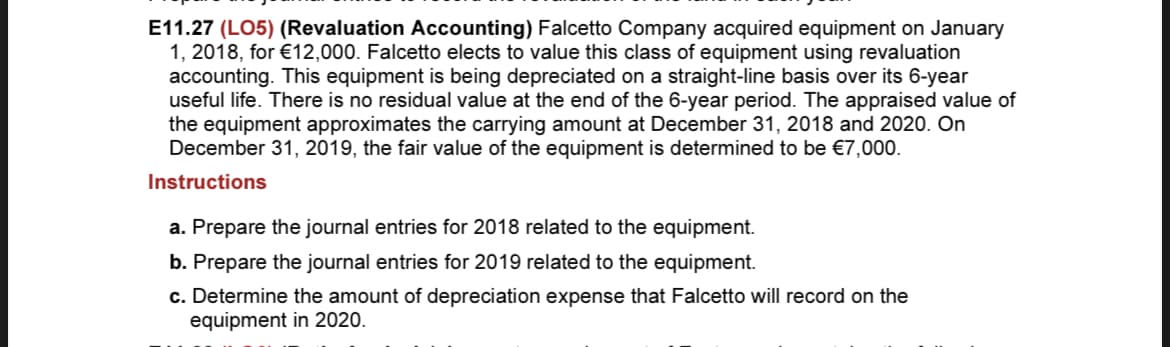

E11.27 (LO5) (Revaluation Accounting) Falcetto Company acquired equipment on January 1, 2018, for €12,000. Falcetto elects to value this class of equipment using revaluation accounting. This equipment is being depreciated on a straight-line basis over its 6-year useful life. There is no residual value at the end of the 6-year period. The appraised value of the equipment approximates the carrying amount at December 31, 2018 and 2020. On December 31, 2019, the fair value of the equipment is determined to be €7,000. Instructions a. Prepare the journal entries for 2018 related to the equipment. b. Prepare the journal entries for 2019 related to the equipment. c. Determine the amount of depreciation expense that Falcetto will record on the equipment in 2020.

E11.27 (LO5) (Revaluation Accounting) Falcetto Company acquired equipment on January 1, 2018, for €12,000. Falcetto elects to value this class of equipment using revaluation accounting. This equipment is being depreciated on a straight-line basis over its 6-year useful life. There is no residual value at the end of the 6-year period. The appraised value of the equipment approximates the carrying amount at December 31, 2018 and 2020. On December 31, 2019, the fair value of the equipment is determined to be €7,000. Instructions a. Prepare the journal entries for 2018 related to the equipment. b. Prepare the journal entries for 2019 related to the equipment. c. Determine the amount of depreciation expense that Falcetto will record on the equipment in 2020.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 18DQ: LO.4, 7 In December 2019, Carl Corporation sold land it held as an investment. The corporation...

Related questions

Question

Transcribed Image Text:E11.27 (LO5) (Revaluation Accounting) Falcetto Company acquired equipment on January

1, 2018, for €12,000. Falcetto elects to value this class of equipment using revaluation

accounting. This equipment is being depreciated on a straight-line basis over its 6-year

useful life. There is no residual value at the end of the 6-year period. The appraised value of

the equipment approximates the carrying amount at December 31, 2018 and 2020. On

December 31, 2019, the fair value of the equipment is determined to be €7,000.

Instructions

a. Prepare the journal entries for 2018 related to the equipment.

b. Prepare the journal entries for 2019 related to the equipment.

c. Determine the amount of depreciation expense that Falcetto will record on the

equipment in 2020.

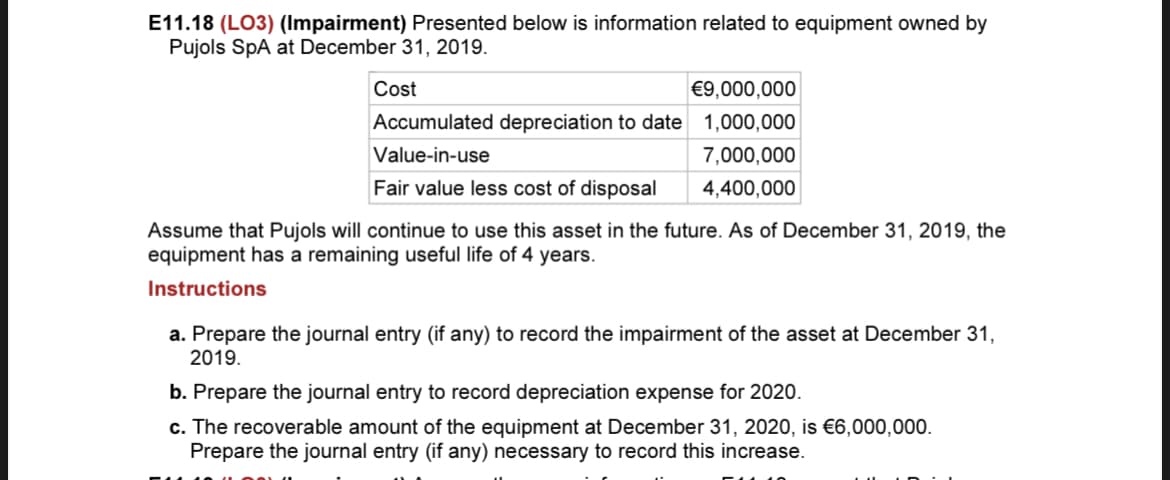

Transcribed Image Text:E11.18 (LO3) (Impairment) Presented below is information related to equipment owned by

Pujols SpA at December 31, 2019.

Cost

€9,000,000

Accumulated depreciation to date 1,000,000

Value-in-use

7,000,000

Fair value less cost of disposal

4,400,000

Assume that Pujols will continue to use this asset in the future. As of December 31, 2019, the

equipment has a remaining useful life of 4 years.

Instructions

a. Prepare the journal entry (if any) to record the impairment of the asset at December 31,

2019.

b. Prepare the journal entry to record depreciation expense for 2020.

c. The recoverable amount of the equipment at December 31, 2020, is €6,000,000.

Prepare the journal entry (if any) necessary to record this increase.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning