Condensad financial data of Bridgaport Company for 2020 and 2019a ara presented below. BRIDGEPORT COMPANY COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1820 $1.150 Receivables 1,780 1.310 Inventory 1600 1.930 Plant assets 1.930 1,710 Accumulated depreciation (1.200 ) (1,160 1 Long tarm imestments iheid to-maturity 1320 1,400 $7.250 $6.340 Accounts payabla $1190 Accrued liabilities 190 270 Bonds payable 1430 1.520 Common stock 1.900 1,730 Ratained earnings 2.540 1,940 $7.250 $6.340 BRIDGEPORT COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6.860 Cost of soods sold 4.620 Grass margin 240 Seling and administrative senses 920 Income from operations 1.320 Other revenues and gains Gain on sale of imvestments Income before tax 1400 Income taxerpense 540 Net income Cash dividends 260 Income ratained in business S600 Additional information: During the yaar. $70 of common stock was issuad in exchanga for plant assets. No plant assets ware sold in 2020. Prepare a statament af cash flows using the indirect mathod. (Show amounts that decrease cash flow with either a-signeg-15,000 or in narenthesiseg (15.000U

Condensad financial data of Bridgaport Company for 2020 and 2019a ara presented below. BRIDGEPORT COMPANY COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1820 $1.150 Receivables 1,780 1.310 Inventory 1600 1.930 Plant assets 1.930 1,710 Accumulated depreciation (1.200 ) (1,160 1 Long tarm imestments iheid to-maturity 1320 1,400 $7.250 $6.340 Accounts payabla $1190 Accrued liabilities 190 270 Bonds payable 1430 1.520 Common stock 1.900 1,730 Ratained earnings 2.540 1,940 $7.250 $6.340 BRIDGEPORT COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6.860 Cost of soods sold 4.620 Grass margin 240 Seling and administrative senses 920 Income from operations 1.320 Other revenues and gains Gain on sale of imvestments Income before tax 1400 Income taxerpense 540 Net income Cash dividends 260 Income ratained in business S600 Additional information: During the yaar. $70 of common stock was issuad in exchanga for plant assets. No plant assets ware sold in 2020. Prepare a statament af cash flows using the indirect mathod. (Show amounts that decrease cash flow with either a-signeg-15,000 or in narenthesiseg (15.000U

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 2MC: During 2021, Anthony Company purchased debt securities as a long-term investment and classified them...

Related questions

Question

100%

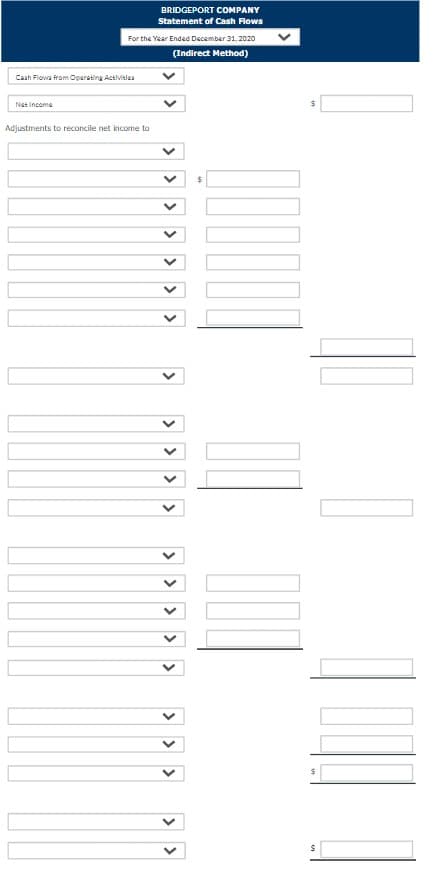

Transcribed Image Text:BRIDGEPORT COMPANY

Statement of Cash Flows

For the Year Ended December 31, 2020

(Indirect Method)

Cash Flows from Operating Activitlea

Net Income

Adjustments to reconcile net income to

> > > > > > >

>

> > > >

> > > > >

> > >

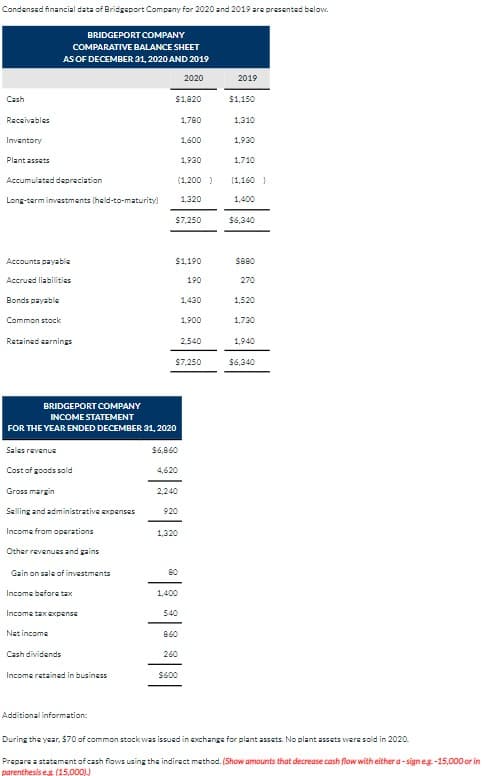

Transcribed Image Text:Condensed financial data of Bridgsport Company for 2020 and 2019 are presented below.

BRIDGEPORT COMPANY

COMPARATIVE BALANCE SHEET

AS OF DECEMBER 31, 2020 AND 2019

2020

2019

Cash

$1,820

$1,150

Receivables

1,780

1,310

Inventory

1,600

1,930

Plant assets

1,930

1,710

Accumulated depreciation

(1,200 )

[1,160 }

Long-term investments (held-to-maturity)

1,320

1,400

$7,250

$6,340

Accounts payable

$1190

SB80

Accrued liabilities

190

270

Bonds payable

1,430

1,520

Common stock

1,900

1,730

Retained carnings

2,540

1,940

$7,250

$6,340

BRIDGEPORT COMPANY

INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 2020

Sales revenue

$6,860

Cost of goods sold

4,620

Gross margin

2,240

Selling and administrative expenses

920

Income from operations

1,320

Other revenuss and gains

Gain on sale of investments

B0

Income before tax

1,400

Income tax expense

540

Net income

B60

Cash dividends

260

Income ratained in business

$600

Additional information:

During the year, $70 of common stock was issued in exchanga for plant assets. No plant assets were sold in 2020.

Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a- sign eg-15,000 or in

parenthesis eg (15,000))

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning