Fielder Industries Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Υ1 Sales .... $1,300,000 $1,180,000 Cost of goods sold.... Gross profit .... Selling expenses Adminstrative expenses .. 682,500 613,600 $ 617,500 $ 260,000 $ 566,400 $ 188,800 169,000 177,000 $ 429,000 $ 188,500 $ 365,800 $ 200,600 Total operating expenses Income from operations.. Other revenue 70,800 78,000 $ 266,500 $ 271,400 Income before income tax Income tax expense.. 117,000 106,200 $ 149,500 $ 165,200 Net income ...

Fielder Industries Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Υ1 Sales .... $1,300,000 $1,180,000 Cost of goods sold.... Gross profit .... Selling expenses Adminstrative expenses .. 682,500 613,600 $ 617,500 $ 260,000 $ 566,400 $ 188,800 169,000 177,000 $ 429,000 $ 188,500 $ 365,800 $ 200,600 Total operating expenses Income from operations.. Other revenue 70,800 78,000 $ 266,500 $ 271,400 Income before income tax Income tax expense.. 117,000 106,200 $ 149,500 $ 165,200 Net income ...

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 87PSB

Related questions

Question

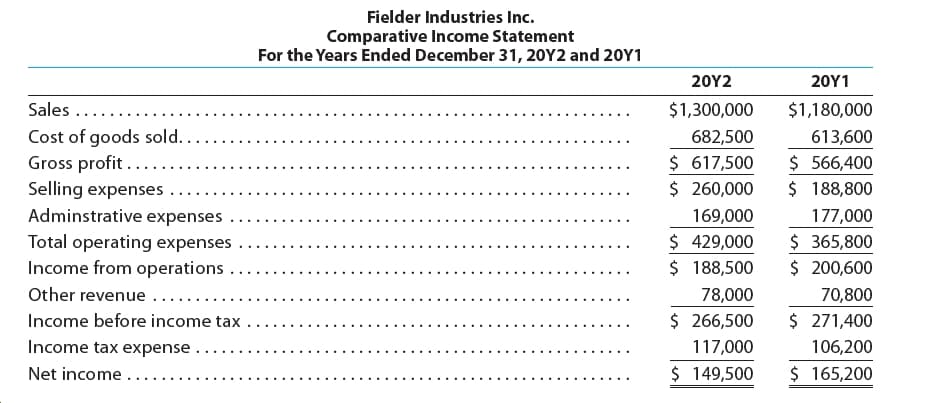

For 20Y2, Fielder Industries Inc. initiated a sales promotion campaign that included the expenditure of an additional $40,000 for advertising. At the end of the year, Leif Grando,the president, is presented with the following condensed comparative income statement:

Please see the attachment for details:

Instructions

1. Prepare a comparative income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. Round percentages to one decimal place.

2. To the extent the data permit, comment on the significant relationships

revealed by the vertical analysis prepared in (1).

Transcribed Image Text:Fielder Industries Inc.

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

20Y2

20Υ1

Sales ....

$1,300,000

$1,180,000

Cost of goods sold....

Gross profit ....

Selling expenses

Adminstrative expenses ..

682,500

613,600

$ 617,500

$ 260,000

$ 566,400

$ 188,800

169,000

177,000

$ 429,000

$ 188,500

$ 365,800

$ 200,600

Total operating expenses

Income from operations..

Other revenue

70,800

78,000

$ 266,500

$ 271,400

Income before income tax

Income tax expense..

117,000

106,200

$ 149,500

$ 165,200

Net income ...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning