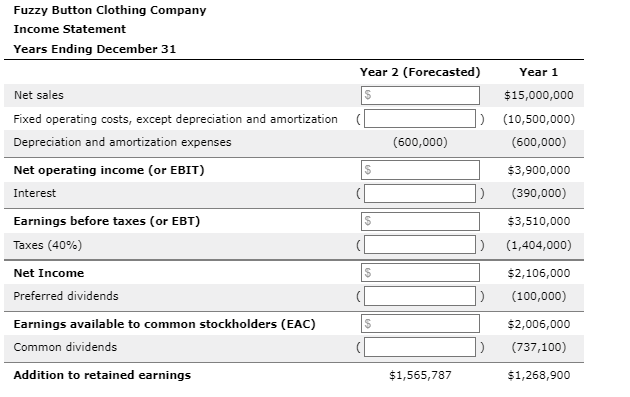

Consider the following scenario: Fuzzy Button Clothing Company’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year. 1. Fuzzy Button is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company’s operating costs (excluding depreciation and amortization) remain at 70.00% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company’s tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Fuzzy Button expects to pay $100,000 and $896,963 of preferred and common stock dividends, respectively. Complete the Year 2 income statement data for Fuzzy Button, then answer the questions that follow. Round each dollar value to the nearest whole dollar.

Consider the following scenario: Fuzzy Button Clothing Company’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year. 1. Fuzzy Button is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company’s operating costs (excluding depreciation and amortization) remain at 70.00% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company’s tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Fuzzy Button expects to pay $100,000 and $896,963 of preferred and common stock dividends, respectively. Complete the Year 2 income statement data for Fuzzy Button, then answer the questions that follow. Round each dollar value to the nearest whole dollar.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.3.2P: Income statement, retained earnings statement, and balance sheet The following financial data were...

Related questions

Question

100%

Consider the following scenario:

Fuzzy Button Clothing Company’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year.

| 1. | Fuzzy Button is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). |

| 2. | The company’s operating costs (excluding |

| 3. | The company’s tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT). |

| 4. | In Year 2, Fuzzy Button expects to pay $100,000 and $896,963 of preferred and common stock dividends, respectively. |

Complete the Year 2 income statement data for Fuzzy Button, then answer the questions that follow. Round each dollar value to the nearest whole dollar.

Transcribed Image Text:Fuzzy Button Clothing Company

Income Statement

Years Ending December 31

Net sales

Fixed operating costs, except depreciation and amortization

Depreciation and amortization expenses

Net operating income (or EBIT)

Interest

Earnings before taxes (or EBT)

Taxes (40%)

Net Income

Preferred dividends

Earnings available to common stockholders (EAC)

Common dividends

Addition to retained earnings

Year 2 (Forecasted)

$

$

$

$

$

(600,000)

Year 1

$15,000,000

) (10,500,000)

(600,000)

$1,565,787

)

$3,900,000

(390,000)

$3,510,000

(1,404,000)

$2,106,000

(100,000)

$2,006,000

(737,100)

$1,268,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning