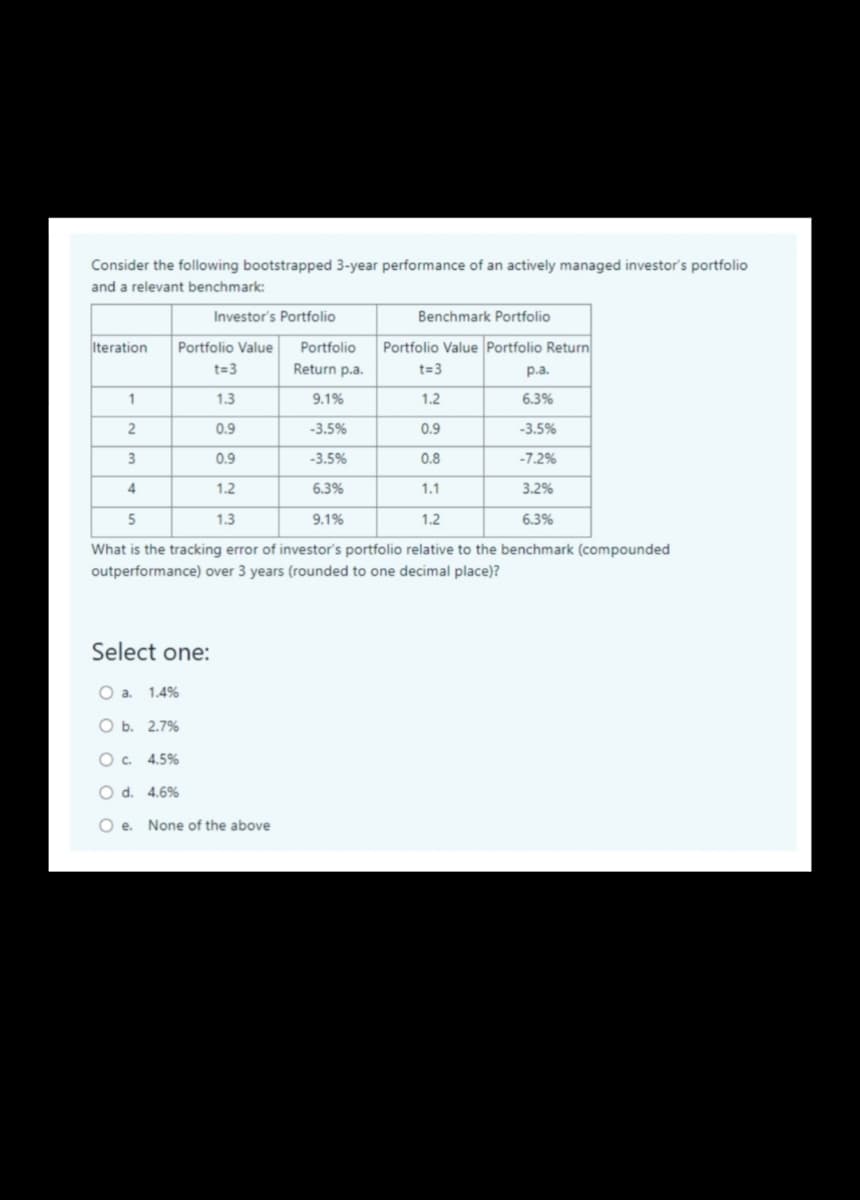

Consider the following bootstrapped 3-year performance of an actively managed investor's portfolio and a relevant benchmark: Investor's Portfolio Benchmark Portfolio Iteration Portfolio Value Portfolio Portfolio Value Portfolio Return t=3 Return p.a. t=3 p.a. 1.3 9.1% 1.2 6.3% 0.9 -3.5% 0.9 -3.5% 3 0.9 -3.5% 0.8 -7.2% 4 1.2 6.3% 1.1 3.2% 5 1.3 9.1% 1.2 6.3% What is the tracking error of investor's portfolio relative to the benchmark (compounded outperformance) over 3 years (rounded to one decimal place)? Select one: O a. 1.4% ОБ. 2.7% Oc 4.5% O d. 4.6% None of the above 2. 1.

Consider the following bootstrapped 3-year performance of an actively managed investor's portfolio and a relevant benchmark: Investor's Portfolio Benchmark Portfolio Iteration Portfolio Value Portfolio Portfolio Value Portfolio Return t=3 Return p.a. t=3 p.a. 1.3 9.1% 1.2 6.3% 0.9 -3.5% 0.9 -3.5% 3 0.9 -3.5% 0.8 -7.2% 4 1.2 6.3% 1.1 3.2% 5 1.3 9.1% 1.2 6.3% What is the tracking error of investor's portfolio relative to the benchmark (compounded outperformance) over 3 years (rounded to one decimal place)? Select one: O a. 1.4% ОБ. 2.7% Oc 4.5% O d. 4.6% None of the above 2. 1.

Chapter7: Types And Costs Of Financial Capital

Section: Chapter Questions

Problem 5EP

Related questions

Question

100%

Transcribed Image Text:Consider the following bootstrapped 3-year performance of an actively managed investor's portfolio

and a relevant benchmark:

Investor's Portfolio

Benchmark Portfolio

Iteration

Portfolio Value

Portfolio

Portfolio Value Portfolio Return

t=3

Return p.a.

t=3

р.а.

1

1.3

9.1%

1.2

6.3%

0.9

-3.5%

0.9

-3.5%

3

0.9

-3.5%

0.8

-7.2%

4

1.2

6.3%

1.1

3.2%

5

1.3

9.1%

1.2

6.3%

What is the tracking error of investor's portfolio relative to the benchmark (compounded

outperformance) over 3 years (rounded to one decimal place)?

Select one:

O a. 1.4%

ОБ. 2.7%

O. 4.5%

O d. 4.6%

O e. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you