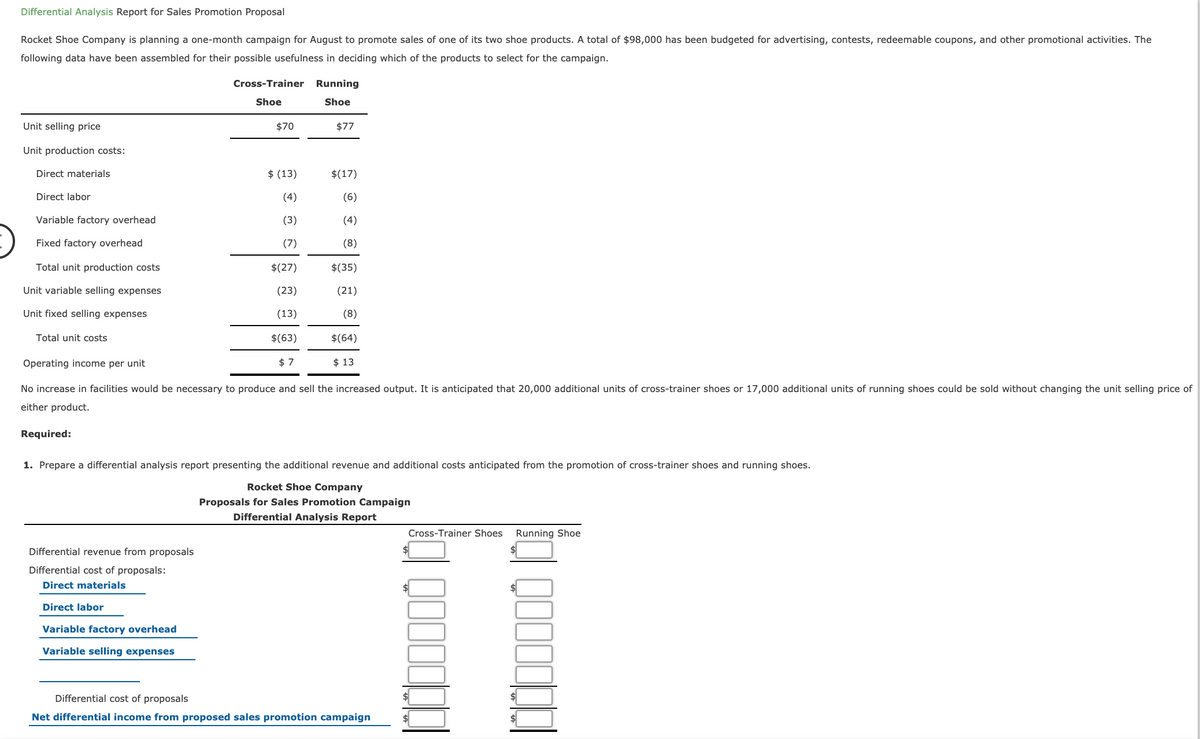

Differential Analysis Report for Sales Promotion Proposal Rocket Shoe Company is planning a one-month campaign for August to promote sales of one of its two shoe products. A total of $98,000 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The following data have been assembled for their possible usefulness in deciding which of the products to select for the campaign. Cross-Trainer Running Shoe Shoe Unit selling price $70 $77 Unit production costs: Direct materials $ (13) $(17) Direct labor (4) (6) Variable factory overhead (3) (4) Fixed factory overhead (7) (8) Total unit production costs $(27) $(35) Unit variable selling expenses (23) (21) Unit fixed selling expenses (13) (8) Total unit costs $(63) $(64) Operating income per unit $7 $ 13 No increase in facilities would be necessary to produce and sell the increased output. It is anticipated that 20,000 additional units of cross-trainer shoes or 17,000 additional units of running shoes could be sold without changing the unit selling pric either product. Required: 1. Prepare a differential analysis report presenting the additional revenue and additional costs anticipated from the promotion of cross-trainer shoes and running shoes. Rocket Shoe Company Proposals for Sales Promotion Campaign Differential Analysis Report Cross-Trainer Shoes Running Shoe Differential revenue from proposals Differential cost of proposals: Direct materials Direct labor Variable factory overhead Variable selling expenses Differential cost of proposals Net differential income from proposed sales promotion campaign

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Differential Analysis Report for Sales Promotion Proposal

(SEE ATTACHMENT FOR QUESTION OVERVIEW, I started, but it's probably wrong)

Rocket Shoe Company is planning a one-month campaign for August to promote sales of one of its two shoe products. A total of $98,000 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The following data have been assembled for their possible usefulness in deciding which of the products to select for the campaign.

| Cross-Trainer Shoe |

Running Shoe |

|||

| Unit selling price | $70 | $77 | ||

| Unit production costs: | ||||

| Direct materials | $ (13) | $(17) | ||

| Direct labor | (4) | (6) | ||

| Variable factory |

(3) | (4) | ||

| Fixed factory overhead | (7) | (8) | ||

| Total unit production costs | $(27) | $(35) | ||

| Unit variable selling expenses | (23) | (21) | ||

| Unit fixed selling expenses | (13) | (8) | ||

| Total unit costs | $(63) | $(64) | ||

| Operating income per unit | $ 7 | $ 13 |

No increase in facilities would be necessary to produce and sell the increased output. It is anticipated that 20,000 additional units of cross-trainer shoes or 17,000 additional units of running shoes could be sold without changing the unit selling price of either product.

Required:

1. Prepare a differential analysis report presenting the additional revenue and additional costs anticipated from the promotion of cross-trainer shoes and running shoes.

| Cross-Trainer Shoes | Running Shoe | |

| Differential revenue from proposals | $ | $ |

| Differential cost of proposals: | ||

| a. (Choose from option below) | $ | $ |

| b. (Choose from option below) | ||

| c. (Choose from option below) | ||

| d. (Choose from option below) | ||

| e. (Choose from option below) | ||

| Differential cost of proposals | $ | $ |

| f. (Choose from option below) | $ | $ |

The sales manager’s tentative decision should be ____________ (Accepted/opposed) . The _________ (cross trainer shoe / running shoe) will contribute more to operating income than would be contributed by promoting the _____________ (cross trainer shoes / running shoes).

Trending now

This is a popular solution!

Step by step

Solved in 2 steps