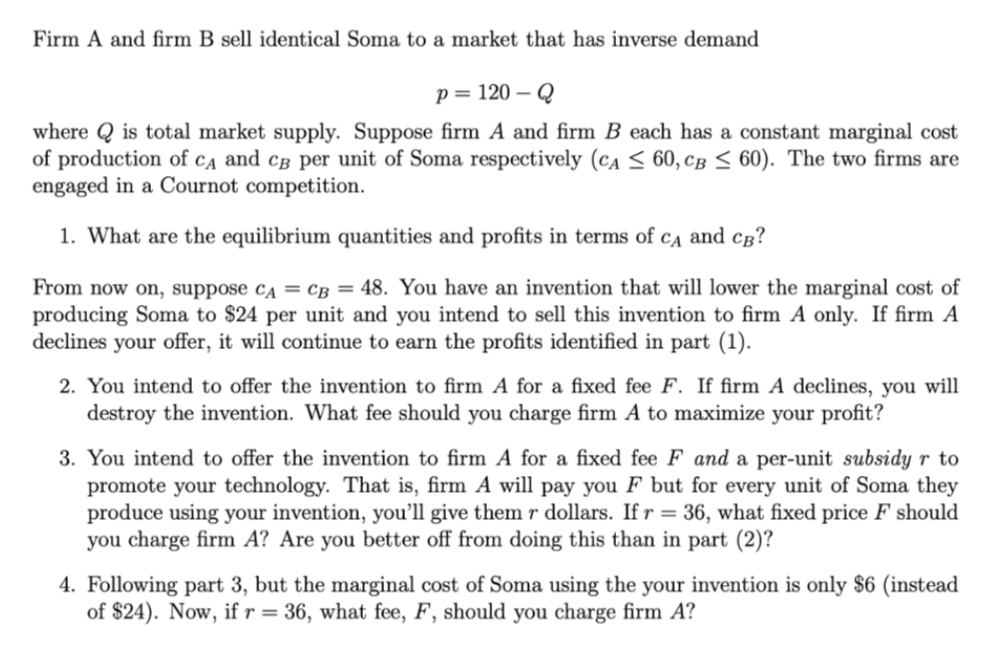

Firm A and firm B sell identical Soma to a market that has inverse demand p= 120 – Q where Q is total market supply. Suppose firm A and firm B each has a constant marginal cost of production of CA and cB per unit of Soma respectively (CA S 60, CB < 60). The two firms are engaged in a Cournot competition.

Firm A and firm B sell identical Soma to a market that has inverse demand p= 120 – Q where Q is total market supply. Suppose firm A and firm B each has a constant marginal cost of production of CA and cB per unit of Soma respectively (CA S 60, CB < 60). The two firms are engaged in a Cournot competition.

Chapter15: Imperfect Competition

Section: Chapter Questions

Problem 15.3P

Related questions

Question

1

Transcribed Image Text:Firm A and firm B sell identical Soma to a market that has inverse demand

p = 120 – Q

where Q is total market supply. Suppose firm A and firm B each has a constant marginal cost

of production of ca and câ per unit of Soma respectively (ca < 60, CB < 60). The two firms are

engaged in a Cournot competition.

1. What are the equilibrium quantities and profits in terms of cĄ and cg?

From now on, suppose ca = cB = 48. You have an invention that will lower the marginal cost of

producing Soma to $24 per unit and you intend to sell this invention to firm A only. If firm A

declines your offer, it will continue to earn the profits identified in part (1).

2. You intend to offer the invention to firm A for a fixed fee F. If firm A declines, you will

destroy the invention. What fee should you charge firm A to maximize your profit?

3. You intend to offer the invention to firm A for a fixed fee F and a per-unit subsidy r to

promote your technology. That is, firm A will pay you F but for every unit of Soma they

produce using your invention, you’ll give them r dollars. If r = 36, what fixed price F should

you charge firm A? Are you better off from doing this than in part (2)?

4. Following part 3, but the marginal cost of Soma using the your invention is only $6 (instead

of $24). Now, if r = 36, what fee, F, should you charge firm A?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning