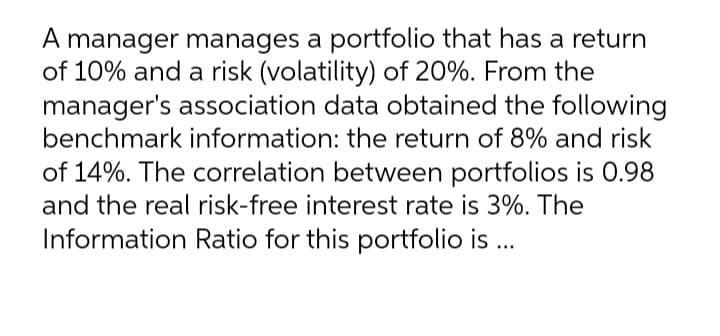

A manager manages a portfolio that has a return of 10% and a risk (volatility) of 20%. From the manager's association data obtained the following benchmark information: the return of 8% and risk of 14%. The correlation between portfolios is 0.98 and the real risk-free interest rate is 3%. The Information Ratio for this portfolio is ...

Q: 2. ABC company sells an old piece of equipment for $5,000 cash. At the same moment, it buys a new tr...

A: Sale of equipment = $5000 Buy of new truck = $25000

Q: You purchased 100 shares in a real estate investment trust for $50 a share. The trust paid the follo...

A: Annualized returns is return earned over the period of single year by holding the investment.

Q: The Walkers are saving up to go on a family vacation in 3 years. They invest $2900 into an account w...

A: Here, Present value = $2,900 Interest rate = 1.27% compounded quarterly Number of years = 3 years To...

Q: Find the periodic payment R required to amortize a loan of P dollars over t years with interest char...

A: The periodic amount will be found using excel’s PMT function. It is the minimum amount that must be ...

Q: Explain the mode of delivery in foreign contracts.

A: It is defined as the delivery as a part of the contract of trade between the seller and the buyer. ...

Q: You invest $900 in stock A and $900 in stock B. If you earn 10 percent on stock A and 5 percent on s...

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: 6. If EBIT equals $200,000 and interest expenses equals $30,000 and Tax rate is 50%. What is the net...

A: EBIT = $200,000 Interest expenses = $30,000 Tax rate = 50%

Q: A 0.235 cu. m, packed bed reactor costs $7.000 in 2002. What is the estimated cost of a 0.336 cu. m....

A: On a balance sheet of a company, a capitalised cost is an item that is applied to the cost base of a...

Q: 1. Although Mutual funds and Hedge funds are regulated, they are not traded on exchanges * O True O ...

A: Mutual funds and hedge funds are both managed portfolios made up of pooled money with the purpose of...

Q: 20. Lina's Corp's sales last year were $852,500, its operating costs were $543,750, and its interest...

A: Sales = $852,500 Operating expenses = $543,750 Interest charges = $18,750

Q: (a) Briefly explain why information asymmetry can widen the effective bid ask spread of a stock.

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one...

Q: how the Du Pont system of analysis breaks down return on assets. Also explain how it breaks down ret...

A: Du pont system Return on equity = net profit margin×asset turnover× financial leverage

Q: 9. TSE company reported a Net income of $150 million for year N. Depreciation expense was $141 milli...

A: Net income = $150 million Depreciation = $141 million Interest expenses = $60 million Tax rate = 30%

Q: An investment of $100,000 in safe 10-year corporate bonds yields an average of 12% per year, payable...

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: Cal withdrew $800 from his HSA to pay for non-medical expenses. He had to pay 25% income tax plus a ...

A: Withdrawal Amount = $800 Income Tax = 25% Penalty = 10%

Q: A man borrowed $3800 from a bank for 9 months. A friend was cosigner of the man's personal note. T a...

A: Given p=3800 T=9months Rate = 3.5%

Q: What is the relevance of personal financial planning in a daily life of a student? And what is the s...

A: Financial planning is a systematic approach to achieving one's life goals. As you travel through lif...

Q: 22. Alfa Corp's stock price at the end of last year was $50.25, and its book value per share was $37...

A: Stock price = $50.25 Book value = $37.50

Q: your required return is 7.32% how would adding ETFS with average annual returns that are expected to...

A: Meaning of ETFs( Exchange traded funds) This is a bunch of securities which is responsible for the ...

Q: You got asked to analyze a 5-year project for your firm. The project produces an annual revenue of $...

A: Initial Investment $ 20,000.00 Annual revenue $ 28,500.00 Labor and materials cost $ 5,0...

Q: nds: a zero-coupon bond with a maturity of six years, and a perpetual b 8%. How many percent of your...

A: Duration of perpetuity bond = (1+yield)/yield = (1+8%)/8% = 13.5

Q: Determine the following: 1. Total present amount of the obligations. 2. Total future amount of the o...

A: Present value can be defined as the amount of money that have to be invested today to earn a require...

Q: 7. LSP Corporation has forecasted sales of $120,000, operating expenses excluding depreciation and a...

A: Sales (S) = $120,000 Operating expenses (O) = $40,000 Amortization and depreciation (D) = $20,000 Ne...

Q: ) The time is progressed by using the event count method.

A: Event count method is the process of measure the no. Of discrete events over period of time.

Q: The VSE Corporation currently pays no dividend because of depressed earnings. A recent change in man...

A: The price of stock is equal to the present value of all future dividends and the future price of sto...

Q: I won 15 000.00 on lotto, invest for 3 years so I can earn interest. Bank has offered 10% interest. ...

A: Compound interest is calculated on the opening balance of investment instead of the initial investme...

Q: ABD Company's manufacturing overhead is 20% of its total conversion costs. If direct labor is PhP2,2...

A: Manufacturing overhead is referred as an indirect costs, which incurs at the time of production proc...

Q: What is LVMH's capital structure? If it has debt, will it be able to generate the future required ca...

A: With all the analysis, we can conclude that LVMH is harmless. Its market value is said to be rising ...

Q: Suppose an income stream will produce income at a rate of 4000 + 1000t dollars per year for 5 years,...

A: Present value Present value of an amount with continuous compounding. With continuous compounding i...

Q: Mr. O got a 5 year, 100,000 dollars balloon commercial loan. The annual interest rate is 6% and the ...

A: Loan amount (L) = $100000 r = 6% per annum = 0.5% per month n = 30 years = 360 months Let X = Monthl...

Q: Compute the capitalized cost of a new car worth P800,000.00 if it is estimated that it requires P20,...

A: New car cost (C) = P 800000 Annual cost (A) = P 20000 Salvage value (S) = P 300000 n = 5 years r = 1...

Q: You want to be able to withdraw $35,000 from your account each year for 15 years after you retire. ...

A: Given, Amount required each year after requirement us $35000. term of payment is 15 years Rate of in...

Q: In late November 2014, a car dealership in southern Wisconsin was offering a new 2014 Toyota Corolla...

A: Monthly payment: Monthly loan payments are usually divided into equal installments during the loan'...

Q: Jana, now 23 years old, is a grade school teacher in Batangas City. She has been invited by her high...

A: A deposit or payment of equal amount of money at equal intervals of time is called annuity. Insuranc...

Q: average price-earnings ratios of the small firms in textile industry is 12.50. On the other hand, Ep...

A: P/E ratio is most widely used as ratio for comparison between the value of shares with industry aver...

Q: resale lvaluue of a What is the rate of depreciation (in $ per year) after 5 years? Icar arter t yea...

A: Time Period = (t=5) Resale Value R(t) =300,000 e-0.1t

Q: A proposed new investment has projected sales of $710,000. Variable costs are 38 percent of sales, a...

A: Projected net income can be calculated as: = Sales revenue - sum of all costs

Q: (iv) Find the discounted paybacks for Projects L and S. According to the payback criterion, which pr...

A: The discounted payback period is computed by using the present value of cash flows where the investo...

Q: a single bank faces a required reserve ratio of 20 percent, has total reserves of $500,000, and chec...

A: The maximum amount of money that this bank can increase is the amount of its excess reserves. Amoun...

Q: How much more money is required to fund an ordinary perpetuity than a 25-year ordinary annuity if bo...

A: Effective Annual rate: It is the interest rate on loan/investment restated from the nominal intere...

Q: According to the Black-Scholes Model, a call option has a value of 4,500. The underlying asset curre...

A: Market Value is 140,000 Total Exercise price of the option is 138,000 Market price of the call optio...

Q: (the Scream Machine) at a theme park. Alternative A required a $300,000 investment, produced after-t...

A: Future worth analysis is one of the methods used to make a cost benefit analysis of alternative proj...

Q: 7. LSP Corporation has forecasted sales of $100,000, operating expenses excluding depreciation and a...

A: Bartleby honor code states that when various questions are asked, the expert should answer only the ...

Q: The payback method helps firms establish and identify a maximum acceptable payback period that helps...

A: Payback period is the number of years required to recover the initial investment in the project. Ans...

Q: Comparisons of income can be very difficult for two companies, even though they sell the same produc...

A: The amount of income reported by a company depends on two main things. First is its revenues. Second...

Q: Explore the amount $1 is discounted for different compound interest rates across time. The graph sho...

A: Given, PVN=1FVN=$11+iN

Q: Galvanized Products is considering purchasing a new computer system for their enterprise data manage...

A: 1. Computation of loan amount. Amount of loan = 100000 × 25% = 25000 Loan including interest = 25000...

Q: what is the stock market, and why is it important?

A: Stock Market: Stock markets are platforms where the sellers & buyers meet for the exchange of e...

Q: Explain 1-2 sentences Financial Risk Interest Rates Volatility Foreign Currency Liquidity Derivati...

A: Financial risk is a type of risk that can lead to the loss of stakeholder capital. For the governmen...

Q: Summit Systems will pay a dividend of $1.48 this year. If you expect Summit's dividend to grow by ...

A: Expected dividend (D1) = $1.48 Growth rate (g) = 5.3% Cost of capital (r) = 10.7%

M4

Step by step

Solved in 2 steps

- Two-Asset Portfolio Stock A has an expected return of 12% and a standard deviation of 40%. Stock B has an expected return of 18% and a standard deviation of 60%. The correlation coefficient between Stocks A and B is 0.2. What are the expected return and standard deviation of a portfolio invested 30% in Stock A and 70% in Stock B?Consider a position consisting of 200,000 investment in asset A and 300,000 investment in asset B. Assume that the daily volatility of the assets are 1.5% and 1.8% respectively, and that coefficient of correlation between their returns is 0.4. What is the five day 95% VAR for the portfolio (given 95% confidence level represents 1.65 standard deviations on the left side of the normal distribution)?Table attached shows the historical returns for Companies A, B and C If one investor has a portfolio consisting of 70% Company A and 30% Company B, what are the average portfolio return and standard deviation? What is Sharpe ratio if the risk-free rate is 3.5%? 2. If another investor has a portfolio consisting of 1/3 Company A, 1/3 Company B and 1/3 Company C, what are the average portfolio return and standard deviation? What is Sharpe ratio if the risk-free rate is 3.5%?

- A portfolio consists of 70% of investment A and 30% of investment B. The expected returnon investment A is 7% and the expected return on investment B is 9%. The standarddeviation of returns of investment A is 2.19%. The standard deviation of returns ofinvestment B is 4.1%. The correlation coefficient of the returns of investment A andinvestment B=+1. Finda. the expected return from the portfoliob. the standard deviation (risk) of the returns from the portfolioA portfolio that combines the risk-free asset and the market portfolio has an expected return of 7 percent and a standard deviation of 10 percent.The risk-free rate is 4 percent, and the expected return on the market portfolio is 12 percent. Assume the capital asset pricing model holds. Compute and justify the expected rate of return would a security earn if it had a 0.45 correlation with the market portfolio and a standard deviation of 55 percent.Consider a position consisting of a K200,000 investment in Asset A and a K300,000 investment in Asset B. Assume that the daily volatilities of the assets are 1.5% and 1.8% respectively, and that the coefficient of correlation between their returns is 0.4. What is the five day 95% Value at Risk (VaR) for the portfolio (95% confidence level represents 1.65 standard deviations on the left side of a normal distribution)?

- Your employer has asked you to investigate the firm’s portfolio risk and return. The portfolio comprises three stocks. It is invested 50 percent in stock A, 30 percent in stock B and 20 percent in stock C. You gathered the following information: a) Determine what is the portfolio’s expected return b) Determine the portfolio’s variance and standard deviation c) Assume that the expected risk-free rate is 2.75 percent. Determine the expected risk premium on the portfolio.Suppose Johnson & Johnson and Walgreen Boots Alliance have expected returns and volatilities shown here, with a correlation of 20%. Calculate a. the expected return and b. the volatility(standard deviation) of a portfolio that consists of a long position of $12,000 in Johnson & Johnson and a short position of $2,000 in Walgreens. Expected Return Standard Deviation Johnson & Johnson 7.7% 16.5% Walgreens 9.4% 19.2%A portfolio has an average return of 14.4 percent, a standard deviation of 18.5 percent, and a beta of 1.96. The risk-free rate is 2.6 percent. What is the Sharpe ratio?

- You are constructing a portfolio of two assets, Asset A and Asset B. The expected returns of the assets are 12 percent and 15 percent, respectively. The standard deviations of the assets are 29 percent and 48 percent, respectively. The correlation between the two assets is .25 and the risk-free rate is 5 percent. What is the optimal Sharpe ratio in a portfolio of the two assets? What is the smallest expected loss for this portfolio over the coming year with a probability of 2.5 percent?Using the data in the following table, LOADING... , consider a portfolio that maintains a 75% weight on stock A and a 25% weight on stock B. a. What is the return each year of this portfolio? b. Based on your results from part (a), compute the average return and volatility of the portfolio. c. Show that (i) the average return of the portfolio is equal to the (weighted) average of the average returns of the two stocks, and (ii) the volatility of the portfolio equals the same result as from the calculation in Eq. 11.9. d. Explain why the portfolio has a lower volatility than the average volatility of the two stocks. Question content area bottom Part 1 a. What is the return each year of this portfolio? Enter the return of this portfolio for each year in the table below: (Round to two decimal places.) Year 2010 2011 2012 2013 2014 2015 Portfolio enter your response here% enter your response here% enter your response…During a particular investment period, a wealth management company held an investment portfolio that earned an average return of 13% with standard deviation of 30% and beta of 1.5. The average risk-free rate of return during this investment period was 2%. (full process) (a) Calculate the Sharpe and Treynor measures of performance evaluation for this investment portfolio. This investment portfolio is composed of the following two asset classes: Asset Class Weight Return Equity 0.80 15% Bonds 0.20 5% During this particular investment period, the information on a benchmark portfolio is given in the following table. Asset Class Weight Return Equity (S&P500 Index) 0.50 17% Bonds (Lehman Brothers Index) 0.50 5% (b) Determine whether the investment portfolio of the wealth management company performed better than the benchmark portfolio in terms of the total…