Elite Lawn & Plowing (EL&P) is a lawn and snow plowing service with both residential and commercial clients. The owner believes that the commercial sector has more growth opportunities and is considering dropping the residential service. Twenty employees worked a total of 20,000 hours last year, 13,000 on residential jobs and 7,000 on commercial jobs. Wages were $25 per hour for all work done. Any materials used are included in overhead as supplies. All overhead is allocated on the basis of labor-hours worked, which is also the basis for customer charges. Because of increased competition for commercial accounts, EL&P can charge $60 per hour for residential work, but only $45 per hour for commercial work. Required: a. If overhead for the year was $205,000, what were the profits of the residential and commercial services using labor-hours as the allocation base? b. Overhead consists of costs of traveling to the site, using equipment (including vehicle rental), and using supplies, which can be traced as follows. Cost Driver Volume Commercial Residential 76 Activity Traveling Using equipment Using supplies Cost $ 25,000 60,000 120,000 $205,000 Cost Driver Number of clients served 24 Equipment hours Area serviced in square yards 1,775 65,000 1,225 35,000 Total overhead

Elite Lawn & Plowing (EL&P) is a lawn and snow plowing service with both residential and commercial clients. The owner believes that the commercial sector has more growth opportunities and is considering dropping the residential service. Twenty employees worked a total of 20,000 hours last year, 13,000 on residential jobs and 7,000 on commercial jobs. Wages were $25 per hour for all work done. Any materials used are included in overhead as supplies. All overhead is allocated on the basis of labor-hours worked, which is also the basis for customer charges. Because of increased competition for commercial accounts, EL&P can charge $60 per hour for residential work, but only $45 per hour for commercial work. Required: a. If overhead for the year was $205,000, what were the profits of the residential and commercial services using labor-hours as the allocation base? b. Overhead consists of costs of traveling to the site, using equipment (including vehicle rental), and using supplies, which can be traced as follows. Cost Driver Volume Commercial Residential 76 Activity Traveling Using equipment Using supplies Cost $ 25,000 60,000 120,000 $205,000 Cost Driver Number of clients served 24 Equipment hours Area serviced in square yards 1,775 65,000 1,225 35,000 Total overhead

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter17: Activity Resource Usage Model And Tactical Decision Making

Section: Chapter Questions

Problem 32P: Paladin Company manufactures plain-paper fax machines in a small factory in Minnesota. Sales have...

Related questions

Question

Hello question is attached, thanks.

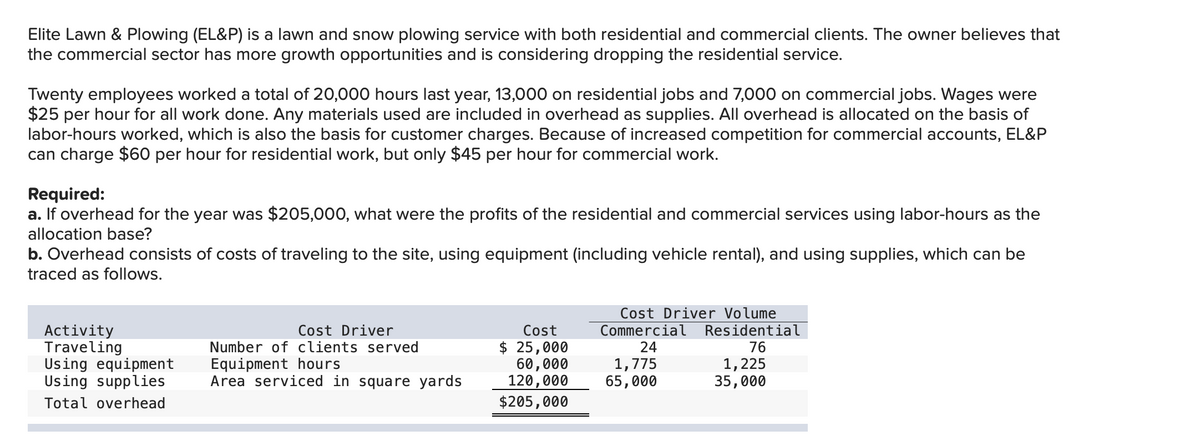

Transcribed Image Text:Elite Lawn & Plowing (EL&P) is a lawn and snow plowing service with both residential and commercial clients. The owner believes that

the commercial sector has more growth opportunities and is considering dropping the residential service.

Twenty employees worked a total of 20,000 hours last year, 13,000 on residential jobs and 7,000 on commercial jobs. Wages were

$25 per hour for all work done. Any materials used are included in overhead as supplies. All overhead is allocated on the basis of

labor-hours worked, which is also the basis for customer charges. Because of increased competition for commercial accounts, EL&P

can charge $60 per hour for residential work, but only $45 per hour for commercial work.

Required:

a. If overhead for the year was $205,000, what were the profits of the residential and commercial services using labor-hours as the

allocation base?

b. Overhead consists of costs of traveling to the site, using equipment (including vehicle rental), and using supplies, which can be

traced as follows.

Cost Driver Volume

Commercial Residential

24

Activity

Traveling

Using equipment

Using supplies

Cost Driver

Number of clients served

Cost

$ 25,000

60,000

120,000

$205,000

76

Equipment hours

Area serviced in square yards

1,775

65,000

1,225

35,000

Total overhead

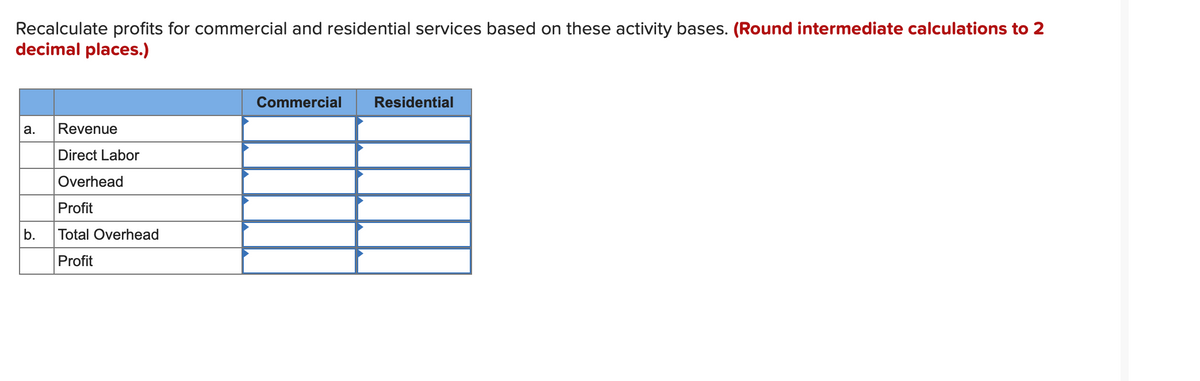

Transcribed Image Text:Recalculate profits for commercial and residential services based on these activity bases. (Round intermediate calculations to 2

decimal places.)

Commercial

Residential

a.

Revenue

Direct Labor

Overhead

Profit

b.

Total Overhead

Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub