%24 %24 Cengage Learning signment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook 4Show Me How ECalculator FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: Beginning inventory 8,100 units at $180 Sale 5,300 units at $300 First purchase 15,000 units at $185 Sale 13,000 units at $300 Second purchase 16,000 units at $192 Sale 14,000 units at $300 The firm uses the perpetual inventory system, and there are 6,800 units of the item on hand at the end of the year. a. What is the total cost of the ending inventory according to FIFO? b. What is the total cost of the ending inventory according to LIFO? ツ 日 a 五 prt sc f12" end home %24 N7.pdf CengageNOWv2|Online teachin x * Cengage Learning /takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false eBook Show Me How Calculator FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: Beginning inventory 8,100 units at $180 Sale 5,300 units at $300 First purchase 15,000 units at $185 Sale 13,000 units at $300 Second purchase 16,000 units at $192 Sale 14,000 units at $300 The firm uses the perpetual inventory system, and there are 6,800 units of the item on hand at the end of the year a. What is the total cost of the ending inventory according to FIFO? 24 b. What is the total cost of the ending inventory according to LIFO?

%24 %24 Cengage Learning signment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook 4Show Me How ECalculator FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: Beginning inventory 8,100 units at $180 Sale 5,300 units at $300 First purchase 15,000 units at $185 Sale 13,000 units at $300 Second purchase 16,000 units at $192 Sale 14,000 units at $300 The firm uses the perpetual inventory system, and there are 6,800 units of the item on hand at the end of the year. a. What is the total cost of the ending inventory according to FIFO? b. What is the total cost of the ending inventory according to LIFO? ツ 日 a 五 prt sc f12" end home %24 N7.pdf CengageNOWv2|Online teachin x * Cengage Learning /takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false eBook Show Me How Calculator FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: Beginning inventory 8,100 units at $180 Sale 5,300 units at $300 First purchase 15,000 units at $185 Sale 13,000 units at $300 Second purchase 16,000 units at $192 Sale 14,000 units at $300 The firm uses the perpetual inventory system, and there are 6,800 units of the item on hand at the end of the year a. What is the total cost of the ending inventory according to FIFO? 24 b. What is the total cost of the ending inventory according to LIFO?

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.3BE: Perpetual inventory using LIFO Beginning inventory, purchases, and sales for Item 88-HX are as...

Related questions

Question

Transcribed Image Text:%24

%24

Cengage Learning

signment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

eBook

4Show Me How

ECalculator

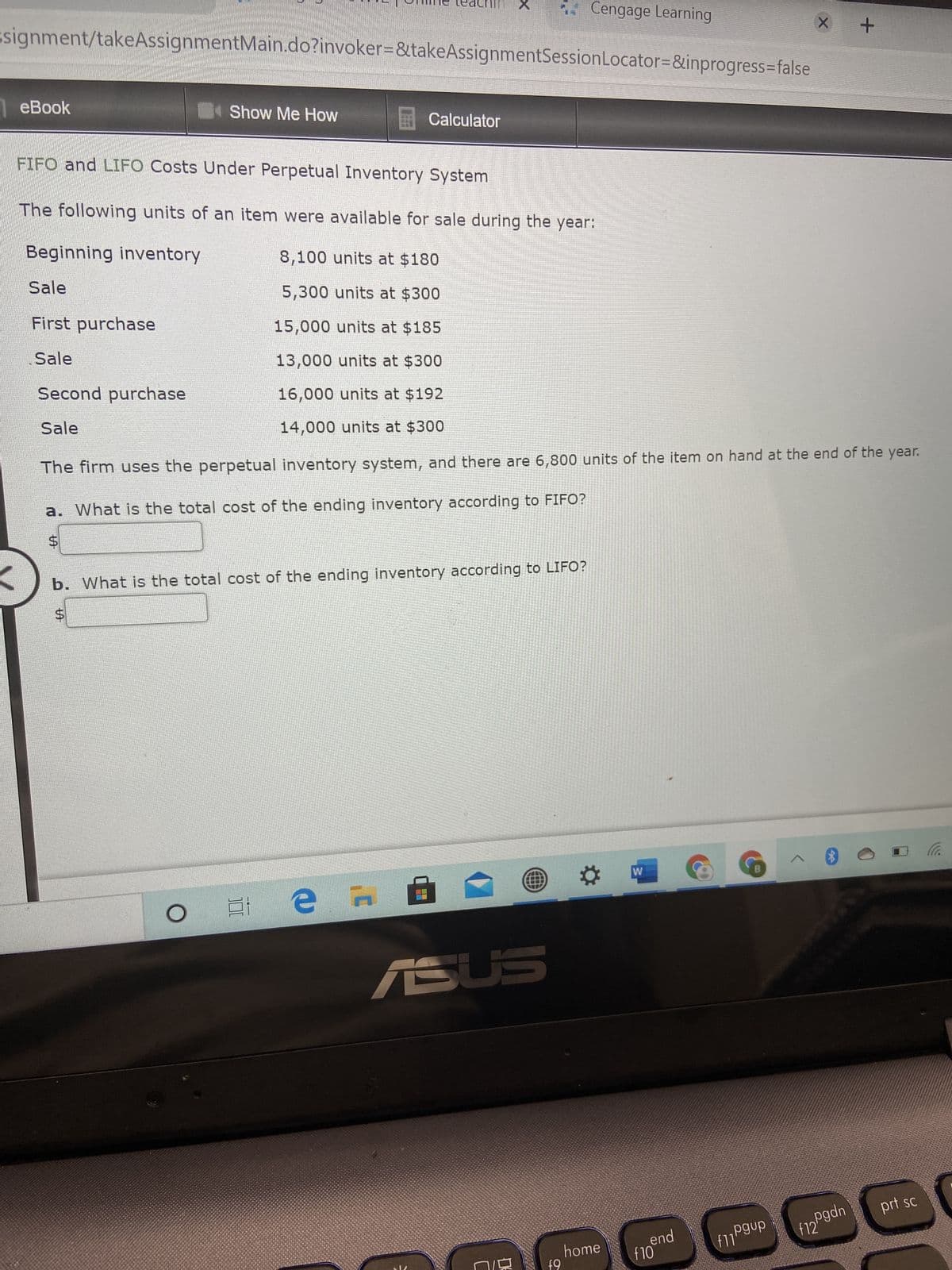

FIFO and LIFO Costs Under Perpetual Inventory System

The following units of an item were available for sale during the year:

Beginning inventory

8,100 units at $180

Sale

5,300 units at $300

First purchase

15,000 units at $185

Sale

13,000 units at $300

Second purchase

16,000 units at $192

Sale

14,000 units at $300

The firm uses the perpetual inventory system, and there are 6,800 units of the item on hand at the end of the year.

a. What is the total cost of the ending inventory according to FIFO?

b. What is the total cost of the ending inventory according to LIFO?

ツ

日 a 五

prt sc

f12"

end

home

Transcribed Image Text:%24

N7.pdf

CengageNOWv2|Online teachin x

* Cengage Learning

/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false

eBook

Show Me How

Calculator

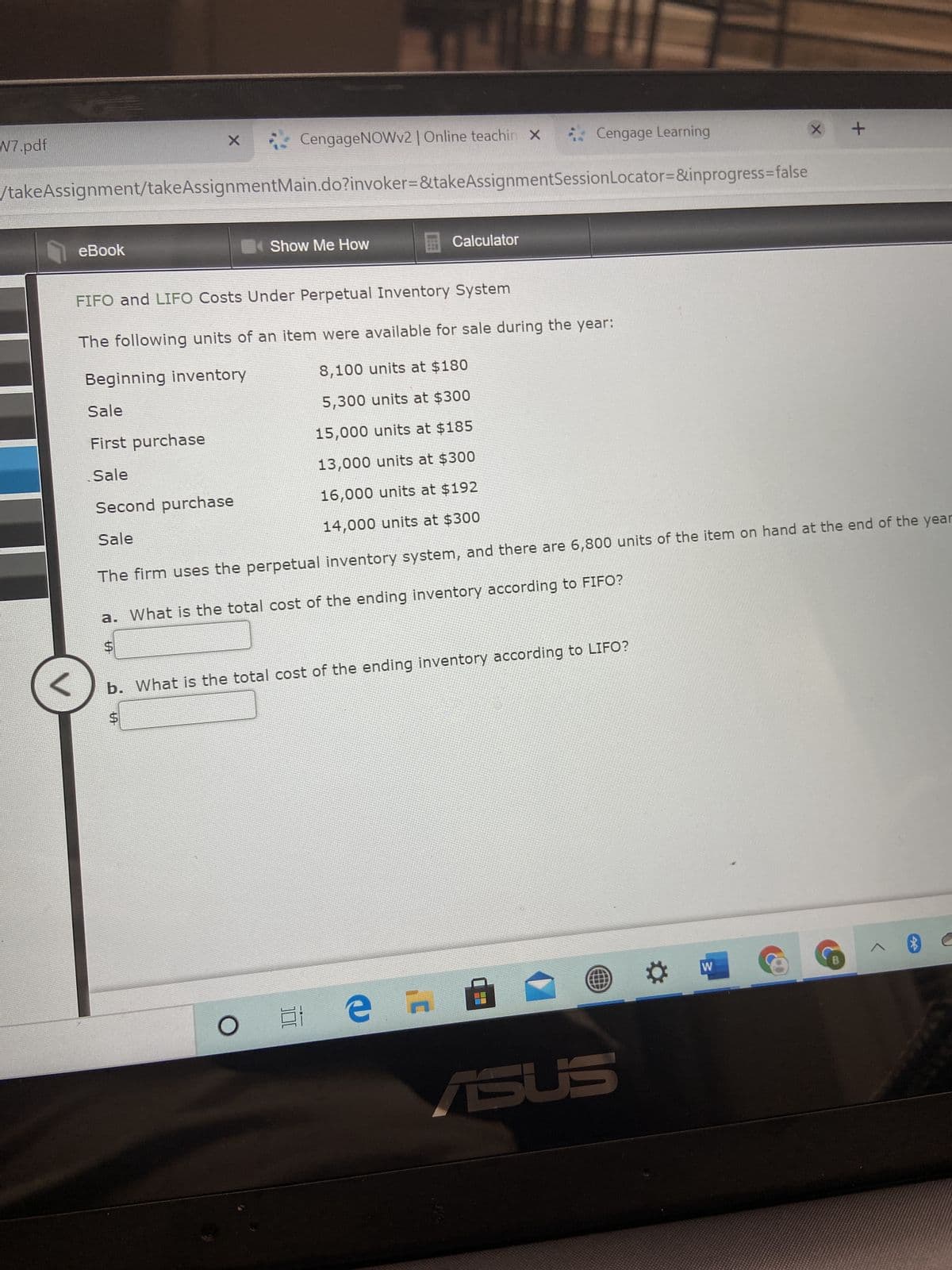

FIFO and LIFO Costs Under Perpetual Inventory System

The following units of an item were available for sale during the year:

Beginning inventory

8,100 units at $180

Sale

5,300 units at $300

First purchase

15,000 units at $185

Sale

13,000 units at $300

Second purchase

16,000 units at $192

Sale

14,000 units at $300

The firm uses the perpetual inventory system, and there are 6,800 units of the item on hand at the end of the year

a. What is the total cost of the ending inventory according to FIFO?

24

b. What is the total cost of the ending inventory according to LIFO?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning