d) What is Enjoy's private marginal cost of production? e) Beverages sell for $310 per thousand gallons. How much beverages would you predict that Enjoy produces per week? f) How much profit does Enjoy earn in this situation?

d) What is Enjoy's private marginal cost of production? e) Beverages sell for $310 per thousand gallons. How much beverages would you predict that Enjoy produces per week? f) How much profit does Enjoy earn in this situation?

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5.6IP

Related questions

Question

i need D,E,F subparts

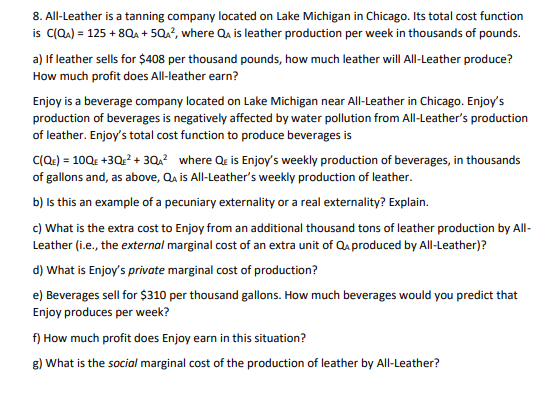

Transcribed Image Text:8. All-Leather is a tanning company located on Lake Michigan in Chicago. Its total cost function

is C(Q.) = 125 + 8QA + 5Q?, where Qa is leather production per week in thousands of pounds.

a) If leather sells for $408 per thousand pounds, how much leather will All-Leather produce?

How much profit does All-leather earn?

Enjoy is a beverage company located on Lake Michigan near All-Leather in Chicago. Enjoy's

production of beverages is negatively affected by water pollution from All-Leather's production

of leather. Enjoy's total cost function to produce beverages is

C(Q.) = 10Q£ +3Q? + 3Qx? where Qe is Enjoy's weekly production of beverages, in thousands

of gallons and, as above, Qa is All-Leather's weekly production of leather.

b) Is this an example of a pecuniary externality or a real externality? Explain.

c) What is the extra cost to Enjoy from an additional thousand tons of leather production by All-

Leather (i.e., the external marginal cost of an extra unit of Qa produced by All-Leather)?

d) What is Enjoy's private marginal cost of production?

e) Beverages sell for $310 per thousand gallons. How much beverages would you predict that

Enjoy produces per week?

f) How much profit does Enjoy earn in this situation?

g) What is the social marginal cost of the production of leather by All-Leather?

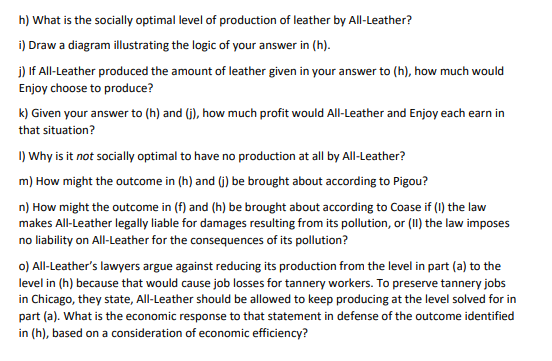

Transcribed Image Text:h) What is the socially optimal level of production of leather by All-Leather?

i) Draw a diagram illustrating the logic of your answer in (h).

j) If All-Leather produced the amount of leather given in your answer to (h), how much would

Enjoy choose to produce?

k) Given your answer to (h) and (j), how much profit would All-Leather and Enjoy each earn in

that situation?

I) Why is it not socially optimal to have no production at all by All-Leather?

m) How might the outcome in (h) and (j) be brought about according to Pigou?

n) How might the outcome in (f) and (h) be brought about according to Coase if (I) the law

makes All-Leather legally liable for damages resulting from its pollution, or (II) the law imposes

no liability on All-Leather for the consequences of its pollution?

o) All-Leather's lawyers argue against reducing its production from the level in part (a) to the

level in (h) because that would cause job losses for tannery workers. To preserve tannery jobs

in Chicago, they state, All-Leather should be allowed to keep producing at the level solved for in

part (a). What is the economic response to that statement in defense of the outcome identified

in (h), based on a consideration of economic efficiency?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning