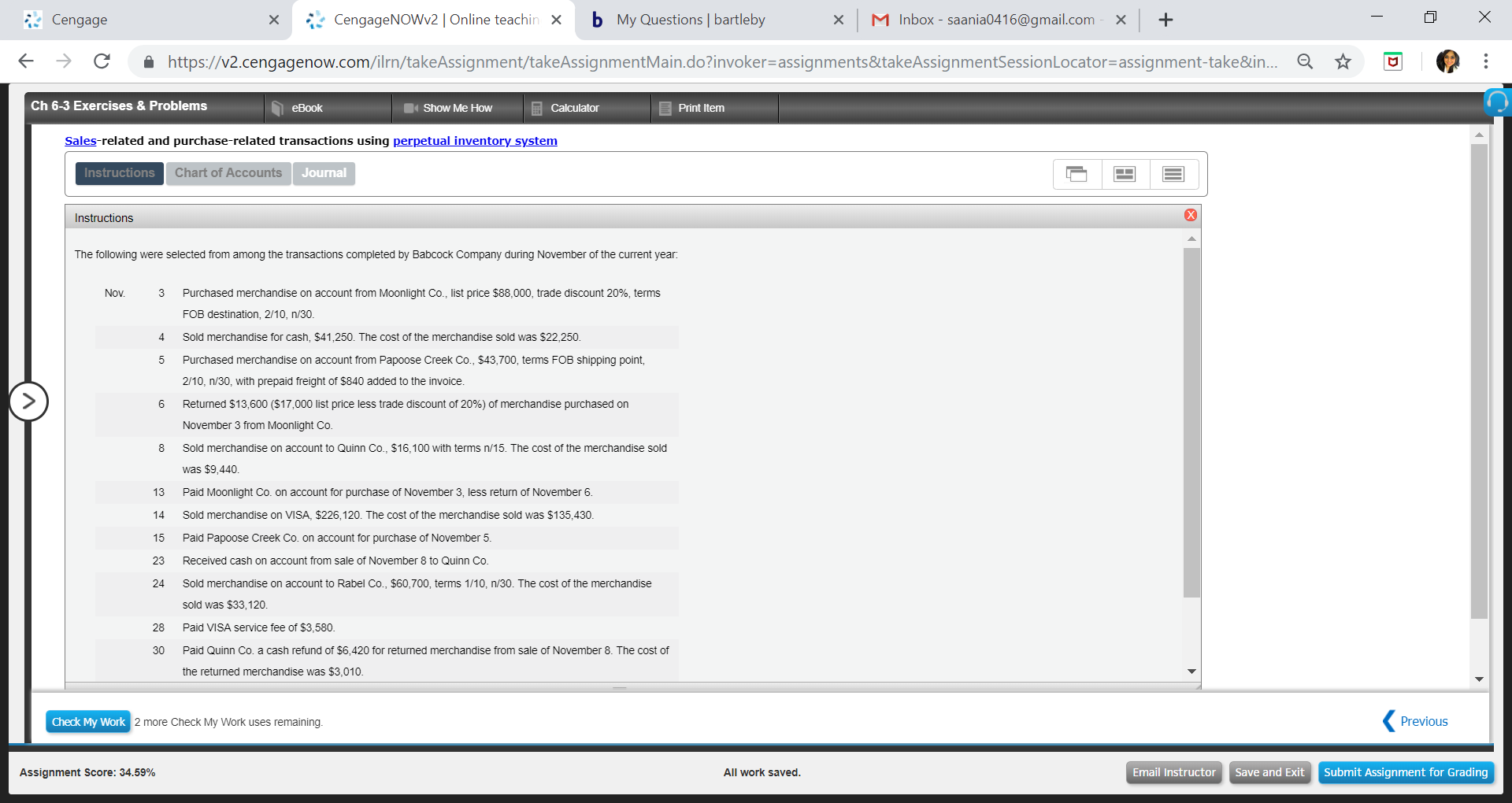

Cengage CengageNOWu2 | Online teachi b My Questions | bartleby XM Inbox - saania0416@gmail.com-X+ ← → C â https://v2.cengagenow.com/rn/takeAssignment takeAssignmentMain doinvoker-assignments&takeAssignmentSessionLocator-assignment take&in. Ch 6-3 Exercises & Problems eBook Show Me Hovw Calculator Print Itemm Sales-related and purchase-related transactions using perpetual inventory_system Instructions Chart of Accounts Journal Instructions The following were selected from among the transactions completed by Babcock Company during November of the current year Nov 3 Purchased merchandise on account from Moonlight Co., list price $88,000, trade discount 20%, terms FOB destination, 2/10, n/30 Sold merchandise for cash, $41,250. The cost of the merchandise sold was $22,250 Purchased merchandise on account from Papoose Creek Co., $43,700, terms FOB shipping point, 2/10, n/30, with prepaid freight of $840 added to the invoice Returned $13,600 ($17,000 list price less trade discount of 20%) of merchandise purchased on November 3 from Moonlight Co Sold merchandise on account to Quinn Co., $16,100 with terms n/15. The cost of the merchandise sold was $9,440 Paid Moonlight Co. on account for purchase of November 3, less return of November 6 Sold merchandise on VISA, $226,120. The cost of the merchandise sold was $135,430 Paid Papoose Creek Co. on account for purchase of November 5 Received cash on account from sale of November 8 to Quinn Co Sold merchandise on account to Rabel Co., $60,700, terms 1/10, n/30. The cost of the merchandise sold was S33,120 Paid VISA service fee of $3,580 Paid Quinn Co. a cash refund of $6,420 for returned merchandise from sale of November 8. The cost of the returned merchandise was $3,010 4 5 6 8 13 14 15 23 24 28 30 Check My Work 2 more Check My Work uses remaining Previous Assignment Score: 34.59% All work saved Email InstructorSave and Exit Submit Assignment for Grading

Cengage CengageNOWu2 | Online teachi b My Questions | bartleby XM Inbox - saania0416@gmail.com-X+ ← → C â https://v2.cengagenow.com/rn/takeAssignment takeAssignmentMain doinvoker-assignments&takeAssignmentSessionLocator-assignment take&in. Ch 6-3 Exercises & Problems eBook Show Me Hovw Calculator Print Itemm Sales-related and purchase-related transactions using perpetual inventory_system Instructions Chart of Accounts Journal Instructions The following were selected from among the transactions completed by Babcock Company during November of the current year Nov 3 Purchased merchandise on account from Moonlight Co., list price $88,000, trade discount 20%, terms FOB destination, 2/10, n/30 Sold merchandise for cash, $41,250. The cost of the merchandise sold was $22,250 Purchased merchandise on account from Papoose Creek Co., $43,700, terms FOB shipping point, 2/10, n/30, with prepaid freight of $840 added to the invoice Returned $13,600 ($17,000 list price less trade discount of 20%) of merchandise purchased on November 3 from Moonlight Co Sold merchandise on account to Quinn Co., $16,100 with terms n/15. The cost of the merchandise sold was $9,440 Paid Moonlight Co. on account for purchase of November 3, less return of November 6 Sold merchandise on VISA, $226,120. The cost of the merchandise sold was $135,430 Paid Papoose Creek Co. on account for purchase of November 5 Received cash on account from sale of November 8 to Quinn Co Sold merchandise on account to Rabel Co., $60,700, terms 1/10, n/30. The cost of the merchandise sold was S33,120 Paid VISA service fee of $3,580 Paid Quinn Co. a cash refund of $6,420 for returned merchandise from sale of November 8. The cost of the returned merchandise was $3,010 4 5 6 8 13 14 15 23 24 28 30 Check My Work 2 more Check My Work uses remaining Previous Assignment Score: 34.59% All work saved Email InstructorSave and Exit Submit Assignment for Grading

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 1RP

Related questions

Question

The question is asking to journalize the transactions but all throughout this chapter, this is my weakest area on how to journalize transactions especially when it comes to when a discount was applied or items were returned. I'm just not getting it. Can you help me please? Thanks

Transcribed Image Text:Cengage

CengageNOWu2 | Online teachi

b

My Questions | bartleby

XM Inbox - saania0416@gmail.com-X+

←

→

C

â

https://v2.cengagenow.com/rn/takeAssignment takeAssignmentMain doinvoker-assignments&takeAssignmentSessionLocator-assignment take&in.

Ch 6-3 Exercises & Problems

eBook

Show Me Hovw

Calculator

Print Itemm

Sales-related and purchase-related transactions using perpetual inventory_system

Instructions

Chart of Accounts

Journal

Instructions

The following were selected from among the transactions completed by Babcock Company during November of the current year

Nov

3

Purchased merchandise on account from Moonlight Co., list price $88,000, trade discount 20%, terms

FOB destination, 2/10, n/30

Sold merchandise for cash, $41,250. The cost of the merchandise sold was $22,250

Purchased merchandise on account from Papoose Creek Co., $43,700, terms FOB shipping point,

2/10, n/30, with prepaid freight of $840 added to the invoice

Returned $13,600 ($17,000 list price less trade discount of 20%) of merchandise purchased on

November 3 from Moonlight Co

Sold merchandise on account to Quinn Co., $16,100 with terms n/15. The cost of the merchandise sold

was $9,440

Paid Moonlight Co. on account for purchase of November 3, less return of November 6

Sold merchandise on VISA, $226,120. The cost of the merchandise sold was $135,430

Paid Papoose Creek Co. on account for purchase of November 5

Received cash on account from sale of November 8 to Quinn Co

Sold merchandise on account to Rabel Co., $60,700, terms 1/10, n/30. The cost of the merchandise

sold was S33,120

Paid VISA service fee of $3,580

Paid Quinn Co. a cash refund of $6,420 for returned merchandise from sale of November 8. The cost of

the returned merchandise was $3,010

4

5

6

8

13

14

15

23

24

28

30

Check My Work

2 more Check My Work uses remaining

Previous

Assignment Score: 34.59%

All work saved

Email InstructorSave and Exit Submit Assignment for Grading

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you