FIGURE 13.18 DECISION TREE FOR HEMMINGWAY, INC. Successful 0.5 Start R&D Project ($5 million), Not Successful 0.5 Do Not Start the R&D Project 1-1 Building Facility ($20 million) Sell Rights Profit ($ millions) 34 20 10 20 -5 High Demand 0.5 Medium Demand 0.3 Low Demand 0.2

FIGURE 13.18 DECISION TREE FOR HEMMINGWAY, INC. Successful 0.5 Start R&D Project ($5 million), Not Successful 0.5 Do Not Start the R&D Project 1-1 Building Facility ($20 million) Sell Rights Profit ($ millions) 34 20 10 20 -5 High Demand 0.5 Medium Demand 0.3 Low Demand 0.2

Purchasing and Supply Chain Management

6th Edition

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

ChapterC: Cases

Section: Chapter Questions

Problem 5.2SB

Related questions

Question

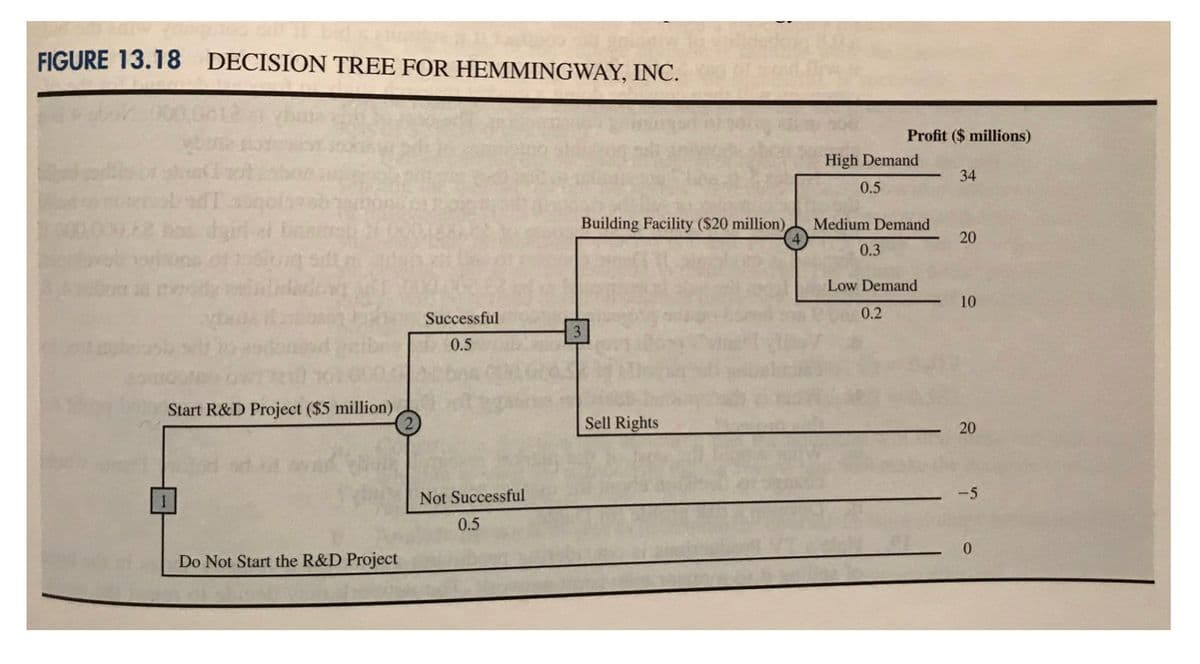

Transcribed Image Text:17. Hemmingway, Inc., is considering a $5 million research and development (R&D) project.

Profit projections appear promising, but Hemmingway's president is concerned because the

probability that the R&D project will be successful is only 0.50. Furthermore, the president

knows that even if the project is successful, it will require that the company build a new

production facility at a cost of $20 million in order to manufacture the product. If the facil-

ity is built, uncertainty remains about the demand and thus uncertainty about the profit that

will be realized. Another option is that if the R&D project is successful, the company could

sell the rights to the product for an estimated $25 million. Under this option, the company

would not build the $20 million production facility.

The decision tree is shown in Figure 13.18. The profit projection for each outcome is

shown at the end of the branches. For example, the revenue projection for the high demand

outcome is $59 million. However, the cost of the R&D project ($5 million) and the cost

of the production facility ($20 million) show the profit of this outcome to be $59 - $5 -

$20 = $34 million. Branch probabilities are also shown for the chance events.

a. Analyze the decision tree to determine whether the company should undertake the

R&D project. If it does, and if the R&D project is successful, what should the company

do? What is the expected value of your strategy?

b.

What must the selling price be for the company to consider selling the rights to the

product?

c. Develop a risk profile for the optimal strategy.

Transcribed Image Text:FIGURE 13.18 DECISION TREE FOR HEMMINGWAY, INC.

Successful

0.5

Start R&D Project ($5 million)

Not Successful

0.5

Do Not Start the R&D Project

Building Facility ($20 million)

Sell Rights

Profit ($ millions)

34

20

10

High Demand

0.5

Medium Demand

0.3

Low Demand

0.2

20

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning