Flexible Budgets, Overhead Cost Variances, and Management Control Fixed manufacturing overhead variance analysis The Sourdough Bread Company bakes baguettes for distribution to upscale grocery stores. The company has two direct-cost categories: direct materials and direct manufacturing labor. The Sourdough Bread Company allocates fixed manufacturing overhead to products on the basis of standard direct manufacturing labor-hours. The following is some budget data for the Sourdough Bread Company for 2017. Direct manufacturing labor use 0.02 hours per baguette Fixed manufacturing overhead $3.00 per direct manufacturing labor-hour The following is additional information for the Sourdough Bread Company for the year ended December 31, 2017: Planned (budgeted) output 3,100,000 baguettes Actual production 2,600,000 baguettes Budgeted direct manufacturing labor 62,000 hours Actual direct manufacturing labor 46,800 hours Actual fixed manufacturing overhead $294,000 Use the blue shaded areas on the ENTERANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong. Requirements 1 Prepare a variance analysis of fixed manufacturing overhead cost. Use the exhibit that shows the variance analysis of fixed manufacturing overhead cost as a guide. a. For variances with a zero amount, leave the box empty; do not select a label or enter a zero. b. Use the ABS function when calculating variances, and use the drop-down selections for F or U when describing the variances. 2 Is fixed overhead underallocated or overallocated? By what amount? a. Use the ABS function when calculating the underallocated or overallocated amount.)

Flexible Budgets, Overhead Cost Variances, and Management Control Fixed manufacturing overhead variance analysis The Sourdough Bread Company bakes baguettes for distribution to upscale grocery stores. The company has two direct-cost categories: direct materials and direct manufacturing labor. The Sourdough Bread Company allocates fixed manufacturing overhead to products on the basis of standard direct manufacturing labor-hours. The following is some budget data for the Sourdough Bread Company for 2017. Direct manufacturing labor use 0.02 hours per baguette Fixed manufacturing overhead $3.00 per direct manufacturing labor-hour The following is additional information for the Sourdough Bread Company for the year ended December 31, 2017: Planned (budgeted) output 3,100,000 baguettes Actual production 2,600,000 baguettes Budgeted direct manufacturing labor 62,000 hours Actual direct manufacturing labor 46,800 hours Actual fixed manufacturing overhead $294,000 Use the blue shaded areas on the ENTERANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong. Requirements 1 Prepare a variance analysis of fixed manufacturing overhead cost. Use the exhibit that shows the variance analysis of fixed manufacturing overhead cost as a guide. a. For variances with a zero amount, leave the box empty; do not select a label or enter a zero. b. Use the ABS function when calculating variances, and use the drop-down selections for F or U when describing the variances. 2 Is fixed overhead underallocated or overallocated? By what amount? a. Use the ABS function when calculating the underallocated or overallocated amount.)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter10: Standard Costing And Variance Analysis

Section: Chapter Questions

Problem 47E: Refer to the information for Cinturon Corporation on the previous page. Required: 1. Break down the...

Related questions

Question

| Flexible Budgets, Overhead Cost Variances, and Management Control | |||||

| Fixed manufacturing overhead |

|||||

| The Sourdough Bread Company bakes baguettes for distribution to upscale grocery stores. The company has two direct-cost categories: direct materials and direct manufacturing labor. The Sourdough Bread Company allocates fixed manufacturing overhead to products on the basis of standard direct manufacturing labor-hours. The following is some budget data for the Sourdough Bread Company for 2017. | |||||

| Direct manufacturing labor use | 0.02 | hours per baguette | |||

| Fixed manufacturing overhead | $3.00 | per direct manufacturing labor-hour | |||

| The following is additional information for the Sourdough Bread Company for the year ended December 31, 2017: | |||||

| Planned (budgeted) output | 3,100,000 | baguettes | |||

| Actual production | 2,600,000 | baguettes | |||

| Budgeted direct manufacturing labor | 62,000 | hours | |||

| Actual direct manufacturing labor | 46,800 | hours | |||

| Actual fixed manufacturing overhead | $294,000 | ||||

| Use the blue shaded areas on the ENTERANSWERS tab for inputs. | |||||

| Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong. | |||||

| Requirements | |||||

| 1 | Prepare a variance analysis of fixed |

||||

| a. | For variances with a zero amount, leave the box empty; do not select a label or enter a zero. | ||||

| b. | Use the ABS function when calculating variances, and use the drop-down selections for F or U when describing the variances. | ||||

| 2 | Is fixed overhead underallocated or overallocated? By what amount? | ||||

| a. | Use the ABS function when calculating the underallocated or overallocated amount.) |

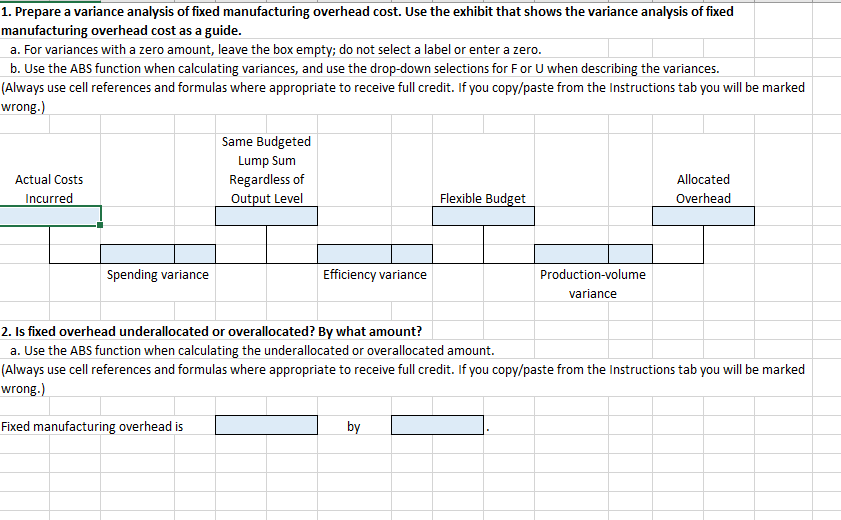

Transcribed Image Text:1. Prepare a variance analysis of fixed manufacturing overhead cost. Use the exhibit that shows the variance analysis of fixed

manufacturing overhead cost as a guide.

a. For variances with a zero amount, leave the box empty; do not select a label or enter a zero.

b. Use the ABS function when calculating variances, and use the drop-down selections for F or U when describing the variances.

(Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked

wrong.)

Same Budgeted

Lump Sum

Actual Costs

Regardless of

Allocated

Incurred

Output Level

Flexible Budget

Overhead

Spending variance

Efficiency variance

Production-volume

variance

2. Is fixed overhead underallocated or overallocated? By what amount?

a. Use the ABS function when calculating the underallocated or overallocated amount.

(Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked

wrong.)

Fixed manufacturing overhead is

by

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning