Jack made monthly contributions of $200 to his son's RESP f The contributions as well as the CESG was invested at the en und that earned a return of 7% compounded monthly. If Jack lecides not to attend post-secondary education, and Jack ma Accumulated Income Payment, and his MTR is at 45%, how m axes for the withdrawal?

Jack made monthly contributions of $200 to his son's RESP f The contributions as well as the CESG was invested at the en und that earned a return of 7% compounded monthly. If Jack lecides not to attend post-secondary education, and Jack ma Accumulated Income Payment, and his MTR is at 45%, how m axes for the withdrawal?

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 52P

Related questions

Question

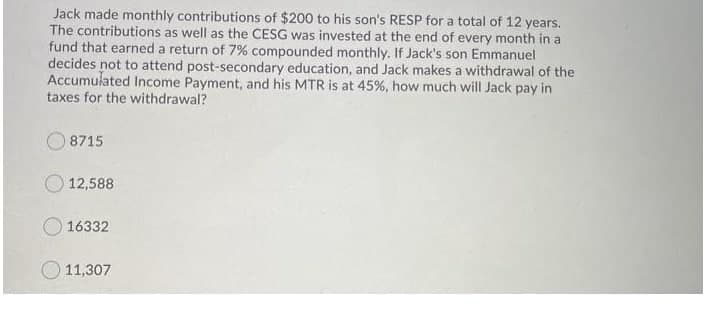

Transcribed Image Text:Jack made monthly contributions of $200 to his son's RESP for a total of 12 years.

The contributions as well as the CESG was invested at the end of every month in a

fund that earned a return of 7% compounded monthly. If Jack's son Emmanuel

decides not to attend post-secondary education, and Jack makes a withdrawal of the

Accumulated Income Payment, and his MTR is at 45%, how much will Jack pay in

taxes for the withdrawal?

8715

12,588

O 16332

11,307

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT