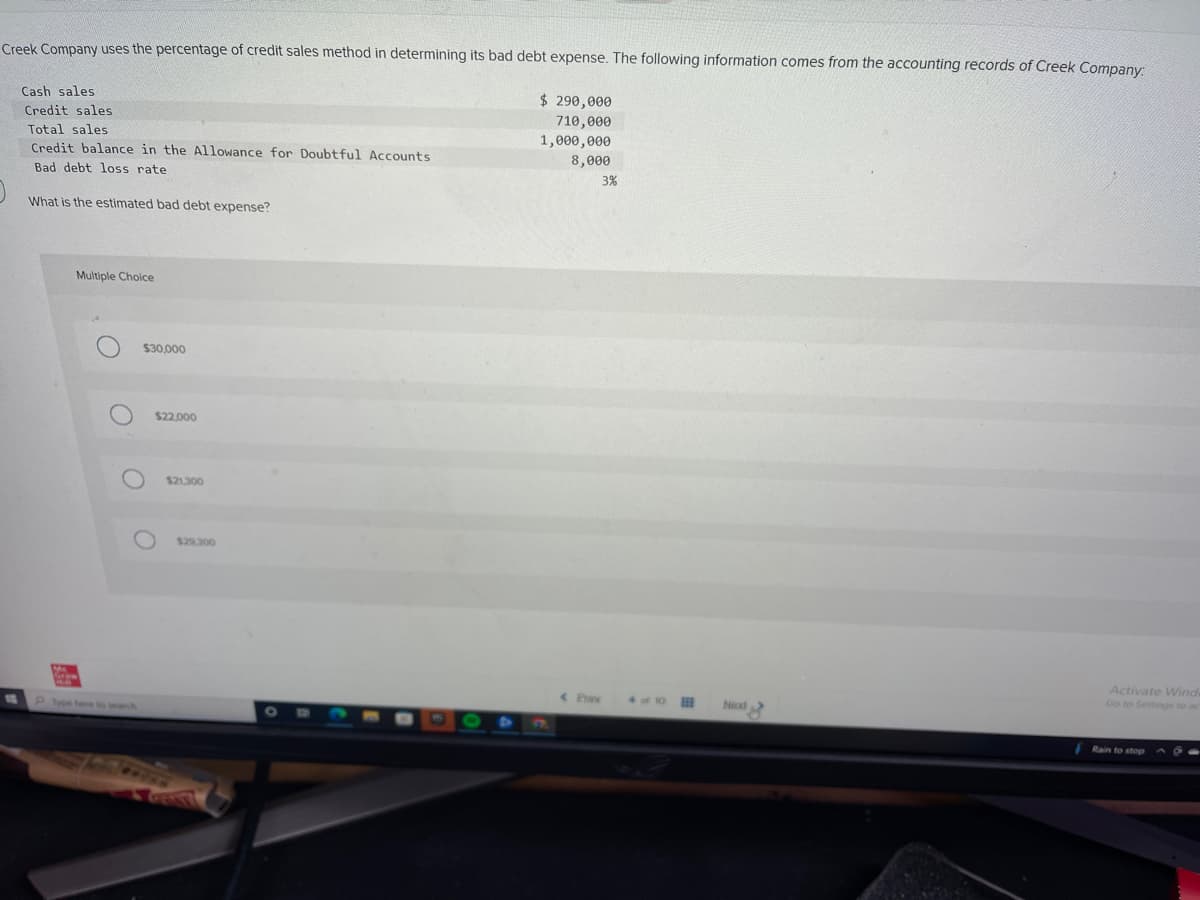

Creek Company uses the percentage of credit sales method in determining its bad debt expense. The following information comes from the accounting records of Creek Company: $ 290,000 Cash sales Credit sales Total sales 710,000 1,000,000 8,000 Credit balance in the Allowance for Doubtful Accounts Bad debt loss rate 3% What is the estimated bad debt expense? Multiple Choice $30,000 $22.000 $21.300

Creek Company uses the percentage of credit sales method in determining its bad debt expense. The following information comes from the accounting records of Creek Company: $ 290,000 Cash sales Credit sales Total sales 710,000 1,000,000 8,000 Credit balance in the Allowance for Doubtful Accounts Bad debt loss rate 3% What is the estimated bad debt expense? Multiple Choice $30,000 $22.000 $21.300

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 5MC: Tines Commerce computes bad debt based on the allowance method. They determine their current years...

Related questions

Question

4

Transcribed Image Text:Creek Company uses the percentage of credit sales method in determining its bad debt expense. The following information comes from the accounting records of Creek Company:

Cash sales

Credit sales

Total sales

Credit balance in the Allowance for Doubtful Accounts

Bad debt loss rate

What is the estimated bad debt expense?

M

Multiple Choice

O

O

$30,000

O

$22.000

$21,300

$29,300

$ 290,000

710,000

1,000,000

8,000

< Praw

3%

4 of 1

BEB

No

Activate Wind

Go to Settings to ac

Rain to stop

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning