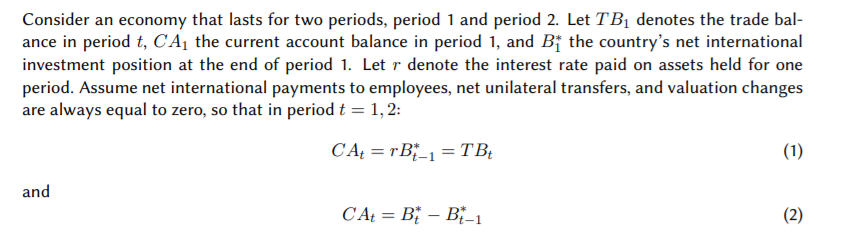

Consider an economy that lasts for two periods, period 1 and period 2. Let TBị denotes the trade bal- ance in period t, CAq the current account balance in period 1, and Bj the country's net international investment position at the end of period 1. Let r denote the interest rate paid on assets held for one period. Assume net international payments to employees, net unilateral transfers, and valuation changes are always equal to zero, so that in period t = 1, 2:

Consider an economy that lasts for two periods, period 1 and period 2. Let TBị denotes the trade bal- ance in period t, CAq the current account balance in period 1, and Bj the country's net international investment position at the end of period 1. Let r denote the interest rate paid on assets held for one period. Assume net international payments to employees, net unilateral transfers, and valuation changes are always equal to zero, so that in period t = 1, 2:

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter7: Nonlinear Optimization Models

Section: Chapter Questions

Problem 69P

Related questions

Question

PLEASE ANSWER

Transcribed Image Text:Consider an economy that lasts for two periods, period 1 and period 2. Let TBị denotes the trade bal-

ance in period t, CA¡ the current account balance in period 1, and Bj the country's net international

investment position at the end of period 1. Let r denote the interest rate paid on assets held for one

period. Assume net international payments to employees, net unilateral transfers, and valuation changes

are always equal to zero, so that in period t = 1, 2:

CAŁ = rB_1 = TB;

(1)

%3|

and

CA = B; – B"_1

(2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,