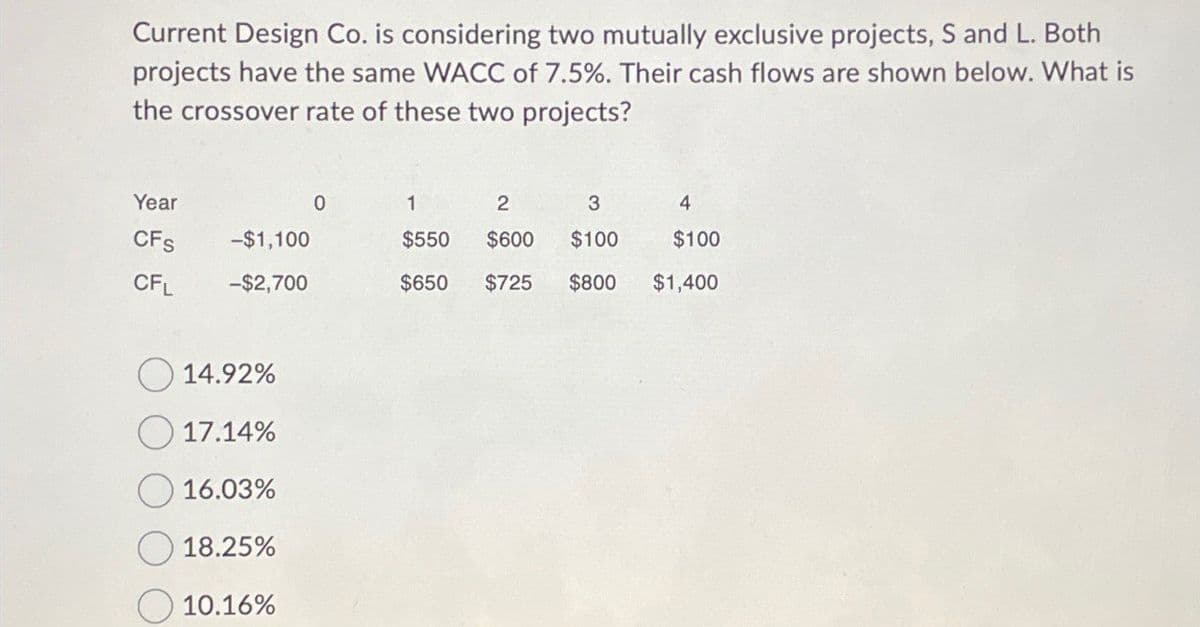

Current Design Co. is considering two mutually exclusive projects, S and L. Both projects have the same WACC of 7.5%. Their cash flows are shown below. What is the crossover rate of these two projects? Year 0 1 2 3 4 CFS -$1,100 $550 $600 $100 $100 CFL -$2,700 $650 $725 $800 $1,400 14.92% 17.14% 16.03% 18.25% 10.16%

Q: US T-bills CPI Year Large Stocks LT Gov Bonds (Rf asset) (inflation) 2017 21.83% 6.24% 0.80% 2.07%…

A: The prices increases over the period and increase in prices is given by the inflation over the…

Q: Zero Coupon Bond Price Calculate the price of a zero coupon bond that matures in 8 years if the…

A: Zero-coupon bond is a bond that pays no coupon payments. It is sold at discount and its par value is…

Q: 3. You take a long position in the Gold futures on 1/15 when the futures price is 1600/oz. Each…

A: Given Data: Contract Size100Initial Margin10000Maintenance Margin6000

Q: Your firm has an average receipt size of $120. A bank has approached you concerning a lockbox…

A: Variables in the question: Description DataAverage receipt size ($)120Days…

Q: Drill Problem 14-7 (Algo) [LU 14-2 (1)] Calculate the average daily balance and finance charge on…

A: Step 1: Tracking Daily BalancesThe first step involves tracking the outstanding balance on the…

Q: Stock Markets and Personal Finance: End of Chapter Problem In early 2021, GameStop achieved meme…

A: Whether an investment turns to be a wise one or not depends on the holding period return. If the…

Q: $9,000.00 and $12,000.00 on April 6 and June 21. The interest rate on her HELOC sits at prime plus…

A:

Q: Larry Davis borrows $82,500 at 14 percent interest toward the purchase of a home. His mortgage is…

A: Step 1:Time value of money refers to the concept which states that a sum of money is worth more now…

Q: The Bruin Stock Fund sells Class A shares that have a front-end load of 5.65 percent, a 12b-1 fee of…

A: Class A Suppose $1 to invest. The initial investment in Class A shares is $.9435 net of the…

Q: Lacy has a $49,500.00 student loan when she graduates on May 4, and the prime rate is set at 4.5%.…

A: A student loan refers to a loan that is extended to students to finance their education fees. It…

Q: Given the following price and dividend information, calculate the lower bound to the 95th confidence…

A: Step 1: Step 2: Step 3: Step 4:

Q: A suburban lawn service bought 10 new mowers at $3500 each. The company made a $5000 down payment…

A: Loan is charged with interest for the period the amount is used at the given rate of interest.…

Q: P QUESTION 21 Answer You invest $100 in a risky asset with an expected rate of return of 0.169 and a…

A: Step 1:For $100,(129 - 100)/100=15%;0.15 = w1(0.169) + (1 - w1)(0.05)0.15 = 0.169w1 + 0.05 -…

Q: Nikul

A: To calculate the value of the concatenator business, we'll use the discounted cash flow (DCF)…

Q: Washington Mutual, was a US bank which went bankrupt at the end of 2008 due to a number of risk…

A: Risk management is a crucial aspect of any organization, especially in the banking industry where…

Q: On November 1, Suzy made a single deposit of $5,000 into an investment account that earns interest…

A:

Q: roblem 17-18 Real Estate Valuation (LO4, CFA3) enterland Partners has collected information on the…

A: Shopping CenterNOIValuationCastleton Round$3.4$11.20Fashion Commons$5.0$39.22Belden…

Q: Brew Ltd. introduced a new product, DV, to its range last year. The machine used to mould each item…

A: Based on the calculations:1. IRR: We didn't calculate the exact IRR, as it requires iterative…

Q: Maple Tree Industries has $265, 000 to invest. The company is trying to decide between two…

A: NPV : It stands for net present value. Net present value is the financial calculation to determine…

Q: What information does the payback period provide? Suppose you are evaluating a project with the…

A: Payback period2.50 yearsYearCash flows1$350,000.002$400,000.003$475,000.004$425,000.00WACC = 9%

Q: Maria and Mike are purchasing their first home together in British Columbia. Their conditionaloffer…

A: The objective of the question is to calculate the Loan to Value (LTV) and total mortgage amount for…

Q: What are the dividends each year for the next four years? What is the share price in three years?…

A: The above answer can be explained as under - Dividends for 1 to 4 years -The excel formulas used…

Q: Using excel formulas to solve The Gilbert Instrument Corporation is considering replacing the wood…

A: We have to compute the NPV of both the scenarios, the company must select the scenario which has…

Q: A newly wedded couple is planning to buy a two bedroom apartment in Windhoek for N$280000. He is…

A: The objective of the question is to calculate the total amount to be paid to the bank, the monthly…

Q: Problem 13-23 Portfolio Returns and Deviations [LO2] Consider the following information about three…

A: Step 1:A portfolio is the collection of financial securities like shares, bonds etc. Mean return is…

Q: None

A: Step 1:

Q: You invest in a portfolio of 5 stocks with an equal investment in each one. The betas of the 5…

A: Number of Stock = n = 5 Betas = 0.75, -1.2, 0.90, 1.3 and 1.5Risk free rate = rf = 4%Market Return…

Q: A 7% semiannual coupon bond matures in 4 years. The bond has a face value of $1,000 and a current…

A: A)Information provided:Face value= future value= 1,000Time= 4 years*2= 8 semi-annual periodsCoupon…

Q: Innovation Company is thinking about marketing a new software product. Upfront costs to market and…

A: a. Net Present Value (NPV) AnalysisThe NPV considers the time value of money and helps us understand…

Q: What is the return on a bond that was issued at 9% coupon rate, 10% YTM, for five years, Face value…

A: Step 1:

Q: Need help with a and b as well as the last question on whether the internal rate of return is the…

A: Part 2: Explanation:Step 1: Assessing the Best Business VentureTo determine the best business…

Q: Robbins Inc. is considering a project that has the following cash flow and WACC data. WACC: 10.25%…

A: YearsCash Flow0-$1,0001$3002$3003$3004$3005$300WACC = 10.25%

Q: Nofal Corporation will pay a $4.10 per share dividend next year. The company pledges to increase…

A: Step 1: The calculation of the stock's value AB1Dividend (D1) $ 4.10 2Growth (g)6.00%3Required…

Q: Gateway Communications is considering a project with an initial fixed assets cost of $1.63 million…

A: NPV Net Present Value is a capital budgeting technique used in decision making on the basis of…

Q: None

A: The optimal capital structure is a critical financial concept for organizations, indicating the best…

Q: Assuming that competition drives down profitability (on existing assets as well as new investment)…

A: The present value is the amount of money you would need to have now in order to have the same amount…

Q: Buhler Industries is a farm implement manufacturer. Management is currently evaluating a proposal to…

A: Part 2: Explanation:Step 1: Calculate the Capital Cost Allowance (CCA) for each year.The CCA…

Q: A debt of $39 comma 000 is repaid over 14 years with payments occurring monthly. Interest is 10%…

A: Step 1:

Q: None

A: Let's break down the calculations for each entry in the table to show how the interest charged,…

Q: Raghubhai

A: Step 1: Give n Value for Calculation Compound = Monthly = 12Monthly Payment = p = $800Number of…

Q: None

A: Step 1:1. Step 2:2.

Q: Consider a firm that just paid a dividend of $5.50 per share. The company expects growth in the…

A: Dividend in Year 1: $5.50 * (1 + 17%) = $6.44Dividend in Year 2: $6.44 * (1 + 17%) = $7.53Dividends…

Q: Vinny's Overhead Construction had free cash flow during 2021 of $27.9 million. The change in gross…

A: An income statement is a financial document that outlines a company's revenues, expenses, and…

Q: You are considering the purchase of one of two machines used in your manufacturing plant. Machine A…

A: MACHINE BCalculate the present value of the maintenance costs for the three…

Q: Hayden Inc. has a number of copiers that were bought four years ago for $27,000. Currently…

A: The inquiry pertains to performing a cost analysis to ascertain the equivalent annual cost of…

Q: Your company is worried that it will not be able to fully support the 28% growth in sales that has…

A: The objective of the question is to calculate the amount of additional external financing needed by…

Q: Question 3.2 A newly constructed bridge costs $ 32,000,000. The same bridge is estimated to need…

A: Capitalized cost is one time cost that is equivalent to all cost that are going to incurr during…

Q: None

A: Since Figure 6.4 is not provided, I won't be able to locate the specific Treasury bond. However, I…

Q: Calculate the upper bound to the 95th confidence interval given the following price and dividend…

A: Price Dividend Dividend Yield$ 64.65 $1.72…

Q: The Brownian Motion is used to model the liquid assets (i.e. "cash") of our startup company Math…

A: The probability that our assets will be worth a certain amount refers to the likelihood of achieving…

Your Question : Please introduction and correct and incorrect option explain!

Step by step

Solved in 2 steps with 1 images

- Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?Bates & Reid, LLC, has identified two mutually exclusive projects, A and B. Project A has a NPV of $14,050.47. Project B has cash flows as described below. Year Cash Flow B 0 -$77,000 1 35,000 2 25,000 3 25,000 4 25,000 If the WACC is 8%, then B’s NPV is _______ and therefore the firm should accept _________ $11,337.55; project B because NPVA > NPVB. $15,062.43; project B because NPVA < NPVB. $15,062.43; project A because NPVA < NPVB. The projects are equally profitable. $11,337.55; project A because NPVA > NPVB.A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 01234 Project S-$1,000$869.10$260$5$10Project L-$1,000$0$250$420$831.87 The company's WACC is 8.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.

- company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 2 3 4 Project S -$1,000 $875.54 $260 $5 $5 Project L -$1,000 $10 $260 $380 $839.00 The company's WACC is 9.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places. %a company is deciding between two mutually exclusive projects. the cash flows are shown below. year 0 project a -$1,000 project b -$1,000 ywar 1 project a 550 project b 400 year 2 project a 550 projecy b 600 year 3 project a 550 project b 900 if the cosy of capital is 10% which project should the compsny selectThomas Company is considering two mutually exclusive projects. The firm, which has a cost of capital of 14%, has estimated its cash flows as shown in the following table: Project A Project B Initial investment (CF0) $150,000 $83,000 Year (t) Cash inflows (CFt) 1 $20,000 $45,000 2 $35,000 $25,000 3 $40,000 $35,000 4 $50,000 $10,000 5 $70,000 $15,000 a. Calculate the NPV of each project, and assess its acceptability. b. Calculate the IRR for each project, and assess its acceptability.

- Bell Manufacturing is attempting to choosethe better of two mutually exclusive projects for expanding the firm’s warehousecapacity. The relevant cash flows for the projects are shown in the following table.The firm’s cost of capital is 15%. project X project Y initial investment 500000 325000 year cash inflow cash inflow 1 100000 140000 2 120000 120000 3 150000 95000 4 190000 70000 5 250000 50000 a. Calculate the IRR to the nearest whole percent for each of the projects. b. Assess the acceptability of each project on the basis of the IRRs found in part a. c. Which project, on this basis, is preferred? (solve using excel)Bell Manufacturing is attempting to choose the better of two mutually exclusive projects for expanding thefirm’s warehouse capacity. The relevant cash flows for the projects are shown in the following table. Project X Project Y initial investment (CF0) $500000 325000 Year(t) Cash inflows (CF0) 1 $100000 $140000 2 120000 120000 3 150000 95000 4 190000 70000 5 250000…HH Companies has identified two mutually exclusive projects. Project A has cash flows of −$40,000, $21,200, $16,800, and $14,000 for Years 0 to 3, respectively. Project B has a cost of $38,000 and annual cash inflows of $25,500 for 2 years. At what rate would you be indifferent between these two projects?

- Central Energy is considering two mutually exclusive projects, Project Red and Project The projects have the following cash flows: Year Project Red Cash Flows Project White Cash Flows 0 -$1,000 -$1,000 1 100 700 2 200 400 3 600 200 4 800 100 Assume that both projects have a 10 percent WACC. At what weighted average cost of capital would the two projects have the same net present value? a. 0.00% b. 10.00% c. 20.04% d. 24.96% e. 14.30%Queens Soliderate is considering two mutually exclusive projects. The firm, which has a 12% cost of capital, has estimated its cash flows as shown in the following table. Project A Project B Initial investment (CF0) $130,000 $85,000 Year (t) Cash inflows (CFt) 1 $25,000 $40,000 2 35,000 35,000 3 45,000 30,000 4 50,000 10,000 5 55,000 5,000 a. Calculate the NPV of each project, and assess its acceptability. b. Calculate the IRR for each project, and assess its acceptability. Required to answer. Single line text.UF Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. WACC: 7.75% Year 0 1 2 3 4 CFs ($1,050) $700 $625 CFL ($1,050) $370 $370 $360 $360 Question: Find the crossover rate. (answer in excel format and show spreadsheet inputs)