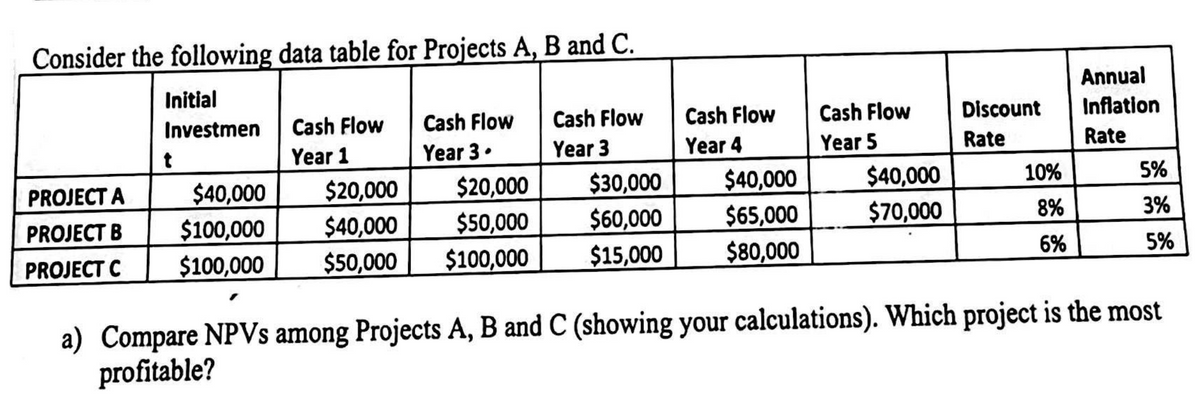

Consider the following data table for Projects A, B and C. Annual Initial Investmen Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow Discount Inflation t Year 1 Year 3⚫ Year 3 Year 4 Year 5 Rate Rate PROJECT A $40,000 $20,000 $20,000 $30,000 $40,000 $40,000 10% 5% PROJECT B $100,000 $40,000 $50,000 $60,000 $65,000 $70,000 8% 3% PROJECT C $100,000 $50,000 $100,000 $15,000 $80,000 6% 5% a) Compare NPVs among Projects A, B and C (showing your calculations). Which project is the most profitable?

Consider the following data table for Projects A, B and C. Annual Initial Investmen Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow Discount Inflation t Year 1 Year 3⚫ Year 3 Year 4 Year 5 Rate Rate PROJECT A $40,000 $20,000 $20,000 $30,000 $40,000 $40,000 10% 5% PROJECT B $100,000 $40,000 $50,000 $60,000 $65,000 $70,000 8% 3% PROJECT C $100,000 $50,000 $100,000 $15,000 $80,000 6% 5% a) Compare NPVs among Projects A, B and C (showing your calculations). Which project is the most profitable?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 2BE

Related questions

Question

Transcribed Image Text:Consider the following data table for Projects A, B and C.

Annual

Initial

Investmen

Cash Flow

Cash Flow

Cash Flow

Cash Flow

Cash Flow

Discount

Inflation

t

Year 1

Year 3⚫

Year 3

Year 4

Year 5

Rate

Rate

PROJECT A

$40,000

$20,000

$20,000

$30,000

$40,000

$40,000

10%

5%

PROJECT B

$100,000

$40,000

$50,000

$60,000

$65,000

$70,000

8%

3%

PROJECT C

$100,000

$50,000

$100,000

$15,000

$80,000

6%

5%

a) Compare NPVs among Projects A, B and C (showing your calculations). Which project is the most

profitable?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning