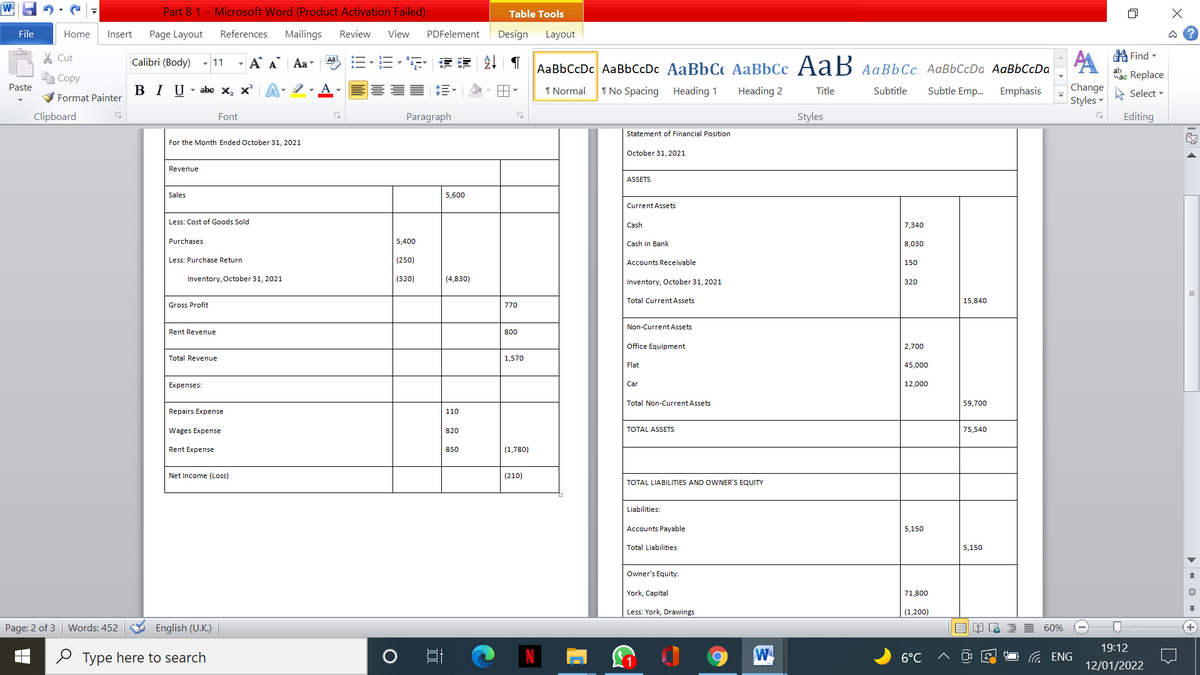

Part B 1 - Microsoft Word (Product Activation Failed) Table Tools File Home Insert Page Layout References Mailings Review View PDFelement Design Layout 昂Find▼ A "ac Replace X Cut Calibri (Body) - A A Aa 请 , T - 11 A :=- - AаBЬСcDc AaBbСcDc AaBbC АаBЬСс А аВ АаВЬСс. AАаBЬСcDa AaBЬСcDa ab A Copy в I U Change Styles - Paste - abe x, x A- 2 - I Normal 1 No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emp. Emphasis e Select - Format Painter Clipboard Font Paragraph Styles Editing Statement of Financial Position For the Month Ended October 31, 2021 October 31, 2021 Revenue ASSETS Sales 5,600 Current Assets Less: Cost of Goods Sold Cash 7,340 Purchases 5,400 Cash in Bank 8,030 Less: Purchase Return (250) Accounts Receivable 150 Inventory, October 31, 2021 (320) (4,830) Inventory, October 31, 2021 320 Total Current Assets 15,840 Gross Profit 770 Non-Current Assets Rent Revenue 800 Office Equipment 2,700 Total Revenue 1,570 Flat 45,000 Expenses: Car 12,000 Total Non-CurrentAssets 59,700 Repairs Expense 110 Wages Expense 820 TOTAL ASSETS 75,540 Rent Expense 850 (1,780) Net Income (Loss) (210) TOTAL LIABILITIES AND OWNER'S EQUITY Liabilities: Accounts Payable | 5,150 Total Liabilities 5,150 Owner's Equity: York, Capital 71,800 Less: York, Drawings (1,200) Page: 2 of 3 Words: 452 English (U.K.) 目單昆 目 60% 19:12 2 Type here to search 6°C ENG 12/01/2022 PART B a) According to the information available in Income and Financial position statements in Part A, calculate the following ratios for Anne's business for October 2021 Competitors Average Current Acid test Net profit margin Accounts receivable Accounts collection period Gross profit margin ratio ratio payable 16 Days 28 Days рayment period 27 Days 12Days Year 2019 0.32 0.55 2.7 1.34 Year 2020 0.28 0.56 2.6 1.32 Year 2021 0.02 0.08 2.8 1.38 26 Days 17 Days b. Assuming Anne's competitor's ratio averages are as stated above for month October of years 2019, 2020 and 2021: Analyse her performance with reference to the ratios of October 2021 calculated in comparison to those of her competitor. Also, briefly explain the impact of Covid -19 outbreak on the average ratios (Maximum of 500 words).

Part B 1 - Microsoft Word (Product Activation Failed) Table Tools File Home Insert Page Layout References Mailings Review View PDFelement Design Layout 昂Find▼ A "ac Replace X Cut Calibri (Body) - A A Aa 请 , T - 11 A :=- - AаBЬСcDc AaBbСcDc AaBbC АаBЬСс А аВ АаВЬСс. AАаBЬСcDa AaBЬСcDa ab A Copy в I U Change Styles - Paste - abe x, x A- 2 - I Normal 1 No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emp. Emphasis e Select - Format Painter Clipboard Font Paragraph Styles Editing Statement of Financial Position For the Month Ended October 31, 2021 October 31, 2021 Revenue ASSETS Sales 5,600 Current Assets Less: Cost of Goods Sold Cash 7,340 Purchases 5,400 Cash in Bank 8,030 Less: Purchase Return (250) Accounts Receivable 150 Inventory, October 31, 2021 (320) (4,830) Inventory, October 31, 2021 320 Total Current Assets 15,840 Gross Profit 770 Non-Current Assets Rent Revenue 800 Office Equipment 2,700 Total Revenue 1,570 Flat 45,000 Expenses: Car 12,000 Total Non-CurrentAssets 59,700 Repairs Expense 110 Wages Expense 820 TOTAL ASSETS 75,540 Rent Expense 850 (1,780) Net Income (Loss) (210) TOTAL LIABILITIES AND OWNER'S EQUITY Liabilities: Accounts Payable | 5,150 Total Liabilities 5,150 Owner's Equity: York, Capital 71,800 Less: York, Drawings (1,200) Page: 2 of 3 Words: 452 English (U.K.) 目單昆 目 60% 19:12 2 Type here to search 6°C ENG 12/01/2022 PART B a) According to the information available in Income and Financial position statements in Part A, calculate the following ratios for Anne's business for October 2021 Competitors Average Current Acid test Net profit margin Accounts receivable Accounts collection period Gross profit margin ratio ratio payable 16 Days 28 Days рayment period 27 Days 12Days Year 2019 0.32 0.55 2.7 1.34 Year 2020 0.28 0.56 2.6 1.32 Year 2021 0.02 0.08 2.8 1.38 26 Days 17 Days b. Assuming Anne's competitor's ratio averages are as stated above for month October of years 2019, 2020 and 2021: Analyse her performance with reference to the ratios of October 2021 calculated in comparison to those of her competitor. Also, briefly explain the impact of Covid -19 outbreak on the average ratios (Maximum of 500 words).

Accounting Information Systems

11th Edition

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Chapter2: Enterprise System

Section: Chapter Questions

Problem 2DQ: The Tigris Company is considering taking customers orders on its Web site. a. What information would...

Related questions

Question

Help me with question b) only

Ratio calculations:

Transcribed Image Text:Part B 1 - Microsoft Word (Product Activation Failed)

Table Tools

File

Home

Insert

Page Layout

References

Mailings

Review

View

PDFelement

Design

Layout

昂Find▼

A

"ac Replace

X Cut

Calibri (Body)

- A A Aa

请 , T

- 11

A :=- -

AаBЬСcDc AaBbСcDc AaBbC АаBЬСс А аВ АаВЬСс. AАаBЬСcDa AaBЬСcDa

ab

A Copy

в I U

Change

Styles -

Paste

- abe x, x A- 2 -

I Normal

1 No Spacing

Heading 1

Heading 2

Title

Subtitle

Subtle Emp.

Emphasis

e Select -

Format Painter

Clipboard

Font

Paragraph

Styles

Editing

Statement of Financial Position

For the Month Ended October 31, 2021

October 31, 2021

Revenue

ASSETS

Sales

5,600

Current Assets

Less: Cost of Goods Sold

Cash

7,340

Purchases

5,400

Cash in Bank

8,030

Less: Purchase Return

(250)

Accounts Receivable

150

Inventory, October 31, 2021

(320)

(4,830)

Inventory, October 31, 2021

320

Total Current Assets

15,840

Gross Profit

770

Non-Current Assets

Rent Revenue

800

Office Equipment

2,700

Total Revenue

1,570

Flat

45,000

Expenses:

Car

12,000

Total Non-CurrentAssets

59,700

Repairs Expense

110

Wages Expense

820

TOTAL ASSETS

75,540

Rent Expense

850

(1,780)

Net Income (Loss)

(210)

TOTAL LIABILITIES AND OWNER'S EQUITY

Liabilities:

Accounts Payable

| 5,150

Total Liabilities

5,150

Owner's Equity:

York, Capital

71,800

Less: York, Drawings

(1,200)

Page: 2 of 3

Words: 452

English (U.K.)

目單昆 目

60%

19:12

2 Type here to search

6°C

ENG

12/01/2022

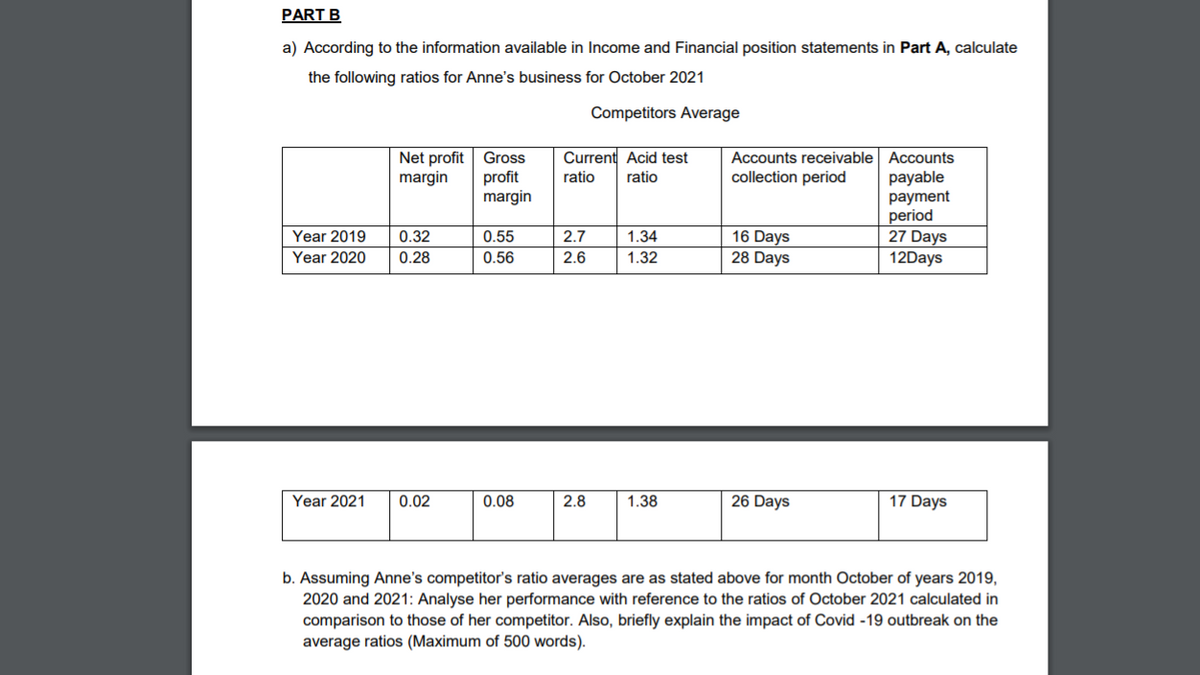

Transcribed Image Text:PART B

a) According to the information available in Income and Financial position statements in Part A, calculate

the following ratios for Anne's business for October 2021

Competitors Average

Current Acid test

Net profit

margin

Accounts receivable Accounts

collection period

Gross

profit

margin

ratio

ratio

payable

16 Days

28 Days

рayment

period

27 Days

12Days

Year 2019

0.32

0.55

2.7

1.34

Year 2020

0.28

0.56

2.6

1.32

Year 2021

0.02

0.08

2.8

1.38

26 Days

17 Days

b. Assuming Anne's competitor's ratio averages are as stated above for month October of years 2019,

2020 and 2021: Analyse her performance with reference to the ratios of October 2021 calculated in

comparison to those of her competitor. Also, briefly explain the impact of Covid -19 outbreak on the

average ratios (Maximum of 500 words).

Expert Solution

Step 1

Ratio Analysis

The Purpose of preparing the Ratio Analysis is to measure the strength and weakness of the business while calculating these ratio as well. Here below given the important ratio

- Profitability Ratio

- Liquidity Ratio

- Solvency Ratio

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning