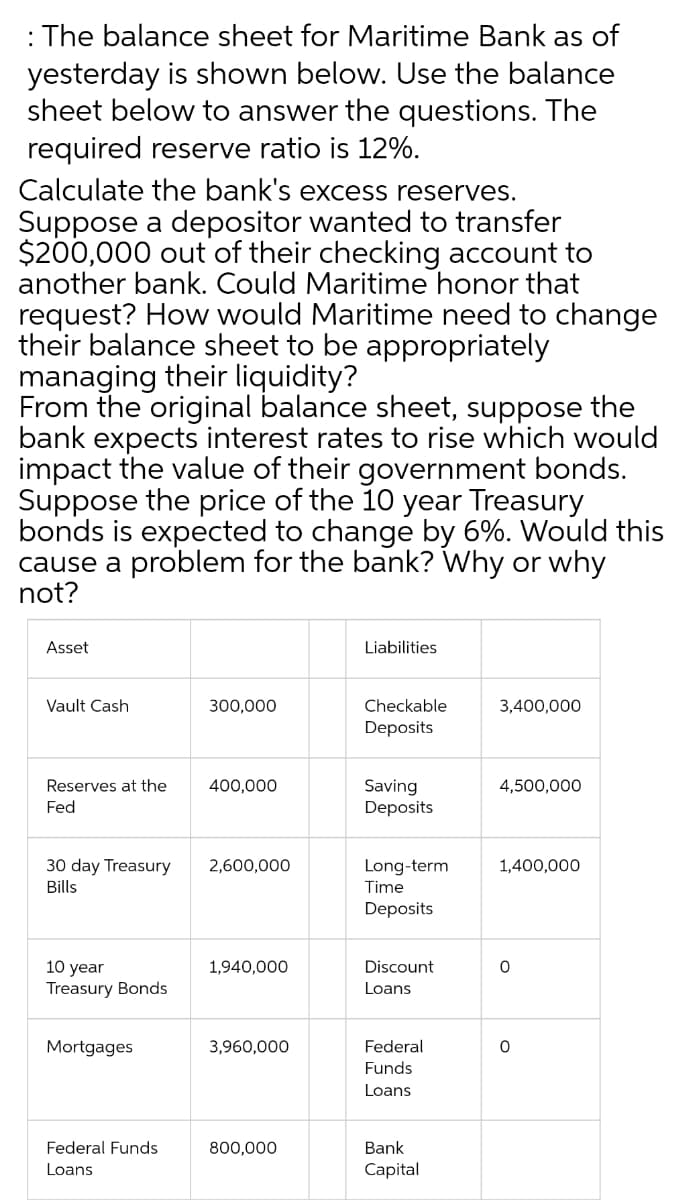

: The balance sheet for Maritime Bank as of yesterday is shown below. Use the balance sheet below to answer the questions. The required reserve ratio is 12%. Calculate the bank's excess reserves. Suppose a depositor wanted to transfer $200,000 out of their checking account to another bank. Could Maritime honor that request? How would Maritime need to change their balance sheet to be appropriately managing their liquidity? From the original balance sheet, suppose the bank expects interest rates to rise which would impact the value of their government bonds. Suppose the price of the 10 year Treasury bonds is expected to change by 6%. Would this cause a problem for the bank? Why or why not? Asset Liabilities Vault Cash 300,000 Checkable 3,400,000 Deposits Reserves at the 400,000 Saving Deposits 4,500,000 Fed 30 day Treasury 2,600,000 Long-term 1,400,000 Bills Time Deposits 10 year Treasury Bonds 1,940,000 Discount Loans Mortgages 3,960,000 Federal Funds Loans Federal Funds 800,000 Bank Loans Capital

: The balance sheet for Maritime Bank as of yesterday is shown below. Use the balance sheet below to answer the questions. The required reserve ratio is 12%. Calculate the bank's excess reserves. Suppose a depositor wanted to transfer $200,000 out of their checking account to another bank. Could Maritime honor that request? How would Maritime need to change their balance sheet to be appropriately managing their liquidity? From the original balance sheet, suppose the bank expects interest rates to rise which would impact the value of their government bonds. Suppose the price of the 10 year Treasury bonds is expected to change by 6%. Would this cause a problem for the bank? Why or why not? Asset Liabilities Vault Cash 300,000 Checkable 3,400,000 Deposits Reserves at the 400,000 Saving Deposits 4,500,000 Fed 30 day Treasury 2,600,000 Long-term 1,400,000 Bills Time Deposits 10 year Treasury Bonds 1,940,000 Discount Loans Mortgages 3,960,000 Federal Funds Loans Federal Funds 800,000 Bank Loans Capital

Principles of Macroeconomics (MindTap Course List)

7th Edition

ISBN:9781285165912

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter16: The Monetary System

Section: Chapter Questions

Problem 5PA

Related questions

Question

Need fully correct solution for this asap.

I'll rate positive for Correct solution.

Transcribed Image Text:: The balance sheet for Maritime Bank as of

yesterday is shown below. Use the balance

sheet below to answer the questions. The

required reserve ratio is 12%.

Calculate the bank's excess reserves.

Suppose a depositor wanted to transfer

$200,000 out of their checking account to

another bank. Could Maritime honor that

request? How would Maritime need to change

their balance sheet to be appropriately

managing their liquidity?

From the original balance sheet, suppose the

bank expects interest rates to rise which would

impact the value of their government bonds.

Suppose the price of the 10 year Treasury

bonds is expected to change by 6%. Would this

cause a problem for the bank? Why or why

not?

Asset

Liabilities

Vault Cash

300,000

Checkable

3,400,000

Deposits

Reserves at the

400,000

Saving

Deposits

4,500,000

Fed

30 day Treasury

2,600,000

Long-term

1,400,000

Bills

Time

Deposits

10 year

Treasury Bonds

1,940,000

Discount

Loans

Mortgages

3,960,000

Federal

Funds

Loans

Federal Funds

800,000

Bank

Loans

Capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning