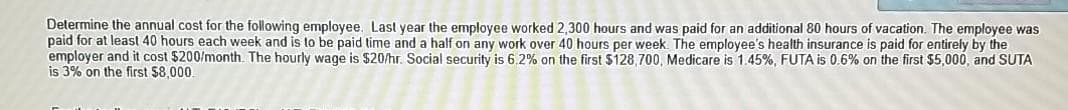

Determine the annual cost for the following employee. Last year the employee worked 2,300 hours and was paid for an additional 80 hours of vacation. The employee was paid for at least 40 hours each week and is to be paid time and a half on any work over 40 hours per week The employee's health insurance is paid for entirely by the employer and it cost $200/month. The hourly wage is $20/hr. Social security is 6.2% on the first $128,700, Medicare is 1.45%, FUTA is 0.6% on the first $5,000, and SUTA is 3% on the first $8,000

Determine the annual cost for the following employee. Last year the employee worked 2,300 hours and was paid for an additional 80 hours of vacation. The employee was paid for at least 40 hours each week and is to be paid time and a half on any work over 40 hours per week The employee's health insurance is paid for entirely by the employer and it cost $200/month. The hourly wage is $20/hr. Social security is 6.2% on the first $128,700, Medicare is 1.45%, FUTA is 0.6% on the first $5,000, and SUTA is 3% on the first $8,000

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 1E

Related questions

Question

Read the question carefully and give me right solution according to the question

Transcribed Image Text:Determine the annual cost for the following employee. Last year the employee worked 2,300 hours and was paid for an additional 80 hours of vacation. The employee was

paid for at least 40 hours each week and is to be paid time and a half on any work over 40 hours per week. The employee's health insurance is paid for entirely by the

employer and it cost $200/month. The hourly wage is $20/hr. Social security is 6.2% on the first $128,700, Medicare is 1.45%, FUTA is 0.6% on the first $5,000, and SUTA

is 3% on the first $8.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning