eoul Tower Corporation recently purchased a building and land on which it is located with the lan to tear down the building and build a new luxury hotel on the site. The cost of the uilding should be * depreciated over the period from acquisition to the date the hotel is scheduled to be torn down. capitalized as part of the cost of the new hotel. capitalized as part of the cost of the land. written off as an extraordinary loss in the year the hotel is torn down.

eoul Tower Corporation recently purchased a building and land on which it is located with the lan to tear down the building and build a new luxury hotel on the site. The cost of the uilding should be * depreciated over the period from acquisition to the date the hotel is scheduled to be torn down. capitalized as part of the cost of the new hotel. capitalized as part of the cost of the land. written off as an extraordinary loss in the year the hotel is torn down.

Chapter14: Property Transact Ions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 76P

Related questions

Question

question 60

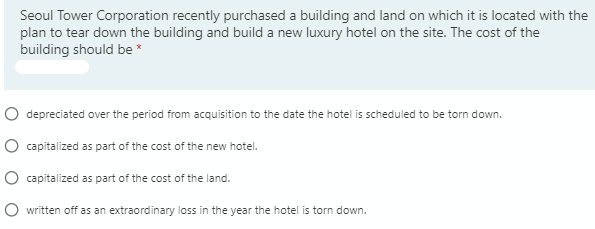

Transcribed Image Text:Seoul Tower Corporation recently purchased a building and land on which it is located with the

plan to tear down the building and build a new luxury hotel on the site. The cost of the

building should be *

O depreciated over the period from acquisition to the date the hotel is scheduled to be torn down.

O capitalized as part of the cost of the new hotel.

O capitalized as part of the cost of the land.

written off as an extraordinary loss in the year the hotel is torn down.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning