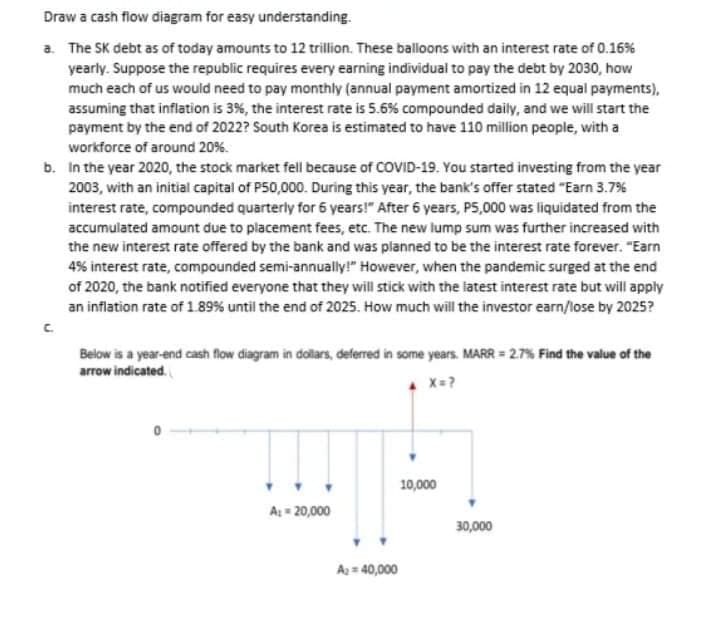

Draw a cash flow diagram for easy understanding. a. The SK debt as of today amounts to 12 trillion. These balloons with an interest rate of 0.16 % yearly. Suppose the republic requires every earning individual to pay the debt by 2030, how much each of us would need to pay monthly (annual payment amortized in 12 equal payments), assuming that inflation is 3%, the interest rate is 5.6% compounded daily, and we will start the payment by the end of 2022? South Korea is estimated to have 110 million people, with a workforce of around 20%. b. In the year 2020, the stock market fell because of COVID-19. You started investing from the year 2003, with an initial capital of P50,000. During this year, the bank's offer stated "Earn 3.7% interest rate, compounded quarterly for 6 years!" After 6 years, P5,000 was liquidated from the accumulated amount due to placement fees, etc. The new lump sum was further increased with the new interest rate offered by the bank and was planned to be the interest rate forever. "Earn 45% interest rate, compounded semi-annually!" However, when the pandemic surged at the end of 2020, the bank notified everyone that they will stick with the latest interest rate but will apply an inflation rate of 1.89% until the end of 2025. How much will the investor earn/lose by 2025? C. Below is a year-end cash flow diagram in dollars, deferred in some years. MARR = 27% Find the value of the arrow indicated. 10,000 A = 20,000 30,000 Az = 40,000

Draw a cash flow diagram for easy understanding. a. The SK debt as of today amounts to 12 trillion. These balloons with an interest rate of 0.16 % yearly. Suppose the republic requires every earning individual to pay the debt by 2030, how much each of us would need to pay monthly (annual payment amortized in 12 equal payments), assuming that inflation is 3%, the interest rate is 5.6% compounded daily, and we will start the payment by the end of 2022? South Korea is estimated to have 110 million people, with a workforce of around 20%. b. In the year 2020, the stock market fell because of COVID-19. You started investing from the year 2003, with an initial capital of P50,000. During this year, the bank's offer stated "Earn 3.7% interest rate, compounded quarterly for 6 years!" After 6 years, P5,000 was liquidated from the accumulated amount due to placement fees, etc. The new lump sum was further increased with the new interest rate offered by the bank and was planned to be the interest rate forever. "Earn 45% interest rate, compounded semi-annually!" However, when the pandemic surged at the end of 2020, the bank notified everyone that they will stick with the latest interest rate but will apply an inflation rate of 1.89% until the end of 2025. How much will the investor earn/lose by 2025? C. Below is a year-end cash flow diagram in dollars, deferred in some years. MARR = 27% Find the value of the arrow indicated. 10,000 A = 20,000 30,000 Az = 40,000

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter18: Six Debates Over Macroeconomic Policy

Section: Chapter Questions

Problem 6PA

Related questions

Question

Transcribed Image Text:Draw a cash flow diagram for easy understanding.

a. The SK debt as of today amounts to 12 trillion. These balloons with an interest rate of 0.16 %

yearly. Suppose the republic requires every earning individual to pay the debt by 2030, how

much each of us would need to pay monthly (annual payment amortized in 12 equal payments),

assuming that inflation is 3%, the interest rate is 5.6% compounded daily, and we will start the

payment by the end of 2022? South Korea is estimated to have 110 million people, with a

workforce of around 20%.

b. In the year 2020, the stock market fell because of COVID-19. You started investing from the year

2003, with an initial capital of P50,000. During this year, the bank's offer stated "Earn 3.7%

interest rate, compounded quarterly for 6 years!" After 6 years, P5,000 was liquidated from the

accumulated amount due to placement fees, etc. The new lump sum was further increased with

the new interest rate offered by the bank and was planned to be the interest rate forever. "Earn

45% interest rate, compounded semi-annually!" However, when the pandemic surged at the end

of 2020, the bank notified everyone that they will stick with the latest interest rate but will apply

an inflation rate of 1.89% until the end of 2025. How much will the investor earn/lose by 2025?

C.

Below is a year-end cash flow diagram in dollars, deferred in some years. MARR = 27% Find the value of the

arrow indicated.

10,000

A = 20,000

30,000

Az = 40,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning