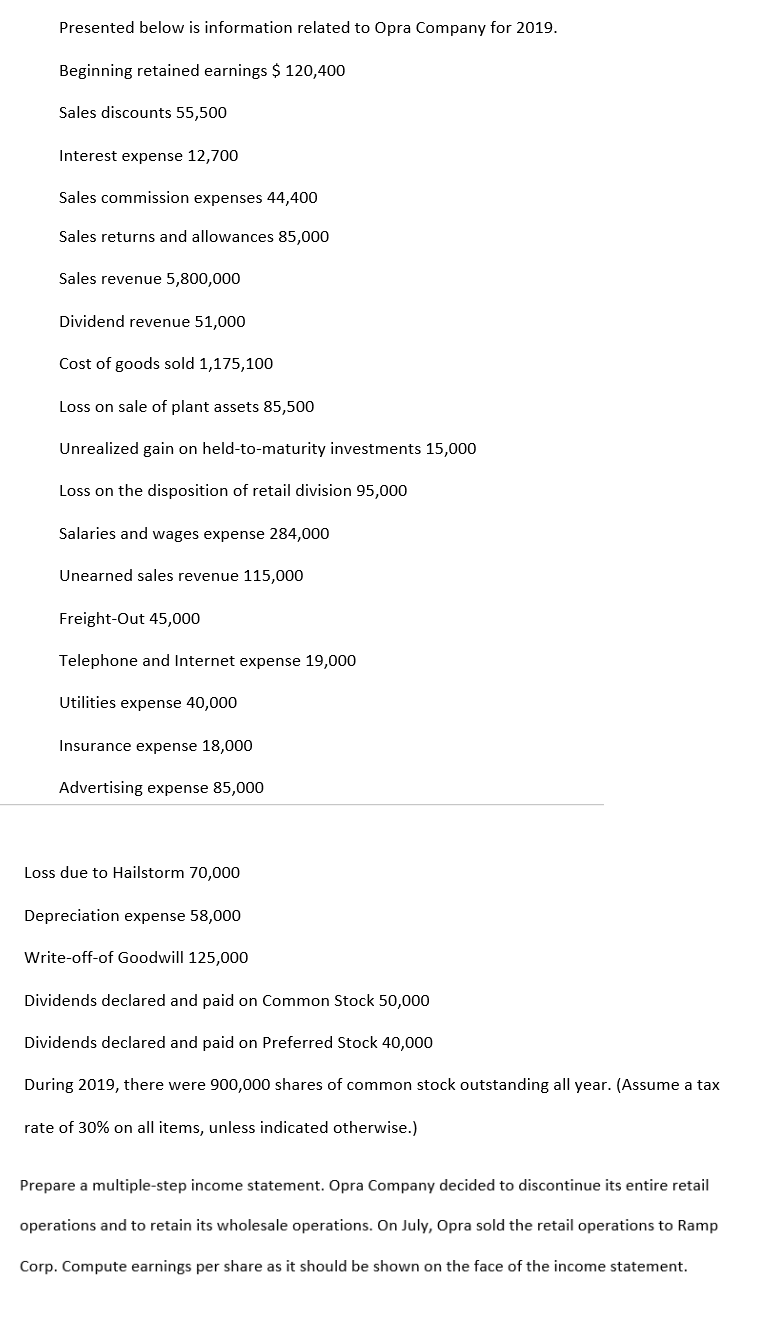

Presented below is information related to Opra Company for 2019. Beginning retained earnings $ 120,400 Sales discounts 55,500 Interest expense 12,700 Sales commission expenses 44,400 Sales returns and allowances 85,000 Sales revenue 5,800,000 Dividend revenue 51,000 Cost of goods sold 1,175,100 Loss on sale of plant assets 85,500 Unrealized gain on held-to-maturity investments 15,000 Loss on the disposition of retail division 95,000 Salaries and wages expense 284,000 Unearned sales revenue 115,000 Freight-Out 45,000 Telephone and Internet expense 19,000 Utilities expense 40,000 Insurance expense 18,000 Advertising expense 85,000 Loss due to Hailstorm 70,000 Depreciation expense 58,000 Write-off-of Goodwill 125,000 Dividends declared and paid on Common Stock 50,000 Dividends declared and paid on Preferred Stock 40,000 During 2019, there were 900,000 shares of common stock outstanding all year. (Assume a tax rate of 30% on all items, unless indicated otherwise.) Prepare a multiple-step income statement. Opra Company decided to discontinue its entire retail operations and to retain its wholesale operations. On July, Opra sold the retail operations to Ramp Corp. Compute earnings per share as it should be shown on the face of the income statement.

Presented below is information related to Opra Company for 2019. Beginning retained earnings $ 120,400 Sales discounts 55,500 Interest expense 12,700 Sales commission expenses 44,400 Sales returns and allowances 85,000 Sales revenue 5,800,000 Dividend revenue 51,000 Cost of goods sold 1,175,100 Loss on sale of plant assets 85,500 Unrealized gain on held-to-maturity investments 15,000 Loss on the disposition of retail division 95,000 Salaries and wages expense 284,000 Unearned sales revenue 115,000 Freight-Out 45,000 Telephone and Internet expense 19,000 Utilities expense 40,000 Insurance expense 18,000 Advertising expense 85,000 Loss due to Hailstorm 70,000 Depreciation expense 58,000 Write-off-of Goodwill 125,000 Dividends declared and paid on Common Stock 50,000 Dividends declared and paid on Preferred Stock 40,000 During 2019, there were 900,000 shares of common stock outstanding all year. (Assume a tax rate of 30% on all items, unless indicated otherwise.) Prepare a multiple-step income statement. Opra Company decided to discontinue its entire retail operations and to retain its wholesale operations. On July, Opra sold the retail operations to Ramp Corp. Compute earnings per share as it should be shown on the face of the income statement.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:Presented below is information related to Opra Company for 2019.

Beginning retained earnings $ 120,400

Sales discounts 55,500

Interest expense 12,700

Sales commission expenses 44,400

Sales returns and allowances 85,000

Sales revenue 5,800,000

Dividend revenue 51,000

Cost of goods sold 1,175,100

Loss on sale of plant assets 85,500

Unrealized gain on held-to-maturity investments 15,000

Loss on the disposition of retail division 95,000

Salaries and wages expense 284,000

Unearned sales revenue 115,000

Freight-Out 45,000

Telephone and Internet expense 19,000

Utilities expense 40,000

Insurance expense 18,000

Advertising expense 85,000

Loss due to Hailstorm 70,000

Depreciation expense 58,000

Write-off-of Goodwill 125,000

Dividends declared and paid on Common Stock 50,000

Dividends declared and paid on Preferred Stock 40,000

During 2019, there were 900,000 shares of common stock outstanding all year. (Assume a tax

rate of 30% on all items, unless indicated otherwise.)

Prepare a multiple-step income statement. Opra Company decided to discontinue its entire retail

operations and to retain its wholesale operations. On July, Opra sold the retail operations to Ramp

Corp. Compute earnings per share as it should be shown on the face of the income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning