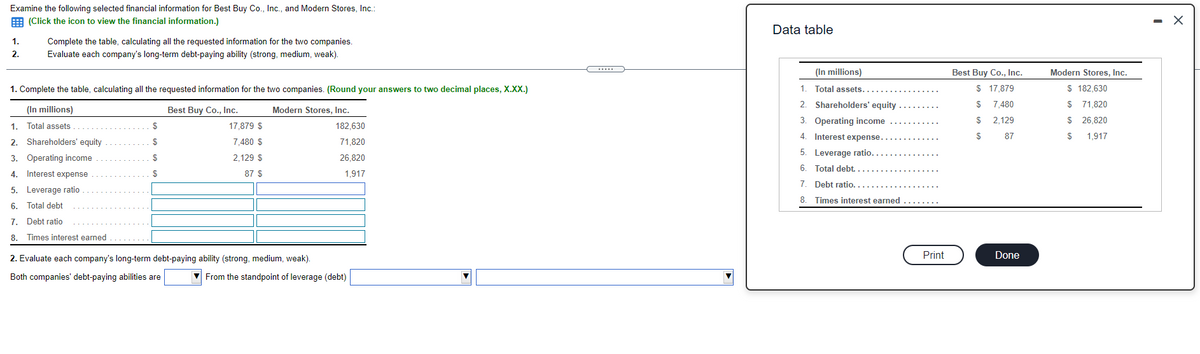

E (Click the icon to view the financial information.) Data table 1. Complete the table, calculating all the requested information for the two companies. Evaluate each company's long-term debt-paying ability (strong, medium, weak). 2. (In millions) Best Buy Co., Inc. Modern Stores, Inc. 1. Total assets... 2. Shareholders' equity $ 17,879 $ 7,480 $ 2,129 $ 87 $ 182,630 $ 71,820 1. Complete the table, calculating all the requested information for the two companies. (Round your answers to two decimal places, X.XX.) (In millions) Best Buy Co., Inc. Modern Stores, Inc. 3. Operating income $ 26,820 1. Total assets 17,879 S 182,630 2. Shareholders' equity 4. Interest expense. $ 1,917 7,480 S 71,820 5. Leverage ratio.. 6. Total debt.. 3. Operating income 2,129 S 26,820 4. Interest expense 87 S 1,917 7. Debt ratio. 5. Leverage ratio 6. Total debt 7. Debt ratio 8. Times interest earned. ....... 8. Times interest eamed Print Done 2. Evaluate each company's long-term debt-paying ability (strong, medium, weak). Both companies' debt-paying abilities are From the standpoint of leverage (debt)

E (Click the icon to view the financial information.) Data table 1. Complete the table, calculating all the requested information for the two companies. Evaluate each company's long-term debt-paying ability (strong, medium, weak). 2. (In millions) Best Buy Co., Inc. Modern Stores, Inc. 1. Total assets... 2. Shareholders' equity $ 17,879 $ 7,480 $ 2,129 $ 87 $ 182,630 $ 71,820 1. Complete the table, calculating all the requested information for the two companies. (Round your answers to two decimal places, X.XX.) (In millions) Best Buy Co., Inc. Modern Stores, Inc. 3. Operating income $ 26,820 1. Total assets 17,879 S 182,630 2. Shareholders' equity 4. Interest expense. $ 1,917 7,480 S 71,820 5. Leverage ratio.. 6. Total debt.. 3. Operating income 2,129 S 26,820 4. Interest expense 87 S 1,917 7. Debt ratio. 5. Leverage ratio 6. Total debt 7. Debt ratio 8. Times interest earned. ....... 8. Times interest eamed Print Done 2. Evaluate each company's long-term debt-paying ability (strong, medium, weak). Both companies' debt-paying abilities are From the standpoint of leverage (debt)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 57P: Grammatico Company has just completed its third year of operations. The income statement is as...

Related questions

Question

Hello, having some trouble with my accounting homework. There are drop down boxes for question 2, and here are the options:

Dropdown box #1: Both companies' debt-paying abilities are (medium, strong, weak).

Dropdown box #2: From the standpoint of leverage (debt) (the companies are about equal, BestBuy is stronger, Modern is stronger).

Dropdown box #3: (Modern has a stronger times-interest-earned ratio, The times-interest-earned ratios are about equal for both companies, Best Buy has a stronger times-interest-earned ratio).

Also, the financial information needed is listed on the right.

Thank you so so much, really struggling with this concept.

Transcribed Image Text:Examine the following selected financial information for Best Buy Co., Inc., and Modern Stores, Inc.:

E (Click the icon to view the financial information.)

Data table

1.

Complete the table, calculating all the requested information for the two companies.

2.

Evaluate each company's long-term debt-paying ability (strong, medium, weak).

(In millions)

Best Buy Co., Inc.

Modern Stores, Inc.

1. Complete the table, calculating all the requested information for the two companies. (Round your answers to two decimal places, X.XX.)

1.

Total assets.

$ 17.879

$ 182,630

(In millions)

2. Shareholders' equity

$

7,480

$ 71,820

Best Buy Co., Inc.

Modern Stores, Inc.

3. Operating income

2,129

2$

26,820

1. Total assets

$

17,879 $

182.630

4. Interest expense.

$

87

1,917

2. Shareholders' equity

$

7,480 $

71,820

5. Leverage ratio.

3. Operating income

2,129 $

26,820

6.

Total debt.

4. Interest expense

$

87 $

1,917

7. Debt ratio.

5. Leverage ratio

8. Times interest earned

6. Total debt

7.

Debt ratio

8. Times interest earned

Print

Done

2. Evaluate each company's long-term debt-paying ability (strong, medium, weak).

Both companies' debt-paying abilities are

From the standpoint of leverage (debt)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning