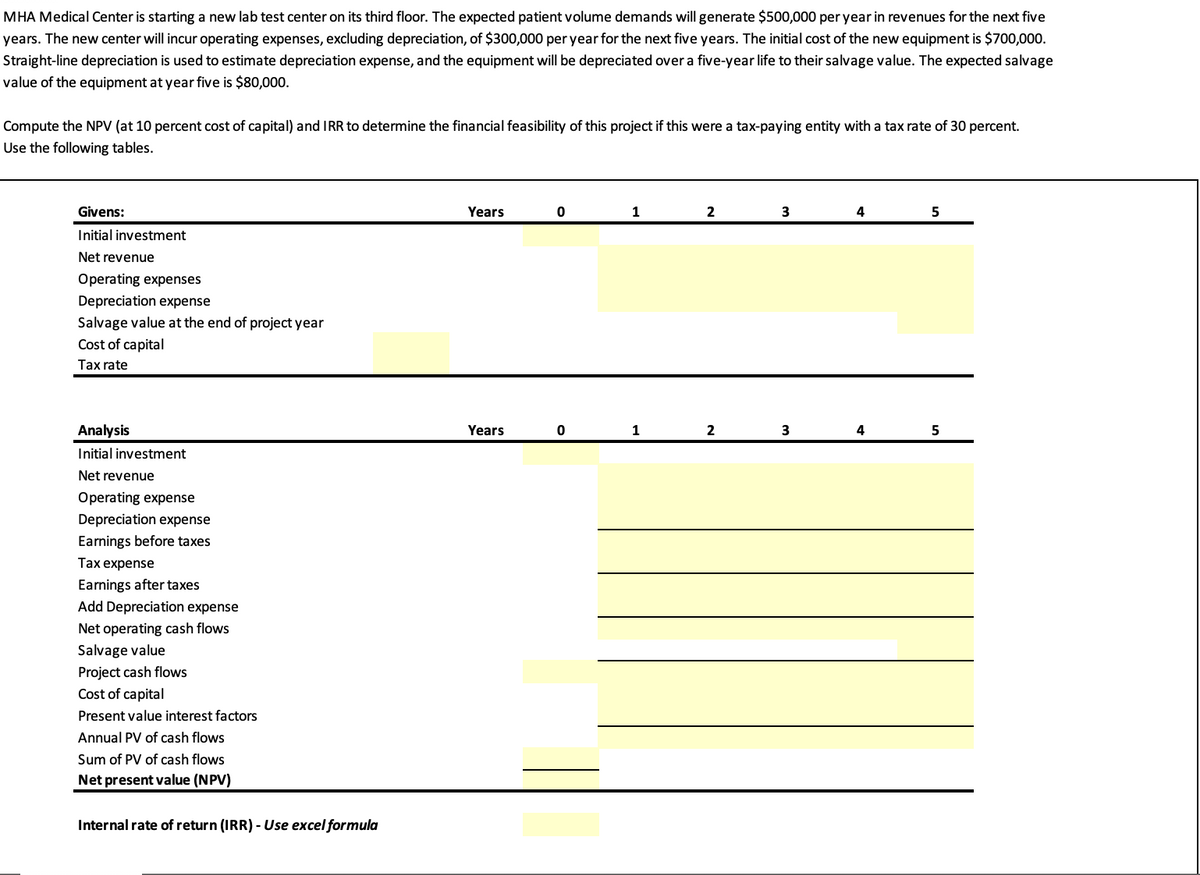

Transcribed Image Text:MHA Medical Center is starting a new lab test center on its third floor. The expected patient volume demands will generate $500,000 per year in revenues for the next five

years. The new center will incur operating expenses, excluding depreciation, of $300,000 per year for the next five years. The initial cost of the new equipment is $700,000.

Straight-line depreciation is used to estimate depreciation expense, and the equipment will be depreciated over a five-year life to their salvage value. The expected salvage

value of the equipment at year five is $80,000.

Compute the NPV (at 10 percent cost of capital) and IRR to determine the financial feasibility of this project if this were a tax-paying entity with a tax rate of 30 percent.

Use the following tables.

Givens:

Initial investment

Net revenue

Operating expenses

Depreciation expense

Salvage value at the end of project year

Cost of capital

Tax rate

Analysis

Initial investment

Net revenue

Operating expense

Depreciation expense

Earnings before taxes

Tax expense

Earnings after taxes

Add Depreciation expense

Net operating cash flows

Salvage value

Project cash flows

Cost of capital

Present value interest factors

Annual PV of cash flows

Sum of PV of cash flows

Net present value (NPV)

Internal rate of return (IRR) - Use excel formula

Years

Years

0

0

1

1

2

2

3

3

4

4

5

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning