Determine the minimum transfer price that Cutting Division would accept. 2. Determine the maximum transfer price that the Assembly Division would pay. 3. If Cutting Division will accept the offer of Assembly Division, how much is the change in its operating income ? 4. If Cutting Division will make a counter offer of P45.25 per part, how much is the change in the operating income of Assembly Division assuming that its external supplier could not supply its needed quantity?

Determine the minimum transfer price that Cutting Division would accept. 2. Determine the maximum transfer price that the Assembly Division would pay. 3. If Cutting Division will accept the offer of Assembly Division, how much is the change in its operating income ? 4. If Cutting Division will make a counter offer of P45.25 per part, how much is the change in the operating income of Assembly Division assuming that its external supplier could not supply its needed quantity?

Chapter5: Process Costing

Section: Chapter Questions

Problem 2PB: The following product costs are available for Kellee Company on the production of eyeglass frames:...

Related questions

Question

1. Determine the minimum transfer price that Cutting Division would accept.

2. Determine the maximum transfer price that the Assembly Division would pay.

3. If Cutting Division will accept the offer of Assembly Division, how much is the change in its operating income ?

4. If Cutting Division will make a counter offer of P45.25 per part, how much is the change in the operating income of Assembly Division assuming that its external supplier could not supply its needed quantity?

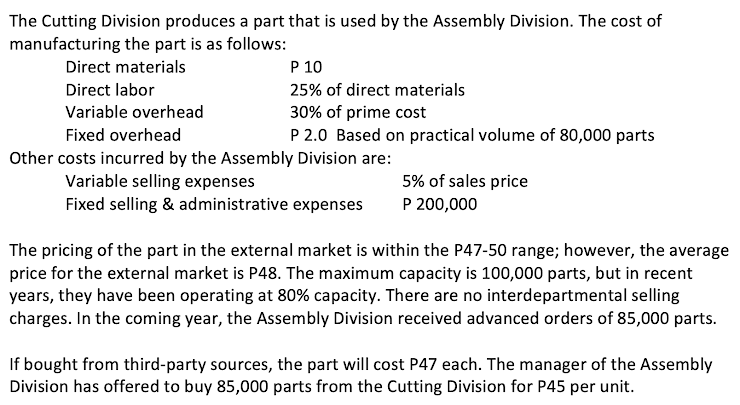

Transcribed Image Text:The Cutting Division produces a part that is used by the Assembly Division. The cost of

manufacturing the part is as follows:

P 10

Direct materials

Direct labor

25% of direct materials

30% of prime cost

Variable overhead

Fixed overhead

P 2.0 Based on practical volume of 80,000 parts

Other costs incurred by the Assembly Division are:

Variable selling expenses

5% of sales price

P 200,000

Fixed selling & administrative expenses

The pricing of the part in the external market is within the P47-50 range; however, the average

price for the external market is P48. The maximum capacity is 100,000 parts, but in recent

years, they have been operating at 80% capacity. There are no interdepartmental selling

charges. In the coming year, the Assembly Division received advanced orders of 85,000 parts.

If bought from third-party sources, the part will cost P47 each. The manager of the Assembly

Division has offered to buy 85,000 parts from the Cutting Division for P45 per unit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning