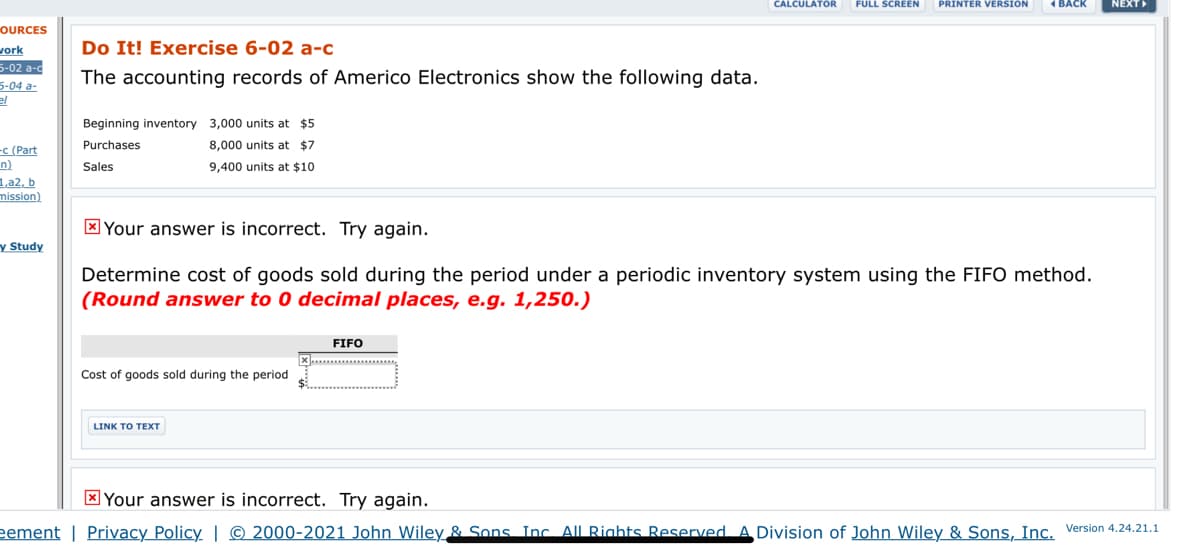

Do It! Exercise 6-02 a-c The accounting records of Americo Electronics show the following data. Beginning inventory 3,000 units at $5 Purchases 8,000 units at $7 Sales 9,400 units at $10

Do It! Exercise 6-02 a-c The accounting records of Americo Electronics show the following data. Beginning inventory 3,000 units at $5 Purchases 8,000 units at $7 Sales 9,400 units at $10

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 2.3C

Related questions

Question

100%

Transcribed Image Text:FULL SCREEN

PRINTER VERSION

NEXT

OURCES

Do It! Exercise 6-02 a-c

vork

5-02 a-d

5-04 a-

el

The accounting records of Americo Electronics show the following data.

Beginning inventory 3,000 units at $5

Purchases

8,000 units at $7

-C (Part

n.

L.a2, b

mission)

Sales

9,400 units at $10

X Your answer is incorrect. Try again.

y Study

Determine cost of goods sold during the period under a periodic inventory system using the FIFO method.

(Round answer to 0 decimal places, e.g. 1,250.)

FIFO

wwwwwwwwwwwwww..

Cost of goods sold during the period

LINK TO TEXT

X Your answer is incorrect. Try again.

eement | Privacy Policy | © 2000-2021 John Wiley & Sons. Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. Version 4.24.21.1

Transcribed Image Text:CALCULATOR

FULL SCREEN

PRINTER VERSION

1 BACK

NEXT

SOURCES

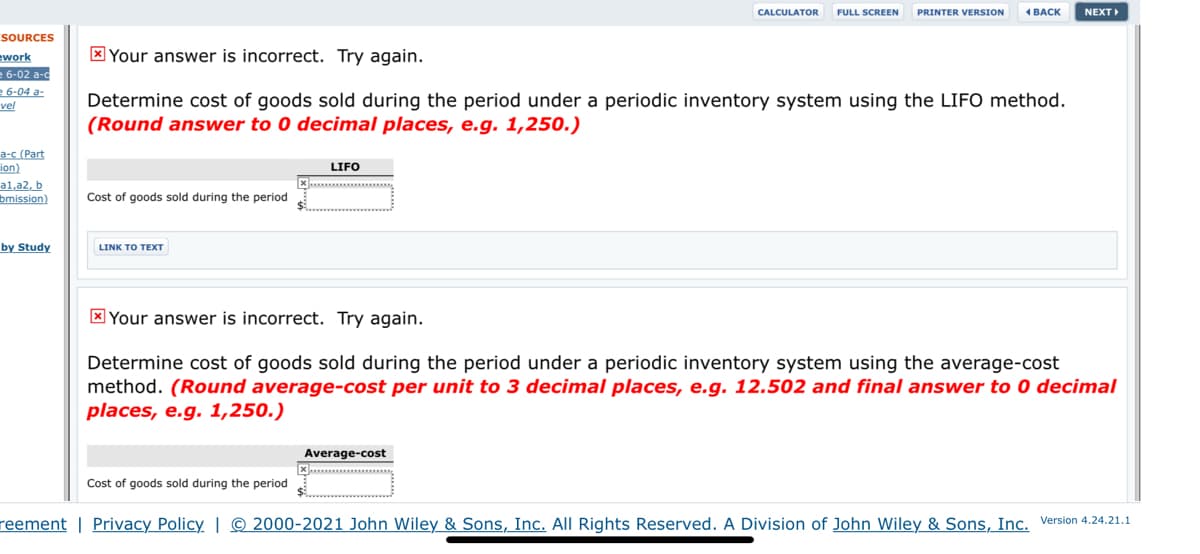

X Your answer is incorrect. Try again.

ework

= 6-02 a-c

e 6-04 a-

vel

Determine cost of goods sold during the period under a periodic inventory system using the LIFO method.

(Round answer to 0 decimal places, e.g. 1,250.)

а-с (Part

ion)

al,a2, b

bmission)

LIFO

Cost

goods sold during the period

by Study

LINK TO TEXT

X Your answer is incorrect. Try again.

Determine cost of goods sold during the period under a periodic inventory system using the average-cost

method. (Round average-cost per unit to 3 decimal places, e.g. 12.502 and final answer to 0 decimal

places, e.g. 1,250.)

Average-cost

Cost of goods sold during the period

reement | Privacy Policy | © 2000-2021 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. Version 4.24.21.1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you