During 20X1, Craig Company had the following transactions: A. Purchased $200,200 of 10-year bonds issued by Makenzie Inc. B. Acquired land valued at $70,000 in exchange for machinery. C. Sold equipment with original cost of $540,200 for $329,200; accumulated depreciation taken on the equipment to the point of sale was $179,200. D. Purchased new machinery for $120,300. E. Purchased common stock in Lemmons Company for $55,000. Required: 1. Prepare the net cash from investing activities section of the statement of cash flows. 2. CONCEPTUAL CONNECTION Usually, the net cash from investing activities is negative. How can Craig cover this negative cash flow? What other information would you like to have to make this decision?

During 20X1, Craig Company had the following transactions: A. Purchased $200,200 of 10-year bonds issued by Makenzie Inc. B. Acquired land valued at $70,000 in exchange for machinery. C. Sold equipment with original cost of $540,200 for $329,200; accumulated depreciation taken on the equipment to the point of sale was $179,200. D. Purchased new machinery for $120,300. E. Purchased common stock in Lemmons Company for $55,000. Required: 1. Prepare the net cash from investing activities section of the statement of cash flows. 2. CONCEPTUAL CONNECTION Usually, the net cash from investing activities is negative. How can Craig cover this negative cash flow? What other information would you like to have to make this decision?

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 1ANFS

Related questions

Question

3-140

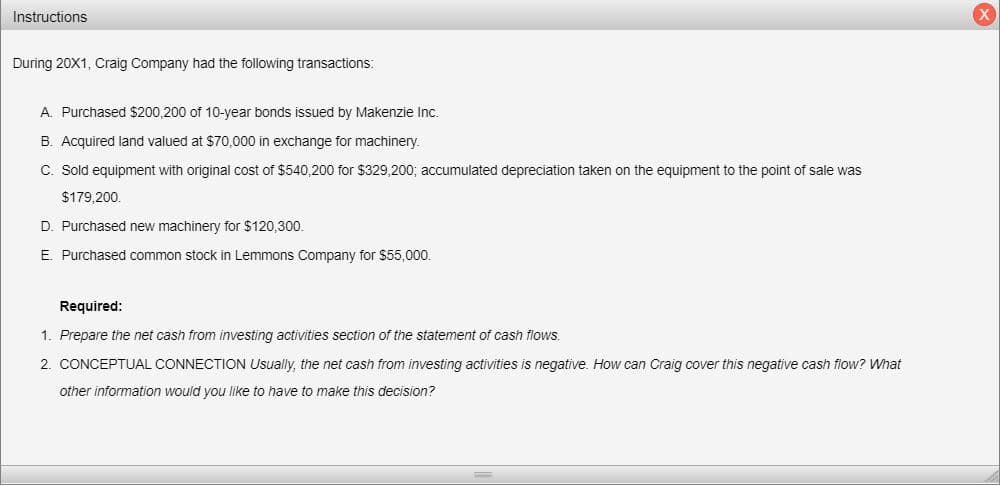

Transcribed Image Text:Instructions

During 20X1, Craig Company had the following transactions:

A. Purchased $200,200 of 10-year bonds issued by Makenzie Inc.

B. Acquired land valued at $70,000 in exchange for machinery.

C. Sold equipment with original cost of $540,200 for $329,200; accumulated depreciation taken on the equipment to the point of sale was

$179,200.

D. Purchased new machinery for $120,300.

E. Purchased common stock in Lemmons Company for $55,000.

Required:

1. Prepare the net cash from investing activities section of the statement of cash flows.

2. CONCEPTUAL CONNECTION Usually, the net cash from investing activities is negative. How can Craig cover this negative cash flow? What

other information would you like to have to make this decision?

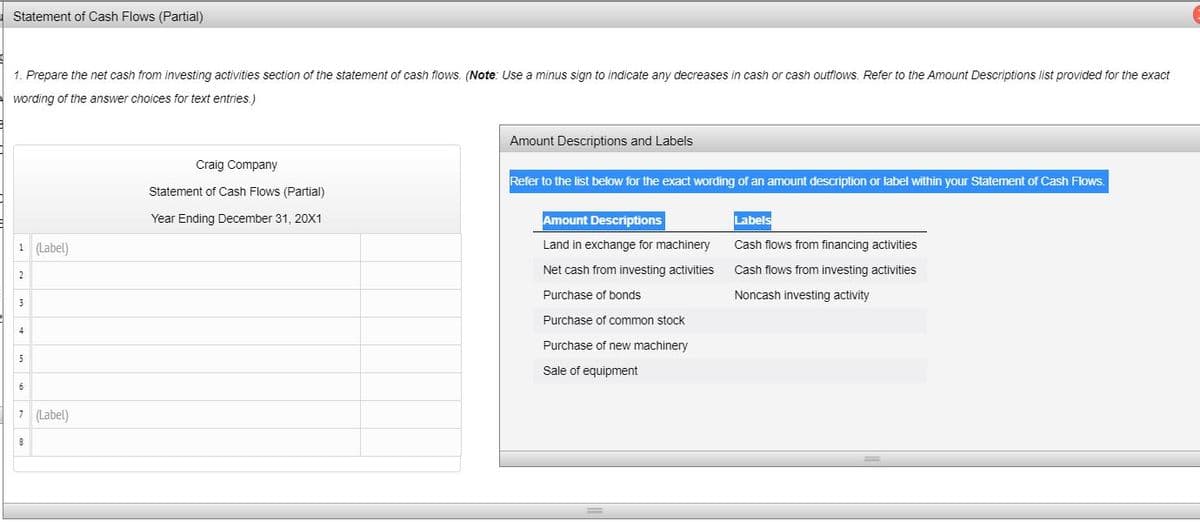

Transcribed Image Text:Statement of Cash Flows (Partial)

1. Prepare the net cash from investing activities section of the statement of cash flows. (Note: Use a minus sign to indicate any decreases in cash or cash outflows. Refer to the Amount Descriptions list provided for the exact

wording of the answer choices for text entries.)

Amount Descriptions and Labels

Craig Company

Refer to the list below for the exact wording of an amount description or label within your Statement of Cash Flows.

Statement of Cash Flows (Partial)

Year Ending December 31, 20X1

Amount Descriptions

Labels

1 (Label)

Land in exchange for machinery

Cash flows from financing activities

Net cash from investing activities

Cash flows from investing activities

2

Purchase of bonds

Noncash investing activity

Purchase of common stock

Purchase of new machinery

Sale of equipment

7 (Label)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning