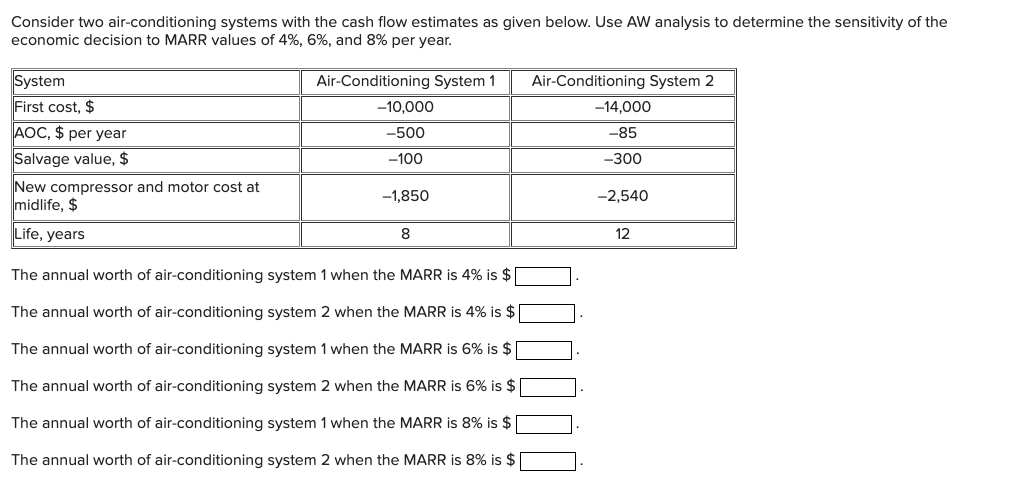

Consider two air-conditioning systems with the cash flow estimates as given below. Use AW analysis to determine the sensitivity of the economic decision to MARR values of 4%, 6%, and 8% per year. Air-Conditioning System 1 System First cost, $ AOC, $ per year Salvage value, $ New compressor and motor cost at midlife, $ Life, years -10,000 -500 -100 -1,850 8 The annual worth of air-conditioning system 1 when the MARR is 4% is $[ The annual worth of air-conditioning system 2 when the MARR is 4% is $ The annual worth of air-conditioning system 1 when the MARR is 6% is $ The annual worth of air-conditioning system 2 when the MARR is 6% is $ The annual worth of air-conditioning system 1 when the MARR is 8% is $ The annual worth of air-conditioning system 2 when the MARR is 8% is $ Air-Conditioning System 2 -14,000 -85 -300 -2,540 12

Consider two air-conditioning systems with the cash flow estimates as given below. Use AW analysis to determine the sensitivity of the economic decision to MARR values of 4%, 6%, and 8% per year. Air-Conditioning System 1 System First cost, $ AOC, $ per year Salvage value, $ New compressor and motor cost at midlife, $ Life, years -10,000 -500 -100 -1,850 8 The annual worth of air-conditioning system 1 when the MARR is 4% is $[ The annual worth of air-conditioning system 2 when the MARR is 4% is $ The annual worth of air-conditioning system 1 when the MARR is 6% is $ The annual worth of air-conditioning system 2 when the MARR is 6% is $ The annual worth of air-conditioning system 1 when the MARR is 8% is $ The annual worth of air-conditioning system 2 when the MARR is 8% is $ Air-Conditioning System 2 -14,000 -85 -300 -2,540 12

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 3MAD

Related questions

Question

Transcribed Image Text:Consider two air-conditioning systems with the cash flow estimates as given below. Use AW analysis to determine the sensitivity of the

economic decision to MARR values of 4%, 6%, and 8% per year.

Air-Conditioning System 1

System

First cost, $

AOC, $ per year

Salvage value, $

New compressor and motor cost at

midlife, $

Life, years

-10,000

-500

-100

-1,850

8

The annual worth of air-conditioning system 1 when the MARR is 4% is $

The annual worth of air-conditioning system 2 when the MARR is 4% is $

The annual worth of air-conditioning system 1 when the MARR is 6% is $

The annual worth of air-conditioning system 2 when the MARR is 6% is $

The annual worth of air-conditioning system 1 when the MARR is 8% is $

The annual worth of air-conditioning system 2 when the MARR is 8% is $

Air-Conditioning System 2

-14,000

-85

-300

-2,540

12

Expert Solution

Step 1

Annual worth

The annual worth is the sum of all the advantages and expenses over the course of a year. We therefore give a single number—the yearly worth—that represents the net of all the various advantages and expenses incurred at various moments throughout the course of a year.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning