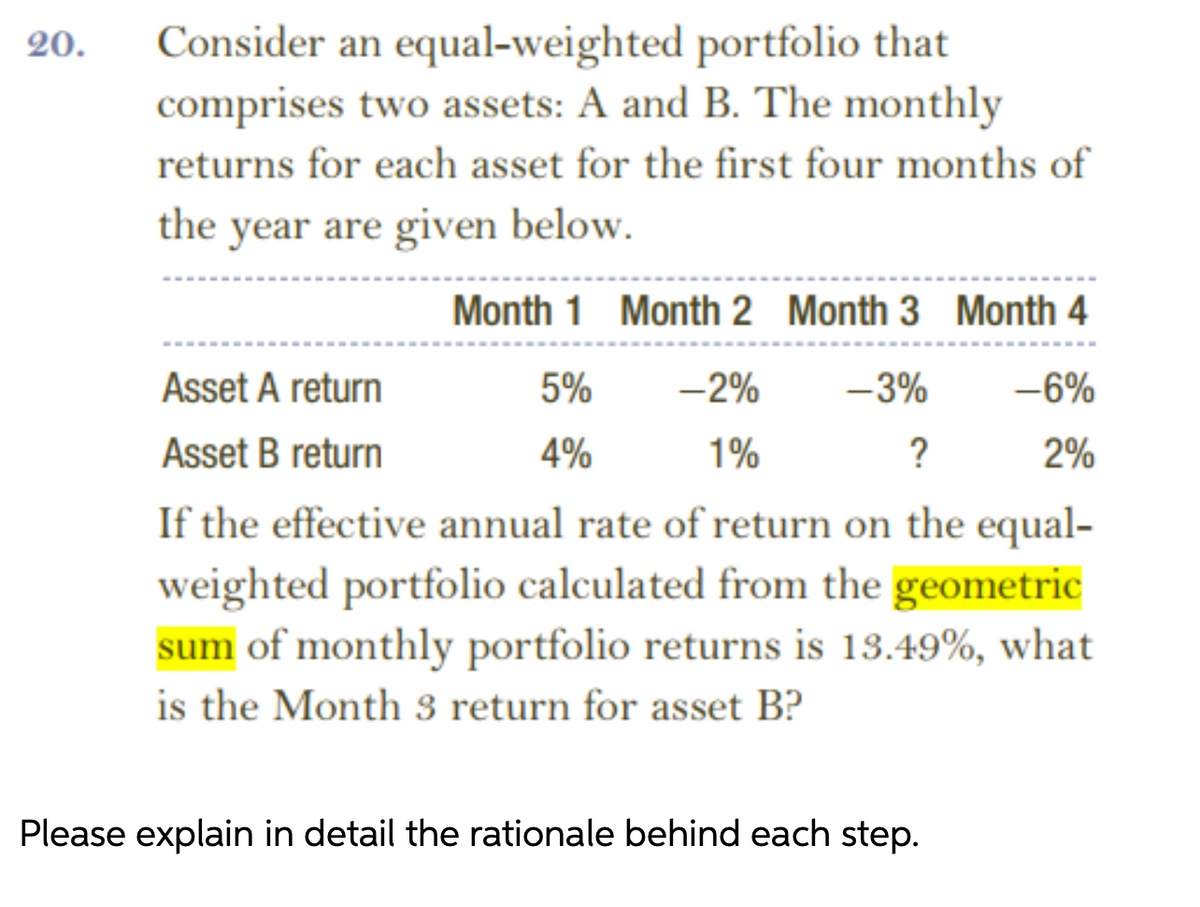

Consider an equal-weighted portfolio that comprises two assets: A and B. The monthly returns for each asset for the first four months of the year are given below. Month 1 Month 2 Month 3 Month 4 Asset A return 5% -2% -3% -6% Asset B return 4% 1% ? 2% If the effective annual rate of return on the equal- weighted portfolio calculated from the geometric sum of monthly portfolio returns is 13.49%, what is the Month 3 return for asset B?

Consider an equal-weighted portfolio that comprises two assets: A and B. The monthly returns for each asset for the first four months of the year are given below. Month 1 Month 2 Month 3 Month 4 Asset A return 5% -2% -3% -6% Asset B return 4% 1% ? 2% If the effective annual rate of return on the equal- weighted portfolio calculated from the geometric sum of monthly portfolio returns is 13.49%, what is the Month 3 return for asset B?

Chapter21: International Cash Management

Section: Chapter Questions

Problem 19QA

Related questions

Question

Transcribed Image Text:Consider an equal-weighted portfolio that

comprises two assets: A and B. The monthly

20.

returns for each asset for the first four months of

the year are given below.

Month 1 Month 2 Month 3 Month 4

Asset A return

5%

-2%

-3%

-6%

Asset B return

4%

1%

?

2%

If the effective annual rate of return on the equal-

weighted portfolio calculated from the geometric

sum of monthly portfolio returns is 13.49%, what

is the Month 3 return for asset B?

Please explain in detail the rationale behind each step.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you