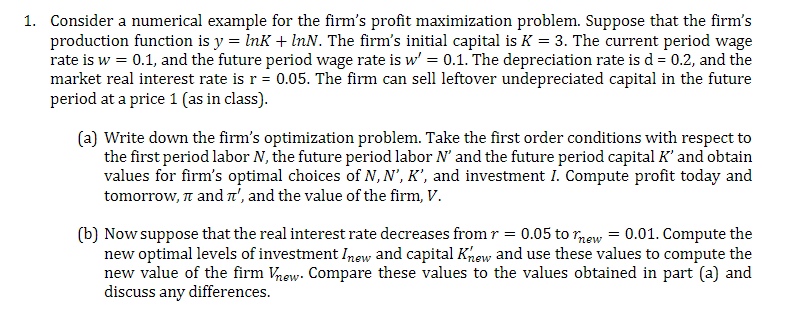

Consider a numerical example for the firm's profit maximization problem. Suppose that the firm's production function is y = lnK + lnN. The firm's initial capital is K = 3. The current period wage rate is w = 0.1, and the future period wage rate is w' = 0.1. The depreciation rate is d = 0.2, and the market real interest rate is r = 0.05. The firm can sell leftover undepreciated capital in the future period at a price 1 (as in class). (a) Write down the firm's optimization problem. Take the first order conditions with respect to the first period labor N, the future period labor N' and the future period capital K' and obtain values for firm's optimal choices of N, N', K’, and investment I. Compute profit today and tomorrow, n and t', and the value of the firm, V. (b) Now suppose that the real interest rate decreases from r = 0.05 to rnew = 0.01. Compute the new optimal levels of investment Inew and capital Khow and use these values to compute the new value of the firm Vnew. Compare these values to the values obtained in part (a) and discuss any differences.

Consider a numerical example for the firm's profit maximization problem. Suppose that the firm's production function is y = lnK + lnN. The firm's initial capital is K = 3. The current period wage rate is w = 0.1, and the future period wage rate is w' = 0.1. The depreciation rate is d = 0.2, and the market real interest rate is r = 0.05. The firm can sell leftover undepreciated capital in the future period at a price 1 (as in class). (a) Write down the firm's optimization problem. Take the first order conditions with respect to the first period labor N, the future period labor N' and the future period capital K' and obtain values for firm's optimal choices of N, N', K’, and investment I. Compute profit today and tomorrow, n and t', and the value of the firm, V. (b) Now suppose that the real interest rate decreases from r = 0.05 to rnew = 0.01. Compute the new optimal levels of investment Inew and capital Khow and use these values to compute the new value of the firm Vnew. Compare these values to the values obtained in part (a) and discuss any differences.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter8: Cost Analysis

Section: Chapter Questions

Problem 2E

Related questions

Question

Transcribed Image Text:1. Consider a numerical example for the firm's profit maximization problem. Suppose that the firm's

production function is y = Ink + InN. The firm's initial capital is K = 3. The current period wage

rate is w = 0.1, and the future period wage rate is w' = 0.1. The depreciation rate is d = 0.2, and the

market real interest rate is r = 0.05. The firm can sell leftover undepreciated capital in the future

period at a price 1 (as in class).

(a) Write down the firm's optimization problem. Take the first order conditions with respect to

the first period labor N, the future period labor N' and the future period capital K' and obtain

values for firm's optimal choices of N, N', K', and investment I. Compute profit today and

tomorrow, n and nt', and the value of the firm, V.

(b) Now suppose that the real interest rate decreases from r = 0.05 to rnew = 0.01. Compute the

new optimal levels of investment Inew and capital Khew and use these values to compute the

new value of the firm Vhew. Compare these values to the values obtained in part (a) and

discuss any differences.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning