continuation of the case study : continuation of the case study : Our mission has always been clear: to build instant, honest, affordable insurance that people love. This might seem like a big, hairy, audacious goal, given the levels of apathy and distrust most people feel towards insurance. Then again, most worthwhile endeavours aren't easy. We believe it's imperative to restore people's confidence that their insurance will do what it says on the tin, and that we are on the right track to doing just that. How are we doing this? First, through our technology. We give people total control, from enabling them to buy cover online in seconds, to allowing them to claim and manage their car, home and single item insurance directly on the Naked app. Our technology also never sleeps, meaning this can be done 24/7 and all without chatting to a call centre. These operational savings are then passed on directly to our clients, through sustainably lower premiums. The second part is the way that we run our business. Inherent in the traditional insurance model is the reality that if less is paid out in claims, it means more profit for the insurer. This results in the client and their insurer being in a constant tug of war over the same money when a claim is submitted. We don't work like that. Instead, we take a flat fee upfront to cover running costs and profit. The rest of the money goes towards claims, with leftover premiums at the end of the year paid to causes our clients choose, rather than our bottom line - this is the Naked Difference and it changes everything about insurance. This means that our profit isn't linked to how much we pay in claims. By aligning our interests with those of our clients, we create mutually beneficial relationships amongst Naked, our clients, and our communities.We're well on our way to changing insurance for goodWhen we started Naked, many people believed that our mission was unobtainable and unrealistic. This new round of funding shows how far we've come - but we're just getting started. There's so much more we'd like to do, and this funding allows us to take things to the next level - building insurance experiences that are simple to use, yet beautiful, while making them available to more and more people. We couldn't be more excited to walk this journey of redefining insurance with you and are immensely grateful for your ongoing support. Question 3: The concepts of "shared value" and "inclusive business" provide several opportunities to organisations and their stakeholders. Evaluate the extent to which Naked is implementing the concepts of "shared value" and "inclusive business". Your answer should contain the following points: Provide a brief introduction to the purpose of "shared value" and "inclusive business". Outline the concept of "shared value" and "inclusive business". Evaluate the extent to which Naked is implementing the concepts of "shared value" and "inclusive business" to Naked. Provide examples to support your answer. Propose ways in which Naked may improve upon their approach to "shared value" and "inclusive business". Recommended readings for this question: British Assessment Bureau. 2016. Creating Shared Value - A new way of doing business? British Assessment Bureau, 13 January 2016. [Online]. Available at: https://www.british- assessment.co.uk/insights/spotlight-introducing-concept- creating-shared-value/ [Accessed 14 January 2023]. Kramer, M. R. and Pfitzer, M. W. 2016. The Ecosystem of Shared Value. Harvard Business Review, October 2016. [Online]. Available at: https://hbr.org/2016/10/the-ecosystem-of-shared-value [Accessed 14 January 2023]. Shared Value Project. 2020. What is shared value? [Online]. Available at: https://sharedvalue.org.au/about/shared- value/ #:~:text-Shared%20value%20is%20a%20business,of%20society '5%20most%20pressing%20i ssues. [Accessed 14 January 2023]. You are required to use a minimum of two additional academic sources, excluding the prescribed textbook, to support your argument/discussion/analysis/evaluation. Wikipedia/ Investopedia/ Social Media are not regarded as academic sources

continuation of the case study : continuation of the case study : Our mission has always been clear: to build instant, honest, affordable insurance that people love. This might seem like a big, hairy, audacious goal, given the levels of apathy and distrust most people feel towards insurance. Then again, most worthwhile endeavours aren't easy. We believe it's imperative to restore people's confidence that their insurance will do what it says on the tin, and that we are on the right track to doing just that. How are we doing this? First, through our technology. We give people total control, from enabling them to buy cover online in seconds, to allowing them to claim and manage their car, home and single item insurance directly on the Naked app. Our technology also never sleeps, meaning this can be done 24/7 and all without chatting to a call centre. These operational savings are then passed on directly to our clients, through sustainably lower premiums. The second part is the way that we run our business. Inherent in the traditional insurance model is the reality that if less is paid out in claims, it means more profit for the insurer. This results in the client and their insurer being in a constant tug of war over the same money when a claim is submitted. We don't work like that. Instead, we take a flat fee upfront to cover running costs and profit. The rest of the money goes towards claims, with leftover premiums at the end of the year paid to causes our clients choose, rather than our bottom line - this is the Naked Difference and it changes everything about insurance. This means that our profit isn't linked to how much we pay in claims. By aligning our interests with those of our clients, we create mutually beneficial relationships amongst Naked, our clients, and our communities.We're well on our way to changing insurance for goodWhen we started Naked, many people believed that our mission was unobtainable and unrealistic. This new round of funding shows how far we've come - but we're just getting started. There's so much more we'd like to do, and this funding allows us to take things to the next level - building insurance experiences that are simple to use, yet beautiful, while making them available to more and more people. We couldn't be more excited to walk this journey of redefining insurance with you and are immensely grateful for your ongoing support. Question 3: The concepts of "shared value" and "inclusive business" provide several opportunities to organisations and their stakeholders. Evaluate the extent to which Naked is implementing the concepts of "shared value" and "inclusive business". Your answer should contain the following points: Provide a brief introduction to the purpose of "shared value" and "inclusive business". Outline the concept of "shared value" and "inclusive business". Evaluate the extent to which Naked is implementing the concepts of "shared value" and "inclusive business" to Naked. Provide examples to support your answer. Propose ways in which Naked may improve upon their approach to "shared value" and "inclusive business". Recommended readings for this question: British Assessment Bureau. 2016. Creating Shared Value - A new way of doing business? British Assessment Bureau, 13 January 2016. [Online]. Available at: https://www.british- assessment.co.uk/insights/spotlight-introducing-concept- creating-shared-value/ [Accessed 14 January 2023]. Kramer, M. R. and Pfitzer, M. W. 2016. The Ecosystem of Shared Value. Harvard Business Review, October 2016. [Online]. Available at: https://hbr.org/2016/10/the-ecosystem-of-shared-value [Accessed 14 January 2023]. Shared Value Project. 2020. What is shared value? [Online]. Available at: https://sharedvalue.org.au/about/shared- value/ #:~:text-Shared%20value%20is%20a%20business,of%20society '5%20most%20pressing%20i ssues. [Accessed 14 January 2023]. You are required to use a minimum of two additional academic sources, excluding the prescribed textbook, to support your argument/discussion/analysis/evaluation. Wikipedia/ Investopedia/ Social Media are not regarded as academic sources

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

continuation of the case study :

continuation of the case study :

Our mission has always been clear: to build instant, honest, affordable insurance that people love. This might seem like a big, hairy, audacious goal, given the levels of apathy and distrust most people feel towards insurance. Then again, most worthwhile endeavours aren't easy. We believe it's imperative to restore people's confidence that their insurance will do what it says on the tin, and that we are on the right track to doing just that. How are we doing this? First, through our technology.

We give people total control, from enabling them to buy cover online in seconds, to allowing them to claim and manage their car, home and single item insurance directly on the Naked app.

Our technology also never sleeps, meaning this can be done 24/7 and all without chatting to a call centre. These operational savings are then passed on directly to our clients, through sustainably lower premiums. The second part is the way that we run our business. Inherent in the traditional insurance model is the reality that if less is paid out in claims, it means more profit for the insurer. This results in the client and their insurer being in a constant tug of war over the same money when a claim is submitted. We don't work like that. Instead, we take a flat fee upfront to cover running costs and profit. The rest of the money goes towards claims, with leftover premiums at the end of the year paid to causes our clients choose, rather than our bottom line - this is the Naked Difference and it changes everything about insurance.

This means that our profit isn't linked to how much we pay in claims. By aligning our interests with those of our clients, we create mutually beneficial relationships amongst Naked, our clients, and our communities.We're well on our way to changing insurance for goodWhen we started Naked, many people believed that our mission was unobtainable and unrealistic. This new round of funding shows how far we've come - but we're just getting started.

There's so much more we'd like to do, and this funding allows us to take things to the next level - building insurance experiences that are simple to use, yet beautiful, while making them available to more and more people. We couldn't be more excited to walk this journey of redefining insurance with you and are immensely grateful for your ongoing support.

Question 3:

The concepts of "shared value" and "inclusive business" provide several opportunities to organisations and their stakeholders. Evaluate the extent to which Naked is implementing the concepts of "shared value" and "inclusive business".

Your answer should contain the following points:

Provide a brief introduction to the purpose of "shared value" and "inclusive business".

Outline the concept of "shared value" and "inclusive business".

Evaluate the extent to which Naked is implementing the concepts of "shared value" and "inclusive business" to Naked.

Provide examples to support your answer.

Propose ways in which Naked may improve upon their approach to "shared value" and "inclusive business".

Recommended readings for this question:

British Assessment Bureau. 2016. Creating Shared Value - A new way of doing business? British Assessment Bureau, 13

January 2016. [Online]. Available at: https://www.british-

assessment.co.uk/insights/spotlight-introducing-concept-

creating-shared-value/ [Accessed 14 January 2023].

Kramer, M. R. and Pfitzer, M. W. 2016. The Ecosystem of Shared Value. Harvard Business Review, October 2016.

[Online]. Available at: https://hbr.org/2016/10/the-ecosystem-of-shared-value [Accessed 14 January 2023].

Shared Value Project. 2020. What is shared value? [Online].

Available at: https://sharedvalue.org.au/about/shared- value/ #:~:text-Shared%20value%20is%20a%20business,of%20society

'5%20most%20pressing%20i ssues. [Accessed 14 January 2023].

You are required to use a minimum of two additional academic sources, excluding the prescribed textbook, to support your argument/discussion/analysis/evaluation. Wikipedia/ Investopedia/ Social Media are not regarded as academic

sources.

Transcribed Image Text:20; 21; 22; 23

23:35

BMNG7321A1_FT ✓

1.

2.

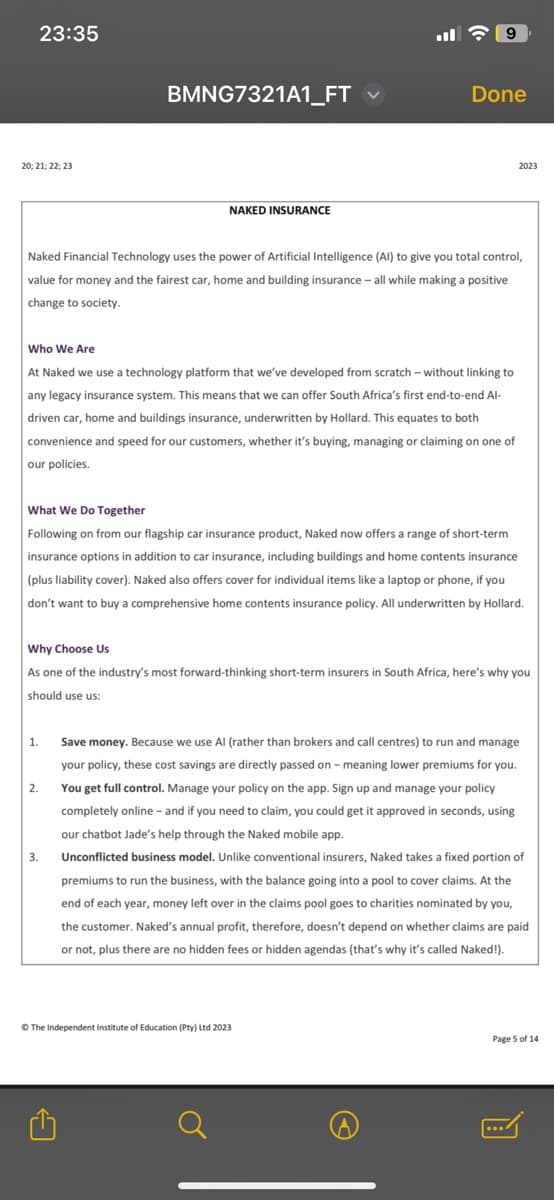

NAKED INSURANCE

Naked Financial Technology uses the power of Artificial Intelligence (Al) to give you total control,

value for money and the fairest car, home and building insurance - all while making a positive

change to society.

Who We Are

At Naked we use a technology platform that we've developed from scratch - without linking to

any legacy insurance system. This means that we can offer South Africa's first end-to-end Al-

driven car, home and buildings insurance, underwritten by Hollard. This equates to both

convenience and speed for our customers, whether it's buying, managing or claiming on one of

our policies.

3.

9

What We Do Together

Following on from our flagship car insurance product, Naked now offers a range of short-term

insurance options in addition to car insurance, including buildings and home contents insurance

(plus liability cover). Naked also offers cover for individual items like a laptop or phone, if you

don't want to buy a comprehensive home contents insurance policy. All underwritten by Hollard.

Done

Why Choose Us

As one of the industry's most forward-thinking short-term insurers in South Africa, here's why you

should use us:

2023

Ⓒ The Independent Institute of Education (Pty) Ltd 2023

a

Save money. Because we use Al (rather than brokers and call centres) to run and manage

your policy, these cost savings are directly passed on - meaning lower premiums for you.

You get full control. Manage your policy on the app. Sign up and manage your policy

completely online - and if you need to claim, you could get it approved in seconds, using

our chatbot Jade's help through the Naked mobile app.

Unconflicted business model. Unlike conventional insurers, Naked takes a fixed portion of

premiums to run the business, with the balance going into a pool to cover claims. At the

end of each year, money left over in the claims pool goes to charities nominated by you,

the customer. Naked's annual profit, therefore, doesn't depend on whether claims are paid

or not, plus there are no hidden fees or hidden agendas (that's why it's called Naked!).

Page 5 of 14

![23:31

Expert Q&A

NAKED INSURANCE

Naked Financial Technology uses the power of Artificial Intelligence (Al) to give you total control, value

for money and the fairest car, home and building insurance - all while making a positive change to

society.

Who We Are

At Naked we use a technology platform that we've developed from scratch - without linking to any

legacy insurance system. This means that we can offer South Africa's first end-to-end Al-driven car,

home, and buildings insurance, underwritten by Hollard. This equates to both convenience and speed

for our customers, whether it's buying, managing, or claiming on one of

our policies.

What We Do Together

Following on from our flagship car insurance product, Naked now offers a range of short-term

insurance options in addition to car insurance, including buildings and home contents insurance(plus

liability cover). Naked also provides cover for individual items like a laptop or phone, if you

don't want to buy a comprehensive home contents insurance policy. All are underwritten by Hollard.

Why Choose Us

As one of the industry's most forward-thinking short-term insurers in South Africa, here's why you

should use us:

Save money. Because we use Al (rather than brokers and call centers) to run and manage your policy,

these cost savings are directly passed on - meaning lower premiums for you.

You get complete control. Manage your policy on the app. Sign up and manage your policy completely

online - and if you need to claim, you can get it approved in seconds, using our chatbot Jade's help

through the Naked mobile app.

Unconflicted business model. Unlike conventional insurers, Naked takes a fixed portion of premiums to

run the business, with the balance going into a pool to cover claims. At the end of each year, money

left over in the claims pool goes to charities nominated by you, the customer. Naked's annual profit,

therefore, doesn't depend on whether claims are paid or not, plus there are no hidden fees or hidden

agendas (that's why it's called Naked!). Naked Financial Technology is an authorized FSP, and our

product (Naked Insurance) is

underwritten by Hollard.

Done

NAKED DOES NOT WORK, THINK OR MAKE MONEY THE WAY TRADITIONAL INSURERS DO.

Often to get something right, our hear and heart need to work together. Naked's revolutionary

business model does just that, and in doing so, breaks the age-old cycle of distrust between insurers

and their customers. Unlike other insurance, they charge a fixed percentage of your premiums to do

everything. No hidden fees or hidden agendas (that's why we're called Naked!). Our flat fee means

that our income doesn't depend on how much we pay out in claims, so we have no reason to make

claiming difficult. When claims are low, premiums left over at the end of the year go to causes you care

about, supporting positive change in South African communities, rather than growing insurance

company profits. That's the Naked Difference and it changes everything about insurance.

INSURANCE CHANGES FOR GOOD: NAKED RAISES R160 MILLION IN FUNDING

Since day one, our mission has been to build insurance that people love. We are still early in our

journey and by raising R160 million (US$11m) we are excited that we will be able to accelerate our

vision. Our focus will be on expanding our team, continuing to invest in the technology that puts

customers in control, meeting the insurance needs of a growing portion of the South African market,

and entering into international markets. This funding round was led by Naspers Foundry and we look

forward to working with an investor of their caliber. Existing Naked investors, Yellowwoods and

Hollard, also participated in the funding round, endorsing our growth plans and success thus far.

Our mission has always been clear: to build instant, honest, affordable insurance that people love. This

might seem like a big, hairy, audacious goal, given the levels of apathy and distrust most people feel

towards insurance. Then again, most worthwhile endeavors aren't easy. We believe it's imperative to

restore people's confidence that their insurance will do what it says on the tin, and that we are on the

right track to doing just that.

How are we doing this? First, through our technology. We give people total control, from enabling them

to buy cover online in seconds, to allowing them to claim and manage their car, home, and single-item

insurance directly on the Naked app. Our technology also never sleeps, meaning this can be done 24/7

and all without chatting to a call center. These operational savings are then passed on directly to our

clients, through sustainably lower premiums.

The second part is the way that we run our business. Inherent in the traditional insurance model is the

reality that if less is paid out in claims, it means more profit for the insurer. This results in the client and

their insurer being in a constant tug of war over the same money when a claim is submitted. We don't

work like that. Instead, we take a flat fee upfront to cover running costs and profit. The rest of the

money goes towards claims, with leftover premiums at the end of the year paid to cause our clients to

choose, rather than our bottom line - this is the Naked Difference and it changes everything about

insurance.

This means that our profit isn't linked to how much we pay in claims. By aligning our interests with

those of our clients, we create mutually beneficial relationships amongst Naked, our clients, and our

communities.

We're well on our way to changing insurance for good. When we started Naked, many people believed

that our mission was unobtainable and unrealistic. This new round of funding shows how far we've

come - but we're just getting started. There's so much more we'd like to do, and this funding allows us

to take things to the next level-building insurance experiences that are simple to use, yet beautiful,

while making them available to more and more people. We couldn't be more excited to walk this

journey of redefining insurance with you and are immensely grateful for your ongoing support.

Question 3: The concepts of "shared value" and "inclusive business" provide several

opportunities to organisations and their stakeholders. Evaluate the extent to which Naked is

implementing the concepts of "shared value" and "inclusive business".

Your answer should contain the following points:

1. Provide a brief introduction to the purpose of "shared value" and "inclusive business".

2. Outline the concept of "shared value" and "inclusive business".

3. Evaluate the extent to which Naked is implementing the concepts of "shared value" and "inclusive business" to

Naked. Provide examples to support your answer.

4. Propose ways in which Naked may improve upon their approach to "shared value" and "inclusive business".

Recommended readings for this question:

British Assessment Bureau. 2016. Creating Shared Value - A new way of doing business? British

Assessment Bureau, 13 January 2016. [Online]. Available at: https://www.british-

assessment.co.uk/insights/spotlight-introducing-concept-creating-shared-value/ [Accessed 14

January 2023].

Kramer, M. R. and Pfitzer, M. W. 2016. The Ecosystem of Shared Value. Harvard Business Review,

October 2016. [Online]. Available at: https://hbr.org/2016/10/the-ecosystem-of-shared-value

[Accessed 14 January 2023].

Shared Value Project. 2020. What is shared value? [Online]. Available at:

10](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fcd448c24-6d86-4fd4-90c5-793b510b15a1%2F395730ad-df3a-4b31-899b-802bb4ef3400%2F959auh_processed.jpeg&w=3840&q=75)

Transcribed Image Text:23:31

Expert Q&A

NAKED INSURANCE

Naked Financial Technology uses the power of Artificial Intelligence (Al) to give you total control, value

for money and the fairest car, home and building insurance - all while making a positive change to

society.

Who We Are

At Naked we use a technology platform that we've developed from scratch - without linking to any

legacy insurance system. This means that we can offer South Africa's first end-to-end Al-driven car,

home, and buildings insurance, underwritten by Hollard. This equates to both convenience and speed

for our customers, whether it's buying, managing, or claiming on one of

our policies.

What We Do Together

Following on from our flagship car insurance product, Naked now offers a range of short-term

insurance options in addition to car insurance, including buildings and home contents insurance(plus

liability cover). Naked also provides cover for individual items like a laptop or phone, if you

don't want to buy a comprehensive home contents insurance policy. All are underwritten by Hollard.

Why Choose Us

As one of the industry's most forward-thinking short-term insurers in South Africa, here's why you

should use us:

Save money. Because we use Al (rather than brokers and call centers) to run and manage your policy,

these cost savings are directly passed on - meaning lower premiums for you.

You get complete control. Manage your policy on the app. Sign up and manage your policy completely

online - and if you need to claim, you can get it approved in seconds, using our chatbot Jade's help

through the Naked mobile app.

Unconflicted business model. Unlike conventional insurers, Naked takes a fixed portion of premiums to

run the business, with the balance going into a pool to cover claims. At the end of each year, money

left over in the claims pool goes to charities nominated by you, the customer. Naked's annual profit,

therefore, doesn't depend on whether claims are paid or not, plus there are no hidden fees or hidden

agendas (that's why it's called Naked!). Naked Financial Technology is an authorized FSP, and our

product (Naked Insurance) is

underwritten by Hollard.

Done

NAKED DOES NOT WORK, THINK OR MAKE MONEY THE WAY TRADITIONAL INSURERS DO.

Often to get something right, our hear and heart need to work together. Naked's revolutionary

business model does just that, and in doing so, breaks the age-old cycle of distrust between insurers

and their customers. Unlike other insurance, they charge a fixed percentage of your premiums to do

everything. No hidden fees or hidden agendas (that's why we're called Naked!). Our flat fee means

that our income doesn't depend on how much we pay out in claims, so we have no reason to make

claiming difficult. When claims are low, premiums left over at the end of the year go to causes you care

about, supporting positive change in South African communities, rather than growing insurance

company profits. That's the Naked Difference and it changes everything about insurance.

INSURANCE CHANGES FOR GOOD: NAKED RAISES R160 MILLION IN FUNDING

Since day one, our mission has been to build insurance that people love. We are still early in our

journey and by raising R160 million (US$11m) we are excited that we will be able to accelerate our

vision. Our focus will be on expanding our team, continuing to invest in the technology that puts

customers in control, meeting the insurance needs of a growing portion of the South African market,

and entering into international markets. This funding round was led by Naspers Foundry and we look

forward to working with an investor of their caliber. Existing Naked investors, Yellowwoods and

Hollard, also participated in the funding round, endorsing our growth plans and success thus far.

Our mission has always been clear: to build instant, honest, affordable insurance that people love. This

might seem like a big, hairy, audacious goal, given the levels of apathy and distrust most people feel

towards insurance. Then again, most worthwhile endeavors aren't easy. We believe it's imperative to

restore people's confidence that their insurance will do what it says on the tin, and that we are on the

right track to doing just that.

How are we doing this? First, through our technology. We give people total control, from enabling them

to buy cover online in seconds, to allowing them to claim and manage their car, home, and single-item

insurance directly on the Naked app. Our technology also never sleeps, meaning this can be done 24/7

and all without chatting to a call center. These operational savings are then passed on directly to our

clients, through sustainably lower premiums.

The second part is the way that we run our business. Inherent in the traditional insurance model is the

reality that if less is paid out in claims, it means more profit for the insurer. This results in the client and

their insurer being in a constant tug of war over the same money when a claim is submitted. We don't

work like that. Instead, we take a flat fee upfront to cover running costs and profit. The rest of the

money goes towards claims, with leftover premiums at the end of the year paid to cause our clients to

choose, rather than our bottom line - this is the Naked Difference and it changes everything about

insurance.

This means that our profit isn't linked to how much we pay in claims. By aligning our interests with

those of our clients, we create mutually beneficial relationships amongst Naked, our clients, and our

communities.

We're well on our way to changing insurance for good. When we started Naked, many people believed

that our mission was unobtainable and unrealistic. This new round of funding shows how far we've

come - but we're just getting started. There's so much more we'd like to do, and this funding allows us

to take things to the next level-building insurance experiences that are simple to use, yet beautiful,

while making them available to more and more people. We couldn't be more excited to walk this

journey of redefining insurance with you and are immensely grateful for your ongoing support.

Question 3: The concepts of "shared value" and "inclusive business" provide several

opportunities to organisations and their stakeholders. Evaluate the extent to which Naked is

implementing the concepts of "shared value" and "inclusive business".

Your answer should contain the following points:

1. Provide a brief introduction to the purpose of "shared value" and "inclusive business".

2. Outline the concept of "shared value" and "inclusive business".

3. Evaluate the extent to which Naked is implementing the concepts of "shared value" and "inclusive business" to

Naked. Provide examples to support your answer.

4. Propose ways in which Naked may improve upon their approach to "shared value" and "inclusive business".

Recommended readings for this question:

British Assessment Bureau. 2016. Creating Shared Value - A new way of doing business? British

Assessment Bureau, 13 January 2016. [Online]. Available at: https://www.british-

assessment.co.uk/insights/spotlight-introducing-concept-creating-shared-value/ [Accessed 14

January 2023].

Kramer, M. R. and Pfitzer, M. W. 2016. The Ecosystem of Shared Value. Harvard Business Review,

October 2016. [Online]. Available at: https://hbr.org/2016/10/the-ecosystem-of-shared-value

[Accessed 14 January 2023].

Shared Value Project. 2020. What is shared value? [Online]. Available at:

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introduction-

VIEWStep 2: Below is the brief introduction and concep to the purpose of "shared value" and "inclusive business-

VIEWStep 3: Below is the discussion of the extent to which Naked is implementing the concepts with examples-

VIEWStep 4: Below are the ways in which Naked may improve upon their approach -

VIEWSolution

VIEWStep by step

Solved in 5 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.