ender can be replaced with a challenger which will cost $70,000 to install, have operating expenses of S8,50 per year, and have a final market value ot 512,0XX) at the end of ts 20-year economic lite. I reciated with the straight line method over a 20-year life with an estimated salvage value of 512,000 at EOY 20. Such equipment (defender or challenger will be needed indefinitely. If the after-tax MAR is 25%, should the defender or the challenger be recommended? n the inlerest and anuity lable for discrele compounding when MARR = 10% per yeur. More Info To Find F To Find P To Find F To Find P To Find A To Find A ender is $ (Round to the nearest dellar. Given P Given F Given A Given A Given F Given P PIF FIA PIA A/F A/P allenger is $ (Rounid lo the nourest dollar.) 1 1.1000 0.9091 1.0000 0.9091 1.0000 1.1000 1.2100 0.0264 2.1000 1.7355 0.4762 0.5762 3 1.3310 0.7513 3.31D0 2.4869 0.3021 0.4021 4 1.4641 0.6830 4.0410 3.1000 0.2155 0.3155 1.6105 O.6209 6.1051 3.7908 0.1638 0.2638 7.7156 1.7716 1.9487 0.5645 0.6132 4.3553 4.8684 0.1296 0.1054 0.2206 replaced immediately 8.4872 0.2054 2.1436 0.1605 11.4359 5.3319 0.0874 0.1874 kept tor at least ene more year 2.3579 0.4241 13.5795 5.7590 0.0735 0.1736 10 2.5037 0.3865 15.9374 6.1446 0.0627 0.1627 2.8531 3.1384 18.5312 21.3843 0.1540 0.1468 11 0.3505 6.4951 0.0540 0.3106 6.0137 0.0468 a 0408 0.0357 12 13 3.4523 0.2897 24.5227 7.1034 0.1408 3.7975 0.2033 27.0750 7.3007 0.1367 0.1315 14 a 0315 0.0276 0.0247 15 4.1772 0.2394 31.7725 7.6061 16 4.5050 0.2176 35.9497 7.8237 0.1270 17 5.0545 0.1978 40.5447 8.0216 0.1247 18 5.5500 0.1799 45.5902 8.2014 0.0219 0.1219 19 6.1159 0.1635 51.1591 8.3649 0.0195 0.1195 20 6.7275 0.1480 57.2750 8.6130 0.0175 0.1176

ender can be replaced with a challenger which will cost $70,000 to install, have operating expenses of S8,50 per year, and have a final market value ot 512,0XX) at the end of ts 20-year economic lite. I reciated with the straight line method over a 20-year life with an estimated salvage value of 512,000 at EOY 20. Such equipment (defender or challenger will be needed indefinitely. If the after-tax MAR is 25%, should the defender or the challenger be recommended? n the inlerest and anuity lable for discrele compounding when MARR = 10% per yeur. More Info To Find F To Find P To Find F To Find P To Find A To Find A ender is $ (Round to the nearest dellar. Given P Given F Given A Given A Given F Given P PIF FIA PIA A/F A/P allenger is $ (Rounid lo the nourest dollar.) 1 1.1000 0.9091 1.0000 0.9091 1.0000 1.1000 1.2100 0.0264 2.1000 1.7355 0.4762 0.5762 3 1.3310 0.7513 3.31D0 2.4869 0.3021 0.4021 4 1.4641 0.6830 4.0410 3.1000 0.2155 0.3155 1.6105 O.6209 6.1051 3.7908 0.1638 0.2638 7.7156 1.7716 1.9487 0.5645 0.6132 4.3553 4.8684 0.1296 0.1054 0.2206 replaced immediately 8.4872 0.2054 2.1436 0.1605 11.4359 5.3319 0.0874 0.1874 kept tor at least ene more year 2.3579 0.4241 13.5795 5.7590 0.0735 0.1736 10 2.5037 0.3865 15.9374 6.1446 0.0627 0.1627 2.8531 3.1384 18.5312 21.3843 0.1540 0.1468 11 0.3505 6.4951 0.0540 0.3106 6.0137 0.0468 a 0408 0.0357 12 13 3.4523 0.2897 24.5227 7.1034 0.1408 3.7975 0.2033 27.0750 7.3007 0.1367 0.1315 14 a 0315 0.0276 0.0247 15 4.1772 0.2394 31.7725 7.6061 16 4.5050 0.2176 35.9497 7.8237 0.1270 17 5.0545 0.1978 40.5447 8.0216 0.1247 18 5.5500 0.1799 45.5902 8.2014 0.0219 0.1219 19 6.1159 0.1635 51.1591 8.3649 0.0195 0.1195 20 6.7275 0.1480 57.2750 8.6130 0.0175 0.1176

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

5

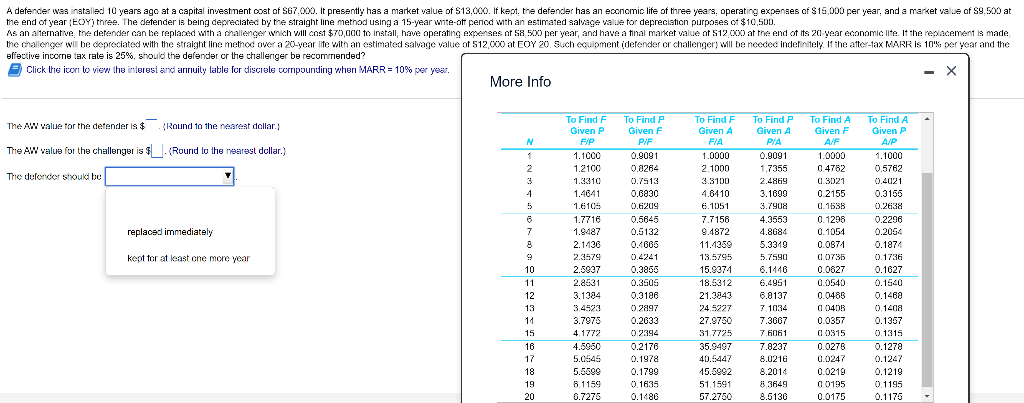

Transcribed Image Text:A defender was installed 10 years ago at a capital investment cost of S67,000. It presently has a market value of S13,000. If kept, the defender has an economic life of three years, operating expenses of $15,000 per year, and a market value of S9,500 at

the end of year (EOY) three. The detender is being depreciated by the straight line method using a 15-year wnte-off pericd with an estimated salvage value tor depreciation purposes of $10,50D.

As an alternative, the detender can be replaced with a challenger wnich will cost $70,000 to Install, have operating expenses of SR,500 per year, and have a final market value ot 512,000 at the end of its 20 year economic Ilte. It the replacement is made,

the challenger wil be depreciated with the straight line method over a 20-year life with an estimated salvage value of 512,000 at EOY 20. Such equipment (defender or challenger; will be needec indefinitely. If the after-tax MARR is 10% per year and the

effective incorne tax rate is 25%, should the defender or the challeıger be recommended?

E Click the icon to view the interesl and arınuity lable for discrele cormpounding when MARR = 10% per year.

- X

More Info

To Find F

To Find P

To Find F

To Find P

To Find A

To Find A

The AW value for the defender is $. Round to the nearest dellar.

Given P

Given F

Given A

Given A

Given F

Given P

FP

PIF

FIA

PIA

A/F

A/P

The AW value for the challenger is $. (Round to the nearest dollar.)

1.1000

0.9091

1.0000

0.9091

1.0000

1.1000

1

2

1.2100

0.0264

2.1000

1.7355

0.4782

0.5762

The defender shoukd be

3

1.3310

0.7513

3.31DD

2.4869

0.3021

0.4021

4

1.4641

0.6830

4.6410

3.1600

0.2155

0.3155

5

1.6105

0.6209

6.1051

3.7908

0.1638

0.2638

1.7716

0.5645

7.7156

4.3553

0.1298

0.2296

replaced immediately

1.9487

0.5132

9.4872

4.8684

0.1054

0.2054

8

2.1436

0.1006

11.1359

5.3349

0.0871

0.1874

kent for at keast one more year

2.3579

0.4241

13.5795

5.7590

0.0735

0.1736

10

2.5937

0.3855

15.9371

6.1446

0.0627

0.1627

11

2.8531

0.3506

18.5312

6.4951

0.0540

0.1540

12

3.1384

0.3106

21.3843

6.0137

0.0488

0.1460

13

3.4523

0.2897

24.5227

7.1034

a 0408

0,1408

14

3.7976

0.2033

27.9750

7.3607

0.0357

0.1357

15

4.1772

0.2394

31.7725

7.6061

0.0315

0.1315

16

4.5950

0.2176

35.9497

7.8237

0.0278

0.1278

17

5.0545

0.1978

40.5447

8.0216

0.0247

0.1247

18

5.5599

0.1799

45.5002

8.2014

0.0219

0.1219

19

6.1159

0.1635

51.1591

8.3649

0.0195

0.1195

20

6.7275

0.1486

57.2750

8.5130

0.0175

0.1175

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education