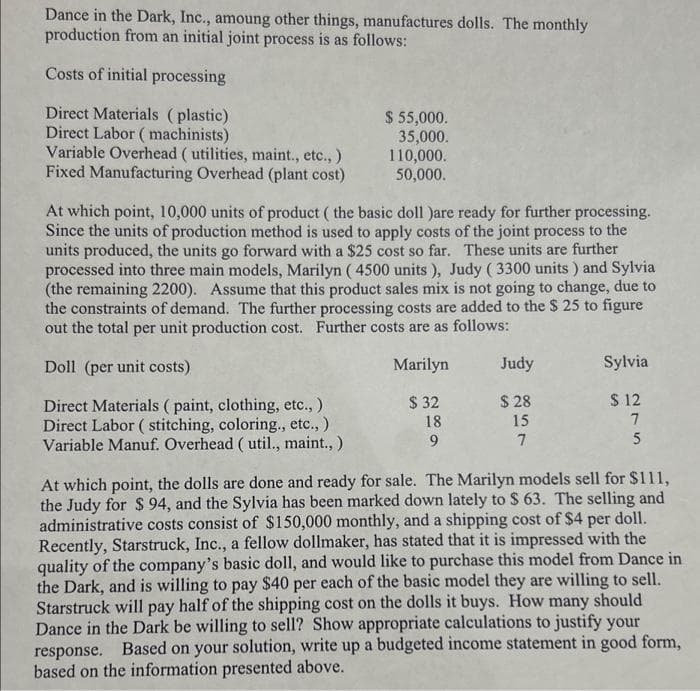

Dance in the Dark, Inc., amoung other things, manufactures dolls. The monthly production from an initial joint process is as follows: Costs of initial processing Direct Materials (plastic) Direct Labor (machinists) Variable Overhead (utilities, maint., etc.,) Fixed Manufacturing Overhead (plant cost) $ 55,000. 35,000. 110,000. 50,000. At which point, 10,000 units of product ( the basic doll )are ready for further processing. Since the units of production method is used to apply costs of the joint process to the units produced, the units go forward with a $25 cost so far. These units are further processed into three main models, Marilyn ( 4500 units), Judy (3300 units) and Sylvia (the remaining 2200). Assume that this product sales mix is not going to change, due to the constraints of demand. The further processing costs are added to the $ 25 to figure out the total per unit production cost. Further costs are as follows: Doll (per unit costs) Marilyn $32 Direct Materials (paint, clothing, etc.,) Direct Labor ( stitching, coloring., etc.,) Variable Manuf. Overhead (util., maint., ) 18 9 Judy $28 15 7 Sylvia $12 7 5 At which point, the dolls are done and ready for sale. The Marilyn models sell for $111, the Judy for $94, and the Sylvia has been marked down lately to $ 63. The selling and administrative costs consist of $150,000 monthly, and a shipping cost of $4 per doll. Recently, Starstruck, Inc., a fellow dollmaker, has stated that it is impressed with the quality of the company's basic doll, and would like to purchase this model from Dance in the Dark, and is willing to pay $40 per each of the basic model they are willing to sell. Starstruck will pay half of the shipping cost on the dolls it buys. How many should Dance in the Dark be willing to sell? Show appropriate calculations to justify your response. Based on your solution, write up a budgeted income statement in good form, based on the information presented above.

Dance in the Dark, Inc., amoung other things, manufactures dolls. The monthly production from an initial joint process is as follows: Costs of initial processing Direct Materials (plastic) Direct Labor (machinists) Variable Overhead (utilities, maint., etc.,) Fixed Manufacturing Overhead (plant cost) $ 55,000. 35,000. 110,000. 50,000. At which point, 10,000 units of product ( the basic doll )are ready for further processing. Since the units of production method is used to apply costs of the joint process to the units produced, the units go forward with a $25 cost so far. These units are further processed into three main models, Marilyn ( 4500 units), Judy (3300 units) and Sylvia (the remaining 2200). Assume that this product sales mix is not going to change, due to the constraints of demand. The further processing costs are added to the $ 25 to figure out the total per unit production cost. Further costs are as follows: Doll (per unit costs) Marilyn $32 Direct Materials (paint, clothing, etc.,) Direct Labor ( stitching, coloring., etc.,) Variable Manuf. Overhead (util., maint., ) 18 9 Judy $28 15 7 Sylvia $12 7 5 At which point, the dolls are done and ready for sale. The Marilyn models sell for $111, the Judy for $94, and the Sylvia has been marked down lately to $ 63. The selling and administrative costs consist of $150,000 monthly, and a shipping cost of $4 per doll. Recently, Starstruck, Inc., a fellow dollmaker, has stated that it is impressed with the quality of the company's basic doll, and would like to purchase this model from Dance in the Dark, and is willing to pay $40 per each of the basic model they are willing to sell. Starstruck will pay half of the shipping cost on the dolls it buys. How many should Dance in the Dark be willing to sell? Show appropriate calculations to justify your response. Based on your solution, write up a budgeted income statement in good form, based on the information presented above.

Chapter5: Process Costing

Section: Chapter Questions

Problem 2PB: The following product costs are available for Kellee Company on the production of eyeglass frames:...

Related questions

Question

Please do not give image format

Transcribed Image Text:Dance in the Dark, Inc., amoung other things, manufactures dolls. The monthly

production from an initial joint process is as follows:

Costs of initial processing

Direct Materials (plastic)

Direct Labor (machinists)

Variable Overhead (utilities, maint., etc.,)

Fixed Manufacturing Overhead (plant cost)

$ 55,000.

35,000.

Doll (per unit costs)

Direct Materials ( paint, clothing, etc.,)

Direct Labor ( stitching, coloring., etc.,)

Variable Manuf. Overhead (util., maint., )

110,000.

50,000.

At which point, 10,000 units of product (the basic doll )are ready for further processing.

Since the units of production method is used to apply costs of the joint process to the

units produced, the units go forward with a $25 cost so far. These units are further

processed into three main models, Marilyn (4500 units), Judy (3300 units) and Sylvia

(the remaining 2200). Assume that this product sales mix is not going to change, due to

the constraints of demand. The further processing costs are added to the $ 25 to figure

out the total per unit production cost. Further costs are as follows:

Marilyn

$32

18

9

Judy

$28

15

7

Sylvia

$12

7

5

At which point, the dolls are done and ready for sale. The Marilyn models sell for $111,

the Judy for $94, and the Sylvia has been marked down lately to $ 63. The selling and

administrative costs consist of $150,000 monthly, and a shipping cost of $4 per doll.

Recently, Starstruck, Inc., a fellow dollmaker, has stated that it is impressed with the

quality of the company's basic doll, and would like to purchase this model from Dance in

the Dark, and is willing to pay $40 per each of the basic model they are willing to sell.

Starstruck will pay half of the shipping cost on the dolls it buys. How many should

Dance in the Dark be willing to sell? Show appropriate calculations to justify your

response. Based on your solution, write up a budgeted income statement in good form,

based on the information presented above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning