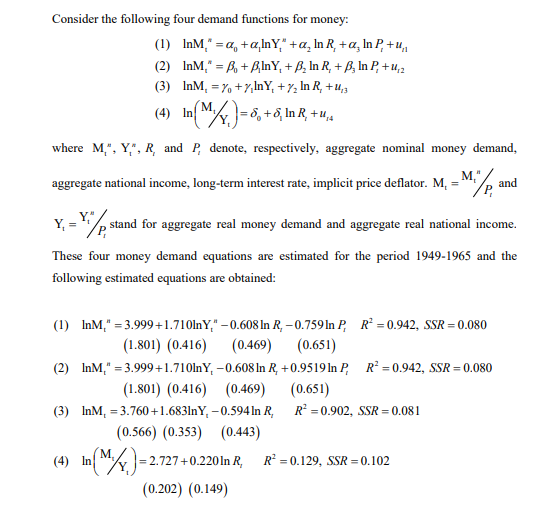

Consider the following four demand functions for money: (1) InM, =a, +a̟InY," +a¸ In R_ +a¸ In P,+u, (2) InM," = B, + BInY, + B, In R, + B, In P, + u,2 (3) InM, = 7, +7,InY, + 7, In R, +u,, %3D (4) In M)=5, +5, In R +u,. where M", Y", R and P, denote, respectively, aggregate nominal money demand, and aggregate national income, long-term interest rate, implicit price deflator. M, = M." Y, =2 ,stand for aggregate real money demand and aggregate real national income. These four money demand equations are estimated for the period 1949-1965 and the following estimated equations are obtained: (1) InM," = 3.999+1.710lnY," –0.608 In R, – 0.759In P, R = 0.942, SSR = 0.080 (0.469) (0.651) (1.801) (0.416) (2) InM," = 3.999+1.710lnY, –0.608 In R, +0.9519ln P, R = 0.942, SSR =0.080 (1.801) (0.416) (0.469) (0.651) (3) InM, = 3.760+1.683lnY, – 0.5941n R, R² =0.902, SSR = 0.081 (0.566) (0.353) (0.443) M, (4) In |=2.727+0.220ln R, R =0.129, SSR =0.102 (0.202) (0.149)

Consider the following four demand functions for money: (1) InM, =a, +a̟InY," +a¸ In R_ +a¸ In P,+u, (2) InM," = B, + BInY, + B, In R, + B, In P, + u,2 (3) InM, = 7, +7,InY, + 7, In R, +u,, %3D (4) In M)=5, +5, In R +u,. where M", Y", R and P, denote, respectively, aggregate nominal money demand, and aggregate national income, long-term interest rate, implicit price deflator. M, = M." Y, =2 ,stand for aggregate real money demand and aggregate real national income. These four money demand equations are estimated for the period 1949-1965 and the following estimated equations are obtained: (1) InM," = 3.999+1.710lnY," –0.608 In R, – 0.759In P, R = 0.942, SSR = 0.080 (0.469) (0.651) (1.801) (0.416) (2) InM," = 3.999+1.710lnY, –0.608 In R, +0.9519ln P, R = 0.942, SSR =0.080 (1.801) (0.416) (0.469) (0.651) (3) InM, = 3.760+1.683lnY, – 0.5941n R, R² =0.902, SSR = 0.081 (0.566) (0.353) (0.443) M, (4) In |=2.727+0.220ln R, R =0.129, SSR =0.102 (0.202) (0.149)

Chapter20: Monetary Policy

Section: Chapter Questions

Problem 4SQP

Related questions

Question

Transcribed Image Text:Consider the following four demand functions for money:

(1) InM," = a, +a,InY," +a, In R, + a, In P, + ,

%3D

(2) InM," = B, + BInY, + B, In R, + B, In P, + u,2

(3) InM, = %, +7,InY, + 7, In R, +u,,

(4) InM)=6, +6, InR, +u,.

where M,", Y,", R, and P, denote, respectively, aggregate nominal money demand,

M,",

and

/P,

aggregate national income, long-term interest rate, implicit price deflator. M,

Y, = /

stand for aggregate real money demand and aggregate real national income.

These four money demand equations are estimated for the period 1949-1965 and the

following estimated equations are obtained:

(1) InM," = 3.999+1.710lnY," – 0.608 In R, – 0.759In P, R = 0.942, SSR = 0.080

(0.469)

(1.801) (0.416)

(0.651)

(2) InM," = 3.999+1.710lnY, –0.608In R, +0.9519 In P, R² =0.942, SSR = 0.080

(1.801) (0.416) (0.469)

(0.651)

R = 0.902, SSR = 0.081

(3) InM, = 3.760 +1.683lnY, – 0.594 In R,

(0.566) (0.353) (0.443)

(4) In M)=2.727+0.2201n R,

R = 0.129, SSR = 0.102

(0.202) (0.149)

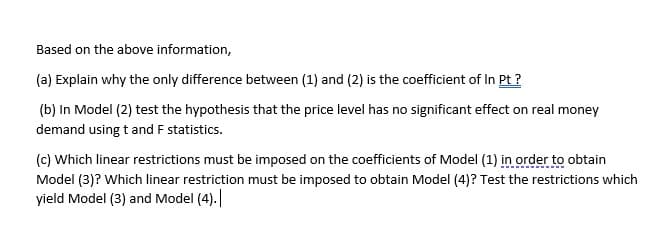

Transcribed Image Text:Based on the above information,

(a) Explain why the only difference between (1) and (2) is the coefficient of In Pt ?

(b) In Model (2) test the hypothesis that the price level has no significant effect on real money

demand using t and F statistics.

(c) Which linear restrictions must be imposed on the coefficients of Model (1) in order to obtain

Model (3)? Which linear restriction must be imposed to obtain Model (4)? Test the restrictions which

yield Model (3) and Model (4).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning