The following information was drawn from the balance sheets of two companies. Company East Assets 192,000 600,000 Liabilities + 88,000 171,000 Equity 104,000 429,000 West Required a. Compute the debt-to-assets ratio to measure the level of financial risk of both companies. b. Compare the two ratios computed in requirement a to identify which company has the higher level of financial risk. Complete this question by entering your answers in the tabs below. Required A Required B Compute the debt-to-assets ratio to measure the level of financial risk of both companies. (Round your answers to 1 decimal place.) Debt to Assets Company Ratio East West Required A Required B >

The following information was drawn from the balance sheets of two companies. Company East Assets 192,000 600,000 Liabilities + 88,000 171,000 Equity 104,000 429,000 West Required a. Compute the debt-to-assets ratio to measure the level of financial risk of both companies. b. Compare the two ratios computed in requirement a to identify which company has the higher level of financial risk. Complete this question by entering your answers in the tabs below. Required A Required B Compute the debt-to-assets ratio to measure the level of financial risk of both companies. (Round your answers to 1 decimal place.) Debt to Assets Company Ratio East West Required A Required B >

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 17E

Related questions

Question

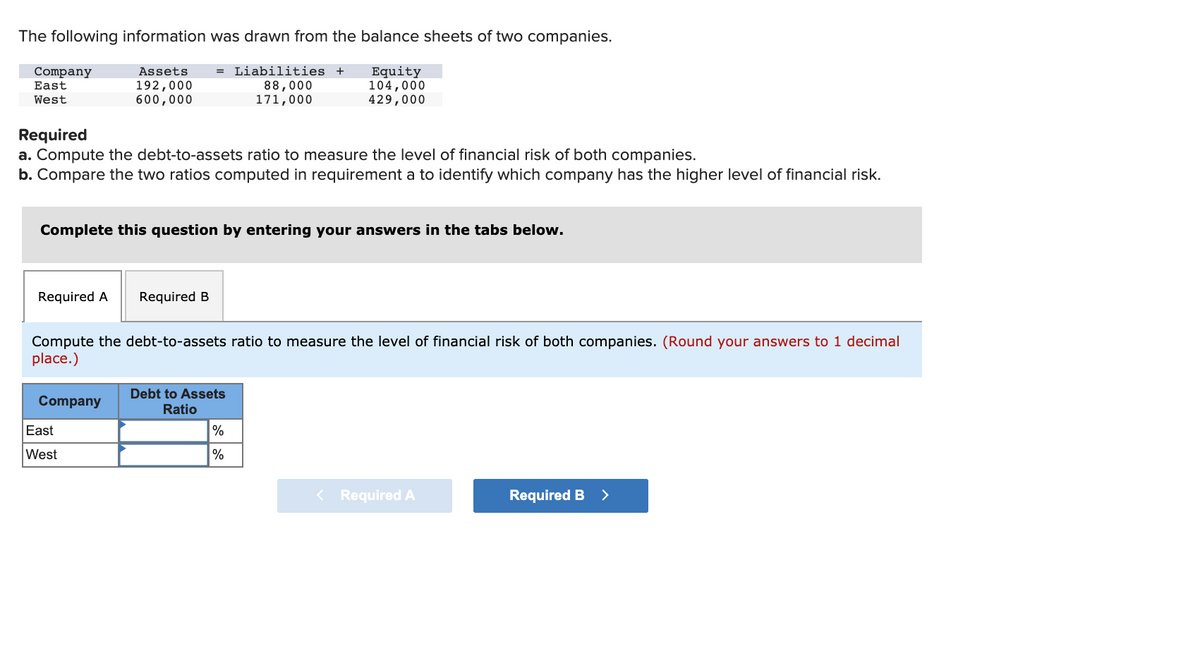

Transcribed Image Text:The following information was drawn from the balance sheets of two companies.

Company

East

Liabilities +

88,000

171,000

Equity

104,000

429,000

Assets

192,000

600,000

West

Required

a. Compute the debt-to-assets ratio to measure the level of financial risk of both companies.

b. Compare the two ratios computed in requirement a to identify which company has the higher level of financial risk.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compute the debt-to-assets ratio to measure the level of financial risk of both companies. (Round your answers to 1 decimal

place.)

Debt to Assets

Company

Ratio

East

West

%

< Required A

Required B >

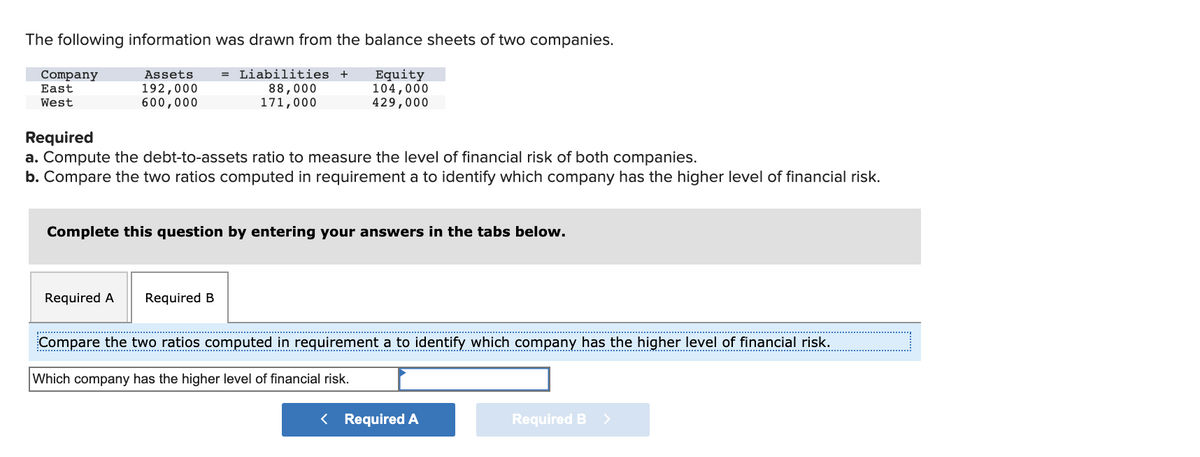

Transcribed Image Text:The following information was drawn from the balance sheets of two companies.

Liabilities

Company

East

Equity

104,000

429,000

Assets

+

%3D

192,000

600,000

88,000

171,000

West

Required

a. Compute the debt-to-assets ratio to measure the level of financial risk of both companies.

b. Compare the two ratios computed in requirement a to identify which company has the higher level of financial risk.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compare the two ratios computed in requirement a to identify which company has the higher level of financial risk.

..........!................. ...... ....... ................ ......................... ............... ................... ......................................*.................. ....... ....... ...

Which company has the higher level of financial risk.

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning