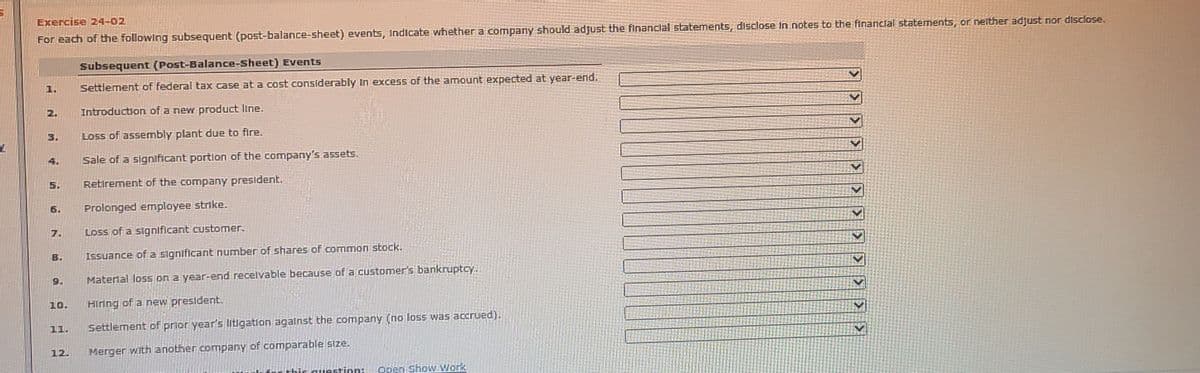

Exercise 24-02 For each of the following subsequent (post-balance-sheet) events, Indicate whether a company should adjust the financlal statements, disclose in notes to the financial statements, or neither adjust nor disclose. Subsequent (Post-Balance-Sheet) Events 1. Settlement of federal tax case at a cost considerably In excess of the amount expected at year-end. 2. Introduction of a new product line. 3. Loss of assembly plant due to fire 4. Sale of a significant portion of the company's assets. 5. Retirement of the company president 6. Prolonged employee strike. 7. Loss of a significant customer. B. Issuance of a significant number of shares of common stock. 9. Matertal loss on a year-end recelvable because of a customer's bankruptcy. 10. Hiring of a new president. 1. Settlement of prior year's Iitigation agatnst the company (no loss was accrued). 12. Merger with another company of comparable size. Kahow work

Exercise 24-02 For each of the following subsequent (post-balance-sheet) events, Indicate whether a company should adjust the financlal statements, disclose in notes to the financial statements, or neither adjust nor disclose. Subsequent (Post-Balance-Sheet) Events 1. Settlement of federal tax case at a cost considerably In excess of the amount expected at year-end. 2. Introduction of a new product line. 3. Loss of assembly plant due to fire 4. Sale of a significant portion of the company's assets. 5. Retirement of the company president 6. Prolonged employee strike. 7. Loss of a significant customer. B. Issuance of a significant number of shares of common stock. 9. Matertal loss on a year-end recelvable because of a customer's bankruptcy. 10. Hiring of a new president. 1. Settlement of prior year's Iitigation agatnst the company (no loss was accrued). 12. Merger with another company of comparable size. Kahow work

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.3APR: Wage and tax statement data on employer FICA tax Ehrlich Co. began business on January 2. Salaries...

Related questions

Question

Transcribed Image Text:Exercise 24-02

For each of the following subsequent (post-balance-sheet) events, Indicate whether a company should adfust the financlal statements, disclose In notes to the financial statements, or nelther adjust nor disclose.

Subsequent (Post-Balance-Sheet) Events

1.

Settlement of federal tax case at a cost considerably In excess of the amount expected at year-end.

2.

Introduction of a new product line.

3.

Loss of assembly plant due to fire.

4.

Sale of a signlficant portion of the company's assets.

5.

Retirement of the company president.

6.

Prolonged employee strike.

7.

Loss of a signlficant customer.

B.

ISsuance ofa significant number of shares of common stock.

9.

Material loss on a year-end recelvable because of a customer's bankruptcy.

10.

Hiring of a new president.

11.

Settlement of prior year's litigation agalnst the company (no loss was accrued).

12.

Merger with another company of comparable size.

For thii- question:

Open Show Work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning