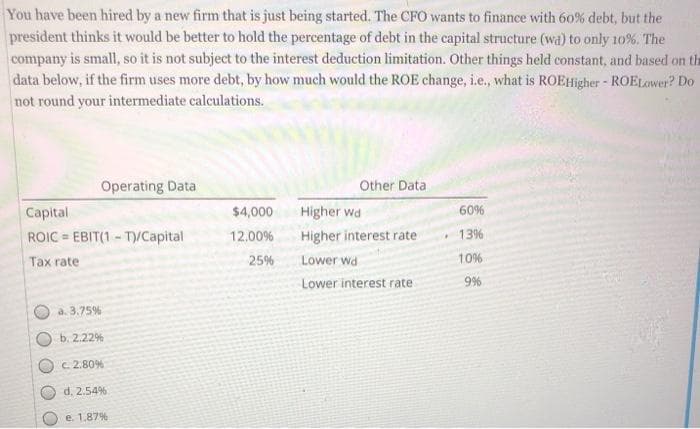

You have been hired by a new firm that is just being started. The CFO wants to finance with 60% debt, but the president thinks it would be better to hold the percentage of debt in the capital structure (wa) to only 10%. The company is small, so it is not subject to the interest deduction limitation. Other things held constant, and based on th data below, if the firm uses more debt, by how much would the ROE change, i.e., what is ROEHigher - ROELower? Do not round your intermediate calculations. Operating Data Other Data Capital $4,000 Higher wd 60% ROIC = EBIT(1 - T)/Capital 12.00% Higher interest rate 13% %3D Tax rate 25% Lower wd 10% Lower interest rate 9% a. 3.75% b. 2.22% C 2.80% d. 2.54% e. 1,87%

You have been hired by a new firm that is just being started. The CFO wants to finance with 60% debt, but the president thinks it would be better to hold the percentage of debt in the capital structure (wa) to only 10%. The company is small, so it is not subject to the interest deduction limitation. Other things held constant, and based on th data below, if the firm uses more debt, by how much would the ROE change, i.e., what is ROEHigher - ROELower? Do not round your intermediate calculations. Operating Data Other Data Capital $4,000 Higher wd 60% ROIC = EBIT(1 - T)/Capital 12.00% Higher interest rate 13% %3D Tax rate 25% Lower wd 10% Lower interest rate 9% a. 3.75% b. 2.22% C 2.80% d. 2.54% e. 1,87%

Chapter15: Capital Structure Decisions

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:You have been hired by a new firm that is just being started. The CFO wants to finance with 60% debt, but the

president thinks it would be better to hold the percentage of debt in the capital structure (wa) to only 10%. The

company is small, so it is not subject to the interest deduction limitation. Other things held constant, and based on th

data below, if the firm uses more debt, by how much would the ROE change, i.e., what is ROEHigher - ROELower? Do

not round your intermediate calculations.

Operating Data

Other Data

Capital

$4,000

Higher wd

60%

ROIC = EBIT(1 - T)/Capital

12.00%

Higher interest rate

13%

%3D

Tax rate

25%

Lower wd

10%

Lower interest rate

9%

a. 3.75%

b. 2.22%

C 2.80%

d. 2.54%

e. 1,87%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning