e. Solve for the equilibrium values of C and 1, and verify the value you obtained for Yby adding C, 1, and G. f. Now suppose that the money supply increases to M/P-1,840 . Solve for Y,i,c, and T, and describe in words the effect of an expansionary monetary policy. g. Set M/P equal to its initial value of 1,600. Now suppose that government spending increases to G-400. Summarize the effects of an expansionary fiscal policy on Y,i, and C.

e. Solve for the equilibrium values of C and 1, and verify the value you obtained for Yby adding C, 1, and G. f. Now suppose that the money supply increases to M/P-1,840 . Solve for Y,i,c, and T, and describe in words the effect of an expansionary monetary policy. g. Set M/P equal to its initial value of 1,600. Now suppose that government spending increases to G-400. Summarize the effects of an expansionary fiscal policy on Y,i, and C.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter5: Business And Economic Forecasting

Section: Chapter Questions

Problem 4E

Related questions

Question

100%

please answer for question E, F and G

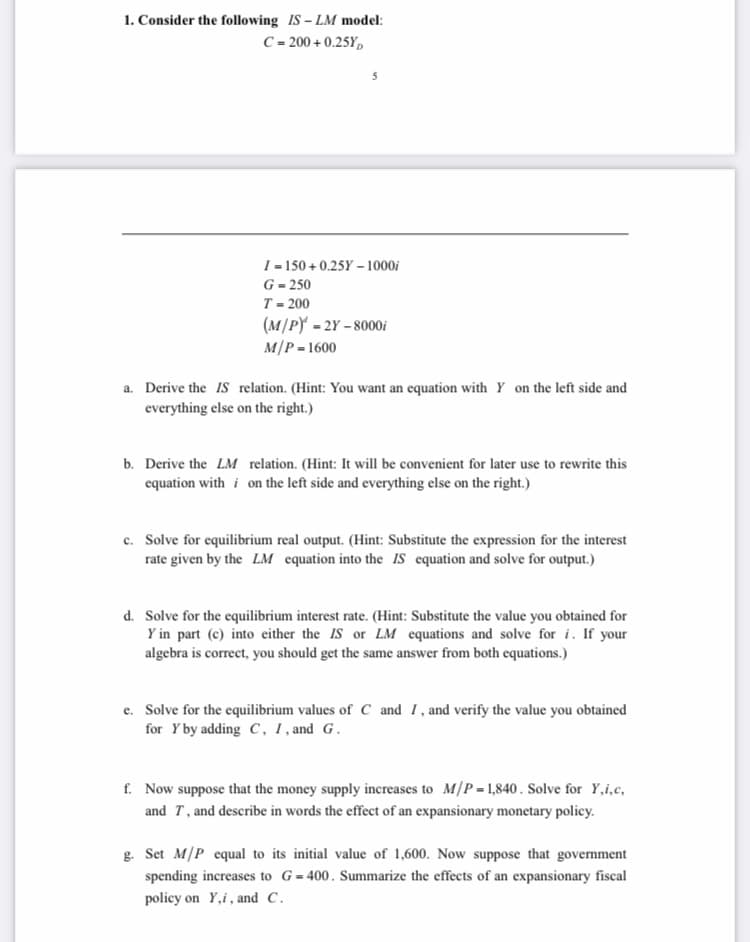

Transcribed Image Text:1. Consider the following IS – LM model:

C = 200 + 0.25Y,

I = 150 + 0.25Y – 1000i

G = 250

T - 200

(M/PY - 2Y – 8000i

M/P = 1600

a. Derive the IS relation. (Hint: You want an equation with Y on the left side and

everything else on the right.)

b. Derive the LM relation. (Hint: It will be convenient for later use to rewrite this

equation with i on the left side and everything else on the right.)

c. Solve for equilibrium real output. (Hint: Substitute the expression for the interest

rate given by the LM equation into the iS equation and solve for output.)

d. Solve for the equilibrium interest rate. (Hint: Substitute the value you obtained for

Y in part (c) into either the IS or LM equations and solve for i. If your

algebra is correct, you should get the same answer from both equations.)

e. Solve for the equilibrium values of C and I, and verify the value you obtained

for Y by adding C, 1, and G.

f. Now suppose that the money supply increases to M/P-1,840. Solve for Y,i,c,

and T, and describe in words the effect of an expansionary monetary policy.

g. Set M/P equal to its initial value of 1,600. Now suppose that government

spending increases to G=400. Summarize the effects of an expansionary fiscal

policy on Y,i, and C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning