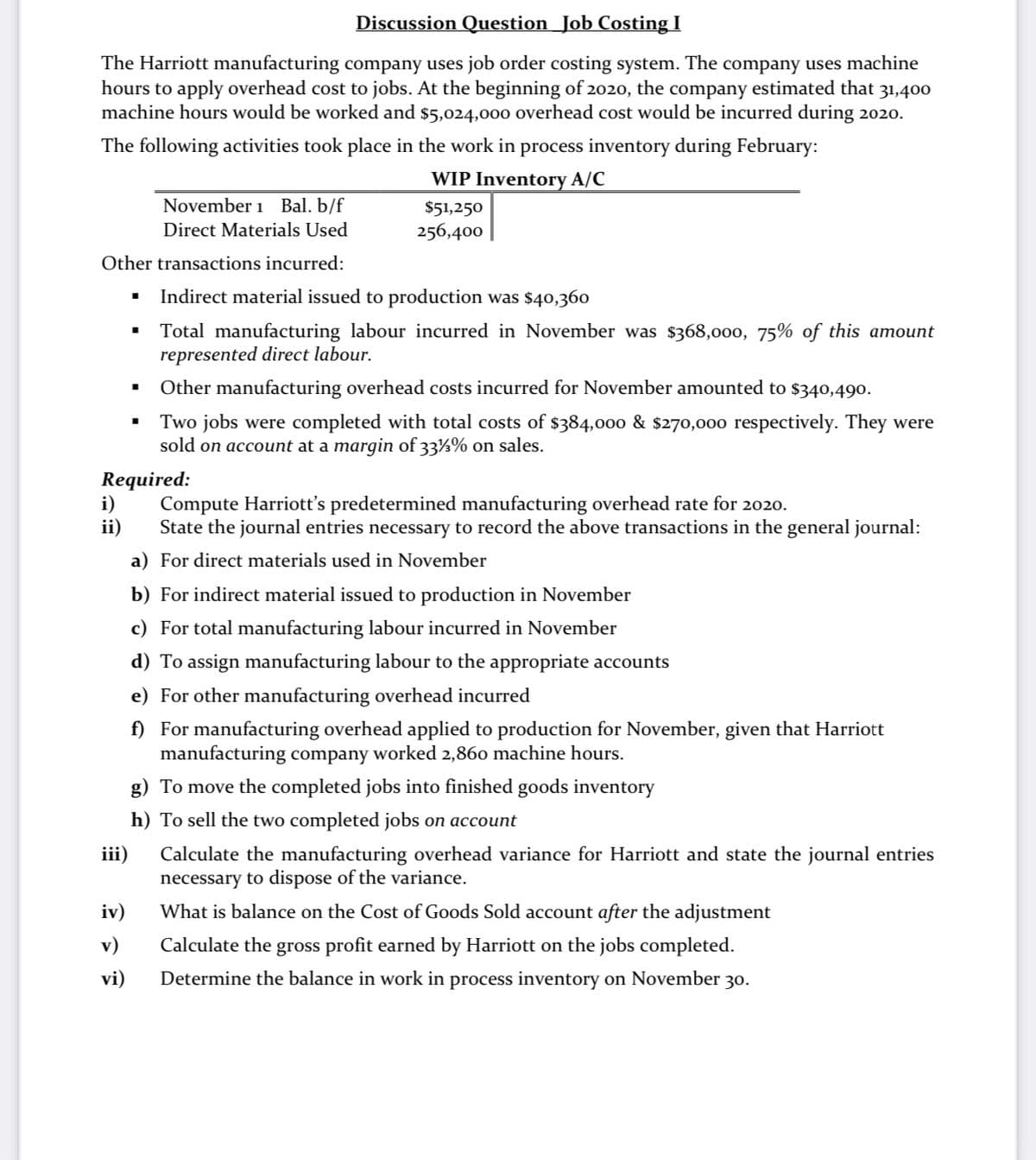

Discussion Question Job Costing I The Harriott manufacturing company uses job order costing system. The company uses machine hours to apply overhead cost to jobs. At the beginning of 2020, the company estimated that 31,40o machine hours would be worked and $5,024,000 overhead cost would be incurred during 2020. The following activities took place in the work in process inventory during February: WIP Inventory A/C November 1 Bal. b/f $51,250 Direct Materials Used 256,400 Other transactions incurred: Indirect material issued to production was $40,360 Total manufacturing labour incurred in November was $368,000, 75% of this amount represented direct labour. Other manufacturing overhead costs incurred for November amounted to $340,490. Two jobs were completed with total costs of $384,000 & $270,000 respectively. They were sold on account at a margin of 33%% on sales. Required: i) ii) Compute Harriott's predetermined manufacturing overhead rate for 2020. State the journal entries necessary to record the above transactions in the general journal: a) For direct materials used in November b) For indirect material issued to production in November c) For total manufacturing labour incurred in November d) To assign manufacturing labour to the appropriate accounts e) For other manufacturing overhead incurred f) For manufacturing overhead applied to production for November, given that Harriott manufacturing company worked 2,860 machine hours. g) To move the completed jobs into finished goods inventory h) To sell the two completed jobs on account Calculate the manufacturing overhead variance for Harriott and state the journal entries necessary to dispose of the variance. iii) iv) What is balance on the Cost of Goods Sold account after the adjustment v) Calculate the gross profit earned by Harriott on the jobs completed. vi) Determine the balance in work in process inventory on November 30.

Discussion Question Job Costing I The Harriott manufacturing company uses job order costing system. The company uses machine hours to apply overhead cost to jobs. At the beginning of 2020, the company estimated that 31,40o machine hours would be worked and $5,024,000 overhead cost would be incurred during 2020. The following activities took place in the work in process inventory during February: WIP Inventory A/C November 1 Bal. b/f $51,250 Direct Materials Used 256,400 Other transactions incurred: Indirect material issued to production was $40,360 Total manufacturing labour incurred in November was $368,000, 75% of this amount represented direct labour. Other manufacturing overhead costs incurred for November amounted to $340,490. Two jobs were completed with total costs of $384,000 & $270,000 respectively. They were sold on account at a margin of 33%% on sales. Required: i) ii) Compute Harriott's predetermined manufacturing overhead rate for 2020. State the journal entries necessary to record the above transactions in the general journal: a) For direct materials used in November b) For indirect material issued to production in November c) For total manufacturing labour incurred in November d) To assign manufacturing labour to the appropriate accounts e) For other manufacturing overhead incurred f) For manufacturing overhead applied to production for November, given that Harriott manufacturing company worked 2,860 machine hours. g) To move the completed jobs into finished goods inventory h) To sell the two completed jobs on account Calculate the manufacturing overhead variance for Harriott and state the journal entries necessary to dispose of the variance. iii) iv) What is balance on the Cost of Goods Sold account after the adjustment v) Calculate the gross profit earned by Harriott on the jobs completed. vi) Determine the balance in work in process inventory on November 30.

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter26: Manufacturing Accounting: The Job Order Cost System

Section: Chapter Questions

Problem 10SPA: JOB ORDER COSTING WITH UNDER- AND OVERAPPLIED FACTORY OVERHEAD M. Evans Sons manufactures parts for...

Related questions

Question

Question (ii) Please to show working on how you arrived with the answers in the

also I need answer for (iv) along with working out .

Please also take into consideration the following when approaching the questions:

- To record materials issued (Direct & Indirect) – Dr. WIP (Direct); Dr. Manufacturing O/H (Indirect); Cr Material Inventory

- Manufacturing Wages/Labour - Note that there are two ways of journalizing this cost

- · First Dr Manufacturing Wages; Cr Wages Payable; Then Dr WIP (Direct), Dr MO (Indirect), Cr Manufacturing Wages

OR

- · Leave out Manufacturing Wages: Dr WIP (Direct), Dr MO (Indirect), Cr Wages Payable

NOTE: Wages Payable may also be referred to as Accrued Wages or Accrued Payroll

- To record Other Manufacturing O/H Costs- Dr Manufacturing O/H; Cr Various A/Cs e.g. Prepaid Insurance, Accumulated

Depreciation , Cash etc. - To record Manufacturing O/H Applied: Dr WIP; Cr Manufacturing O/H

- To record Finished Goods: Dr FG; Cr WIP

- To record Units Sold (Assume Perpetual Inventory System unless told otherwise) this means that there must be two sets of journal entries: Dr COGS, Cr Inventory and Dr

Accounts Receivable /Cash, Cr Sales Revenue - Manufacturing O/H Variance is charged to COGS.

- When determining whether MOHs were over or under applied, use a T-account not a statement (see e-tutor presentation)

Transcribed Image Text:Discussion Question_Job Costing I

The Harriott manufacturing company uses job order costing system. The company uses machine

hours to apply overhead cost to jobs. At the beginning of 2020, the company estimated that 31,400

machine hours would be worked and $5,024,000 overhead cost would be incurred during 2020.

The following activities took place in the work in process inventory during February:

WIP Inventory A/C

November 1 Bal. b/f

$51,250

Direct Materials Used

256,400

Other transactions incurred:

Indirect material issued to production was $40,360

Total manufacturing labour incurred in November was $368,000, 75% of this amount

represented direct labour.

Other manufacturing overhead costs incurred for November amounted to $340,490.

Two jobs were completed with total costs of $384,000 & $270,000 respectively. They were

sold on account at a margin of 33%% on sales.

Required:

i)

ii)

Compute Harriott's predetermined manufacturing overhead rate for 2020.

State the journal entries necessary to record the above transactions in the general journal:

a) For direct materials used in November

b) For indirect material issued to production in November

c) For total manufacturing labour incurred in November

d) To assign manufacturing labour to the appropriate accounts

e) For other manufacturing overhead incurred

f) For manufacturing overhead applied to production for November, given that Harriott

manufacturing company worked 2,860 machine hours.

g) To move the completed jobs into finished goods inventory

h) To sell the two completed jobs on account

iii)

Calculate the manufacturing overhead variance for Harriott and state the journal entries

necessary to dispose of the variance.

iv)

What is balance on the Cost of Goods Sold account after the adjustment

v)

Calculate the gross profit earned by Harriott on the jobs completed.

vi)

Determine the balance in work in process inventory on November 30.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning