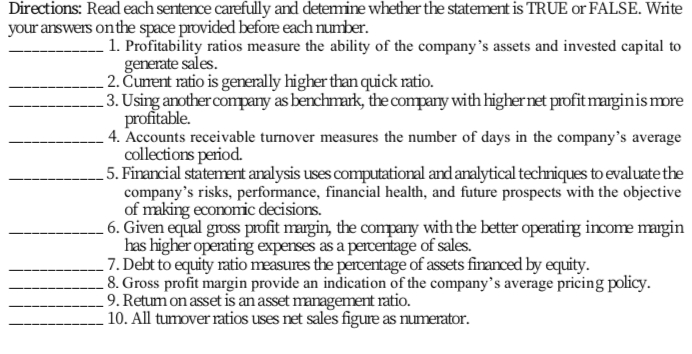

Directions: Read each sentence carefully and detemine whether the statement is TRUE or FALSE. Wite your answers onthe space provided before each number. 1. Profitability ratios measure the ability of the company's assets and invested capital to generate sales. 2. Čument ratio is generally higher than quick ratio. 3. Using another company as benchmark, the company with highernet profit marginismore profitable. - 4. Accounts receivable tumover measures the number of days in the company's average collections period. 5. Financial statement aralysis uses computational and analytical techniques to evaluate the company's risks, performance, financial health, and future prospects with the objective of making economic decisions. . 6. Given equal gross profit magin, the company with the better operating income margin has higher operating experses as a percentage of sales. . 7. Debt to equity ratio measures the percentage of assets financed by equity. 8. Gross profit margin provide an indication of the company's average pricing policy. 9. Retum on asset is an asset management ratio. 10. All tumover ratios uses net sales figure as numerator.

Directions: Read each sentence carefully and detemine whether the statement is TRUE or FALSE. Wite your answers onthe space provided before each number. 1. Profitability ratios measure the ability of the company's assets and invested capital to generate sales. 2. Čument ratio is generally higher than quick ratio. 3. Using another company as benchmark, the company with highernet profit marginismore profitable. - 4. Accounts receivable tumover measures the number of days in the company's average collections period. 5. Financial statement aralysis uses computational and analytical techniques to evaluate the company's risks, performance, financial health, and future prospects with the objective of making economic decisions. . 6. Given equal gross profit magin, the company with the better operating income margin has higher operating experses as a percentage of sales. . 7. Debt to equity ratio measures the percentage of assets financed by equity. 8. Gross profit margin provide an indication of the company's average pricing policy. 9. Retum on asset is an asset management ratio. 10. All tumover ratios uses net sales figure as numerator.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.2KTQ: Quiz 2: Solvency Debt-to-equity ratio Times interest earned ratio Debt service coverage ratio Cash...

Related questions

Question

4,5,6

Transcribed Image Text:Directions: Read each sentence carefully and detemine whether the statement is TRUE or FALSE. Write

your answers onthe space provided before each number.

1. Profitability ratios measure the ability of the company's assets and invested capital to

generate sales.

2. Čunent ratio is generally higher than quick ratio.

3. Using anothercompany as benchmark, the company with highernet profitmarginis more

profitable.

4. Accounts receivable turnover measures the number of days in the company's average

collections period.

5. Firancial statement analysis uses computational and analytical techniques to evaluate the

company's risks, performance, financial health, and future prospects with the objective

of making economic decisions.

- 6. Given equal gross profit margin, the company with the better operating income margin

has higher operating expenses as a percentage of sales.

7. Debt to equity ratio measures the percentage of assets financed by equity.

8. Gross profit margin provide an indication of the company's average pricing policy.

9. Retum on asset is an asset management ratio.

10. All tumover ratios uses net sales figure as numerator.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage