Determine the types of payment made to non-resident person which is subject to withholding tax and explain the responsibility of the payer according to the Income Tax Act 1967. (as amended) B.

Determine the types of payment made to non-resident person which is subject to withholding tax and explain the responsibility of the payer according to the Income Tax Act 1967. (as amended) B.

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 34P

Related questions

Question

Please solve all questions

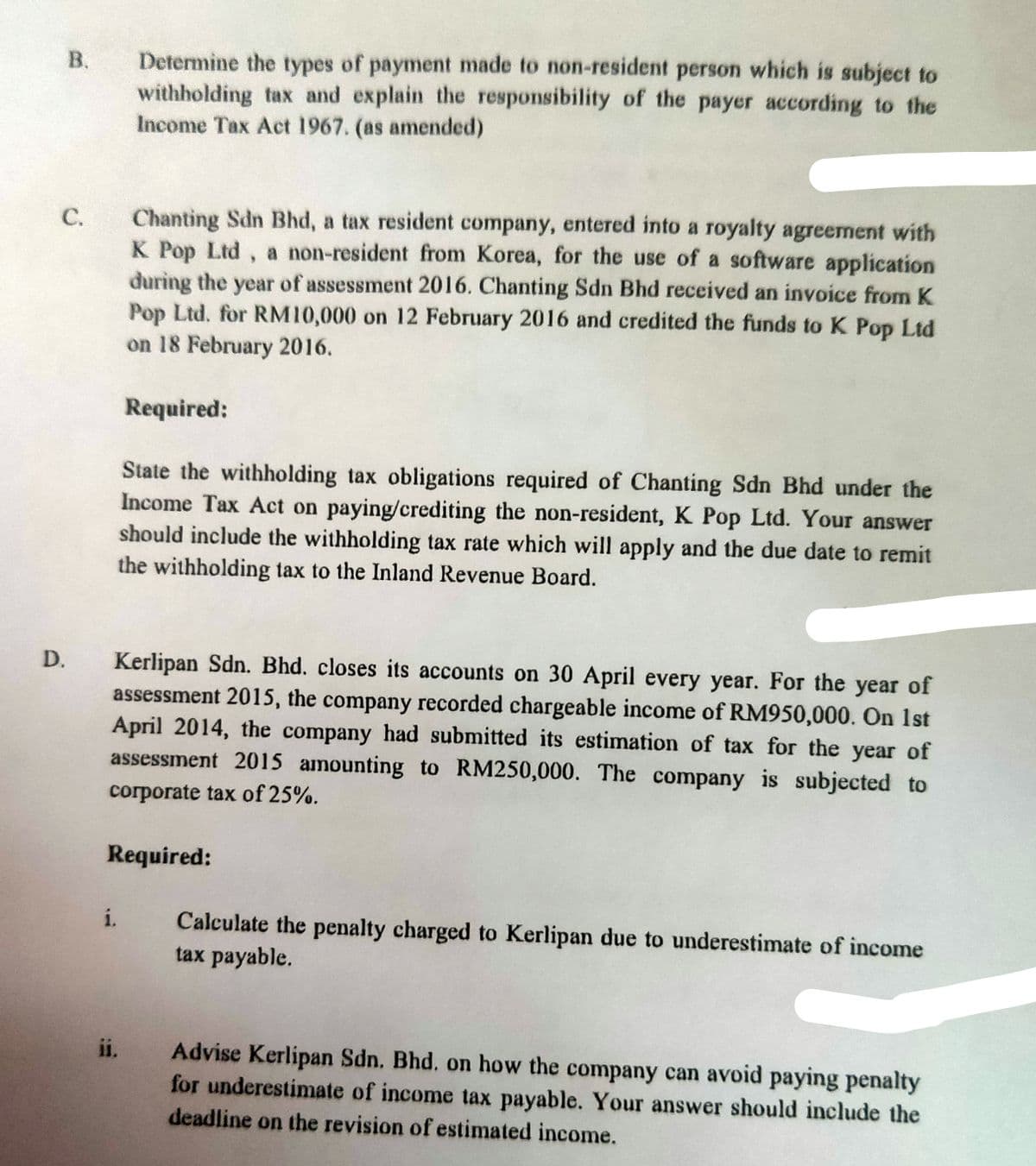

Transcribed Image Text:Determine the types of payment made to non-resident person which is subject to

withholding tax and explain the responsibility of the payer according to the

Income Tax Act 1967. (as amended)

Chanting Sdn Bhd, a tax resident company, entered into a royalty agreement with

K Pop Ltd, a non-resident from Korea, for the use of a software application

during the year of assessment 2016. Chanting Sdn Bhd received an invoice from K

Pop Ltd. for RM10,000 on 12 February 2016 and credited the funds to K Pop Ltd

on 18 February 2016.

С.

Required:

State the withholding tax obligations required of Chanting Sdn Bhd under the

Income Tax Act on paying/crediting the non-resident, K Pop Ltd. Your answer

should include the withholding tax rate which will apply and the due date to remit

the withholding tax to the Inland Revenue Board.

Kerlipan Sdn. Bhd. closes its accounts on 30 April every year. For the year of

assessment 2015, the company recorded chargeable income of RM950,000. On 1st

April 2014, the company had submitted its estimation of tax for the year of

assessment 2015 amounting to RM250,000. The company is subjected to

D.

corporate tax of 25%.

Required:

i.

Calculate the penalty charged to Kerlipan due to underestimate of income

tax payable.

ii.

Advise Kerlipan Sdn. Bhd. on how the company can avoid paying penalty

for underestimate of income tax payable. Your answer should include the

deadline on the revision of estimated income.

B.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT